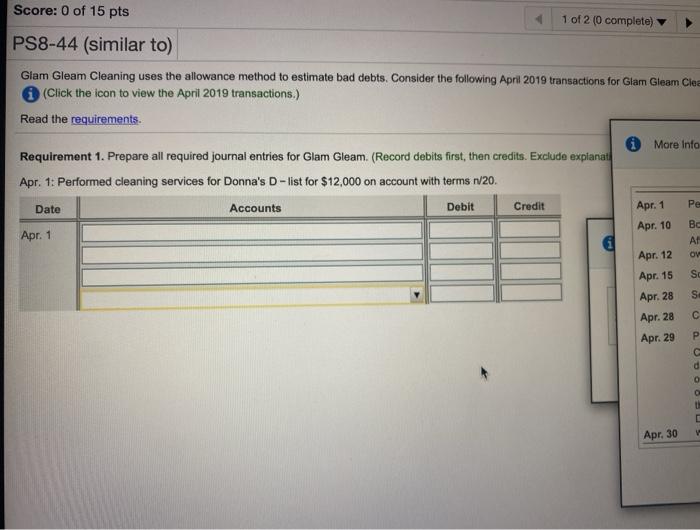

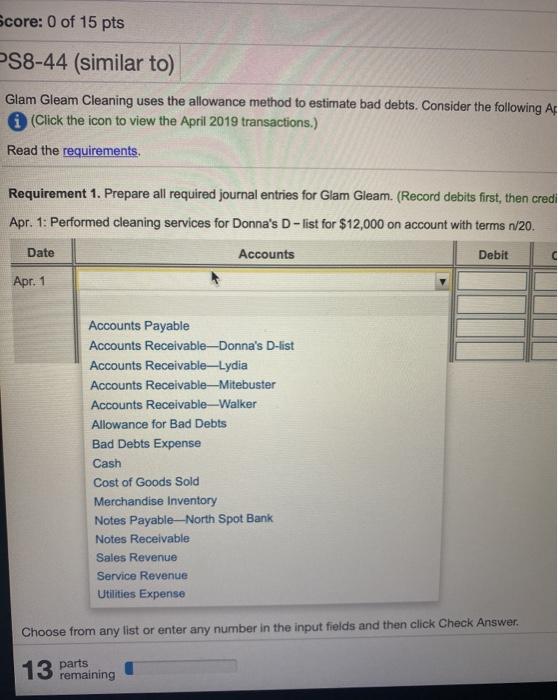

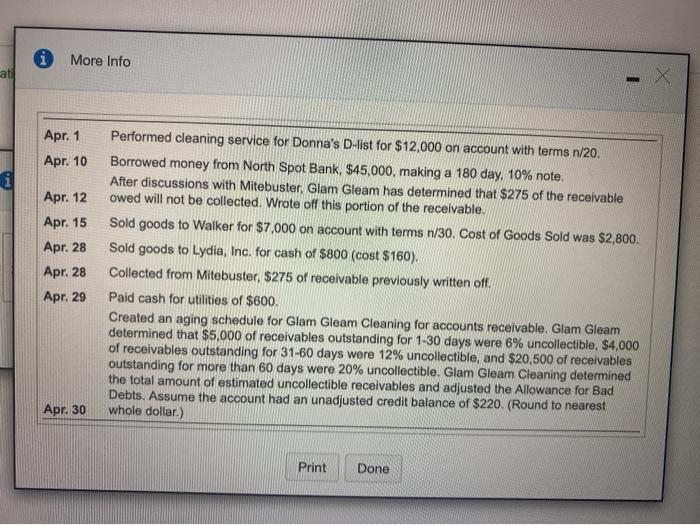

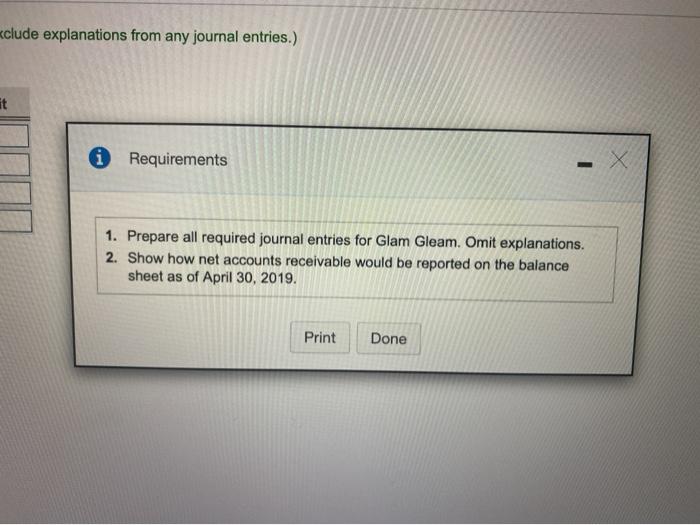

Score: 0 of 15 pts 1 of 2 (0 complete) PS8-44 (similar to) Glam Gleam Cleaning uses the allowance method to estimate bad debts. Consider the following April 2019 transactions for Glam Gleam Clea (Click the icon to view the April 2019 transactions.) Read the requirements More Info Requirement 1. Prepare all required journal entries for Glam Gleam. (Record debits first, then credits. Exclude explanati Apr. 1: Performed cleaning services for Donna's D-list for $12,000 on account with terms r/20. Date Accounts Debit Credit Apr. 1 Apr. 10 Apr. 1 AL OV SO Apr. 12 Apr. 15 Apr. 28 Apr. 28 Apr. 29 S P C d 0 Apr. 30 Score: 0 of 15 pts PS8-44 (similar to) Glam Gleam Cleaning uses the allowance method to estimate bad debts. Consider the following Af (Click the icon to view the April 2019 transactions.) Read the requirements, Requirement 1. Prepare all required journal entries for Glam Gleam. (Record debits first, then credi Apr. 1: Performed cleaning services for Donna's D-list for $12,000 on account with terms n/20. Date Accounts Debit Apr. 1 Accounts Payable Accounts Receivable-Donna's D-list Accounts ReceivableLydia Accounts Receivable-Mitebuster Accounts Receivable-Walker Allowance for Bad Debts Bad Debts Expense Cash Cost of Goods Sold Merchandise Inventory Notes Payable-North Spot Bank Notes Receivable Sales Revenue Service Revenue Utilities Expense Choose from any list or enter any number in the input fields and then click Check Answer. 