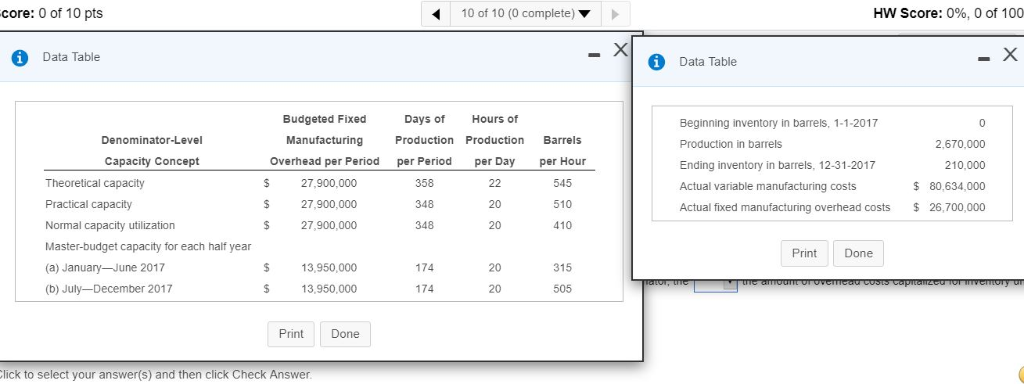

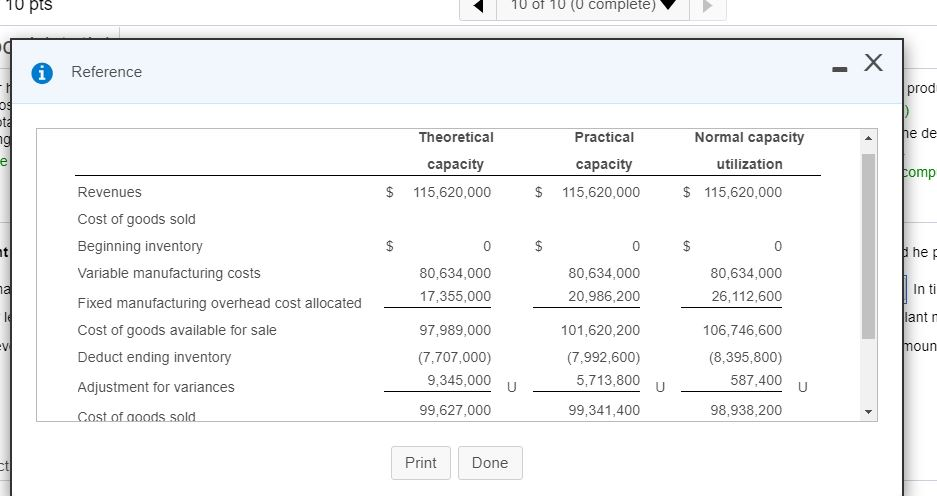

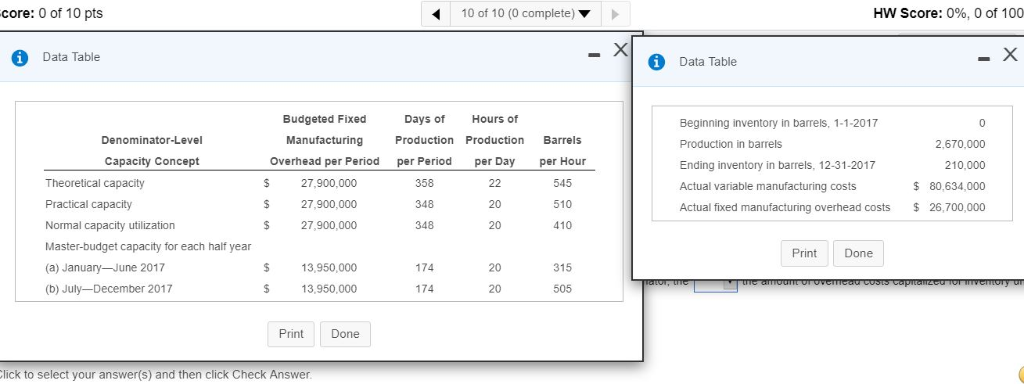

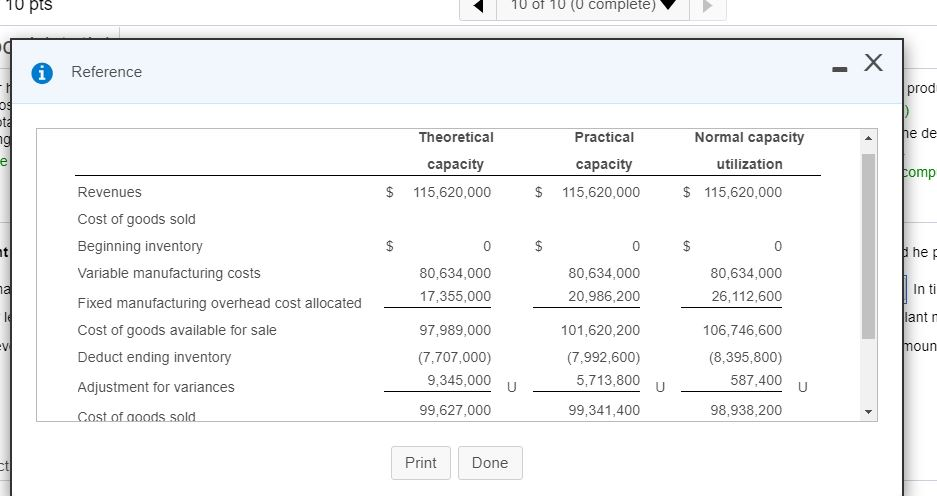

Score: 0 of 10 pts 10 of 10 (0 complete) HW Score: 0 %, 0 of 100 P9-38 (book/static) EQuestion Help Castle Lager has just purchased the Jacksonville Brewery. The brewery absorption costing. It will "sell" its product to Castle Lager at $47 per barrel. Peter Bryant, Castle Lager's controllel, dbl or 2017 two years old and uses In 2017, the Jacksonville Brewery reported these production results E(Click the icon to view the production results.) information about Jacksonville Brewery's capacity and budgeted fixed Castle Lager computed operating income when the denominator-level capacity theoretical capacity practical capacity, and normal capacity utilization (Click the icon to view the information.) (Click the icon to view the operating income computations.) Read the requirements Requirement 1. If the plant manager of the Jacksonville Brewery gets a bonus based on operating income, which denominator-level capacity concept would he prefer use? Explain If the plant manager gets a bonus based on operating income, he/she will prefer the denominator-level capacity to be based on In times of inventories, as in 2017, this denominator level will maximize the fixed overhead trapped in ending inventories and will minimize COGS and maximize operating income. Of course, the plant manager cannot always hope to the denominator, the inventories every period, but on the whole, he/she would still prefer to use this capacity method because the the amount of overhead costs capitalized for inventory unit 10 of 10 (0 complete) core: 0 of 10 pts HW Score: 0%, 0 of 100 - X Data Table Data Table Budgeted Fixed Days of Hours of Beginning inventory in barrels, 1-1-2017 0 Manufacturing Denominator-Level Production Production Barrels Production in barrels 2,670,000 per Hour Capacity Concept Overhead per Period per Period per Day Ending inventory in barrels, 12-31-2017 210.000 Theoretical capacity 358 545 27,900,000 22 Actual variable manufacturing costs 80,634,000 Practical capacity 510 27,900,000 