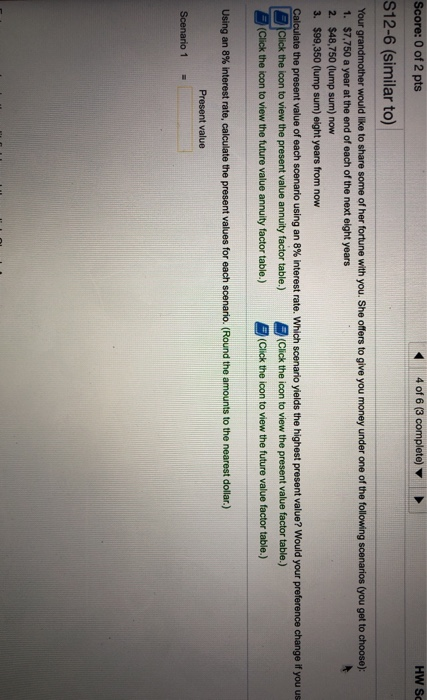

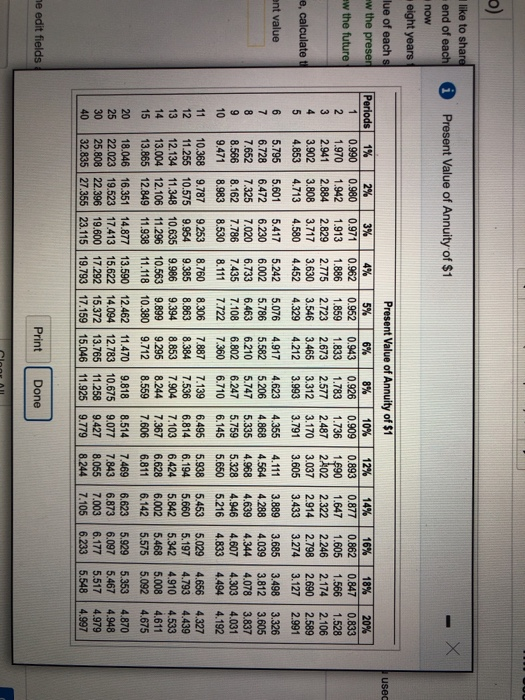

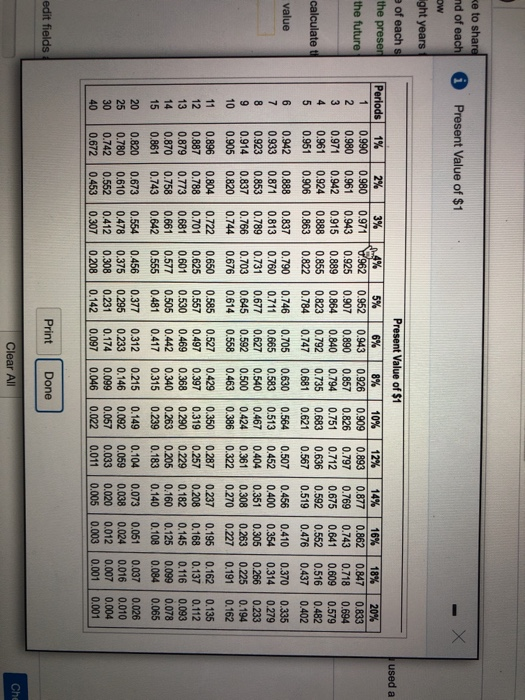

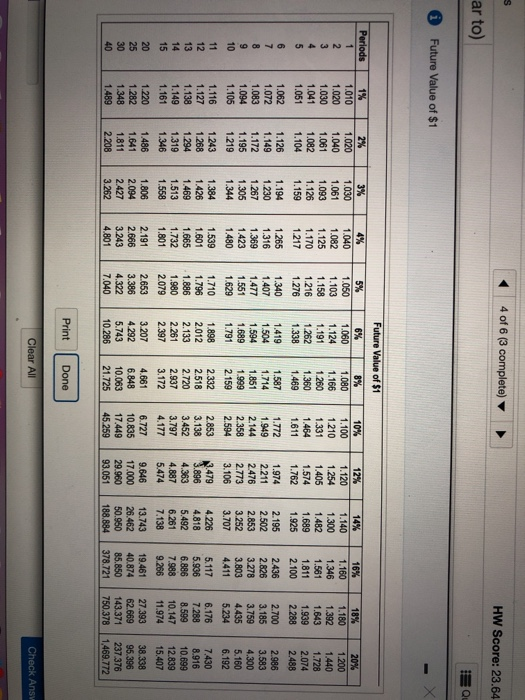

Score: 0 of 2 pts 4 of 6 (3 complete) HW SO S12-6 (similar to) Your grandmother would like to share some of her fortune with you. She offers to give you money under one of the following scenarios (you get to choose): 1. $7,750 a year at the end of each of the next eight years 2. $48,750 (lump sum) now 3. $99,350 (lump sum) eight years from now Calculate the present value of each scenario using an 8% Interest rate. Which scenario yields the highest present value? Would your preference change if you us Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor table.) (Click the icon to view the future value annuity factor table.) (Click the icon to view the future value factor table.) Using an 8% interest rate, calculate the present values for each scenario. (Round the amounts to the nearest dollar.) Present value Scenario 1 = 0 Present Value of Annuity of $1 like to share end of each now eight years ue of each s w the preser w the future used Periods 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 16% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 18% 0.847 1.566 2.174 2.690 3.127 e, calculate to 20% 0.833 1.528 2.106 2.589 2.991 3.326 ant value 980 5.417 5244 6.002 3.605 Present Value of Annuity of $1 2% 3% 4% 5% 6% 8% 10% 12% 14% 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 1.942 1.9131.886 1.859 1.833 1.783 1.736 1.9901.647 2.884 2.829 2.775 2.723 2.673 2.577 2.487 2402 2.322 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 4.713 4.580 4.452 4.329 4.212 3.993 3.791 3.605 3.433 5.076 4.917 4.623 4.355 4.111 3.889 6.472 6.230 5.786 5.206 4.868 4.564 4.288 7.325 7.020 6.733 6.463 6.210 5.747 5.336 4.968 4.639 8.162 7.786 7.435 7.108 6.802 5.328 4.946 8.530 8.111 9.253 8.306 7.887 9.954 8.863 11.348 10.635 9.986 9.394 8.853 7.904 12.106 11.296 10.563 9.295 8.244 6.002 11.938 11.118 10.380 9.712 8.559 7.606 6.142 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7.469 19.523 17.413 15.622 14.094 12.783 