13 parts remaining i More Info ati Apr. 1 Apr. 10 i Apr. 12 Apr. 15 Apr. 28 Apr. 28 Apr. 29 Performed cleaning service for Donna's D-list for $12,000 on account with terms n/20. Borrowed money from North Spot Bank, $45,000, making a 180 day, 10% note. After discussions with Mitebuster, Glam Gleam has determined that $275 of the receivable owed will not be collected. Wrote off this portion of the receivable. Sold goods to Walker for $7,000 on account with terms n/30. Cost of Goods Sold was $2,800. Sold goods to Lydia, Inc. for cash of $800 (cost $160). Collected from Mitebuster, $275 of receivable previously written off. Pald cash for utilities of $600. Created an aging schedule for Glam Gleam Cleaning for accounts receivable. Glam Gleam determined that $5,000 of receivables outstanding for 1-30 days were 6% uncollectible, $4,000 of receivables outstanding for 31-60 days were 12% uncollectible, and $20,500 of receivables outstanding for more than 60 days were 20% uncollectible. Glam Gleam Cleaning determined the total amount of estimated uncollectible receivables and adjusted the Allowance for Bad Debts. Assume the account had an unadjusted credit balance of $220. (Round to nearest whole dollar.) Apr. 30 Print Done clude explanations from any journal entries.) it 0 Requirements X 1. Prepare all required journal entries for Glam Gleam. Omit explanations. 2. Show how net accounts receivable would be reported on the balance sheet as of April 30, 2019. Print Done