348 20 Actual fixed manufacturing overhead costs 26,700,000 27.900.000 410 Normal capacity utilization 348 20 Master-budget capacity for each half year Print Done 13.950.000 174 20 315 (a) January-June 2017 oum or ovemcau costs Capitalirz (b) July-December 2017 13.950.000 174 20 505 Print Done Click to select your answer(s) and then click Check Answer 10 of 10 (0 complete) 10 pts Reference prod os ota Normal capacity Theoretical Practical he de ng e capacity capacity utilization comp $ 115,620,000 Revenues 115,620,000 115,620,000 Cost of goods sold 0 Beginning inventory 0 H he p t Variable manufacturing costs 80,634,000 80,634,000 80,634,000 In ti a 17,355,000 20,986,200 26,112,600 Fixed manufacturing overhead cost allocated lant n 97,989,000 Cost of goods available for sale 101,620,200 106,746,600 moun Deduct ending inventory (7,707,000) (7,992,600) (8,395,800) 587,400 U 9,345,000 5,713,800 Adjustment for variances 99,627,000 99,341,400 98,938,200 Cost of aoads sold Print Done Score: 0 of 10 pts 10 of 10 (0 complete) HW Score P9-38 (book/static) i Requirements Castle Lager has just purchased the Jacksonville Brewery. The brewery is two years old a 1. If the plant manager of the Jacksonville Brewery gets a bonus based on operating income, which denominator-level capacity concept would he prefer to use? Explain. Reference use for U.S 2. What denominator-level capacity concept would Castle Lager prefer income-tax reporting? Explain. 3. How might the IRS limit the flexibility of an absorption-c0sting company like Castle Lager attempting to minimize its taxable income? 0 Beginning inventory 80,634 Variable manufacturing costs 80.634.000 20.986 17.355,000 Fixed manufacturing overhead cost allocated Print Done 101,620 Cost of goods available for sale 97.989.000 ne. of course, the plant manager cannot always hope (7,992,600) Deduct ending inventory (7,707,000) (8,395,800) 9.345,000 U 5,713,800 587,400 the the amount of overhead costs capitalize Adjustment for variances U 99,627,000 99,341,400 98,938,200 Cost of goods sold Gross margin 15 993 000 16.278.600 16.681.800 0 0 Other costs 15.993.000 16.278.600 16,681,800 Operating income Check