10.675 9.077 7.843 22.396 19.600 17.292 15.372 11.258 9.427 9.427 8.055 27.355 23.115 19.793 17.159 11.925 9.7798.244 7.105 3.812 4.078 4.303 6.247 5.759 8.983 7.722 4494 8.780 10.575 9.385 6.87 on or on 7.103 5.812 4.656 4.793 4.910 5.008 9.899 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.870 4.948 4.979 4.997 5.575 5.092 6.623 13.765 5.929 6.097 6 233 15.046 7.003 6.1775.52 5.353 5.467 5.517 5.548 me edit fields Print Done e to share 0 Present Value of $1 w ght years of each s the preser the future used a Periods 3% 0.971 0.943 0.915 0.888 0.863 0.837 4% 1962 0.925 0.889 0.855 3 12% 0.893 0.797 0.712 0.636 0.567 calculate ti 0.822 0.790 value 0,507 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.711 0.452 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.540 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.673 0.610 0.552 0.453 Present Value of $1 5% 6% 8% 10% 0.952 0.943 0.926 0.909 0.907 0.890 0.857 0.826 0.864 0.840 0.794 0.751 0.8230.792 0.735 0.683 0.784 0.747 0.681 0.621 0.746 0.705 0.630 0.564 0.665 0.513 0.627 0.592 0.614 0.558 0.463 0.386 0.585 0.527 0.350 0.557 0.497 0.319 0.469 0.290 0.442 0.340 0.263 0.417 0.315 0.239 0.377 0.312 0.215 0.149 0.295 0.233 0.146 0.092 0.231 0.174 0.099 0.057 0.142 0.097 0.046 0.022 067 33 0.583 0.500 18% 0.847 0.718 0.609 0.516 0.437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.116 0.099 0.084 14% 16% 0.877 0.862 0.769 0.743 0.675 0.641 0.592 0.552 0.519 0.476 0.4560.410 0.400 0.354 0.305 0.263 0.270 0.227 0.237 0.208 0.168 0.182 0.160 0.125 0.140 0.108 0.073 0.051 0.038 0.020 0.005 0.308 0.322 0.429 0251 0.195 0701 0. 0.681 0.530 0.368 0.145 0.000 09 0.676 0.650 0.625 0.601 0.577 0.555 0.456 0.375 0.308 0.208 0.509 OSA 0.481 0.287 0.229 0.205 0.183 0.104 0.059 0.033 0.554 0.078 0.065 0.026 0.010 0.004 0.001 0.478 0.024 0.012 0.307 0.011 0.002 edit fields Print Print Done Clear All 4 of 6 (3 complete) HW Score: 23.64 ar to) * Future Value of $1 Periods 1% 5% 10% 12% 14% 1.140 1.300 1.482 Future Value of $1 6% 8% 1.060 1.080 1.166 1260 1.360 1.469 1.587 1.714 1.851 1.689 1.999 1.791 2.159 1.898 2.332 2.012 2.518 2.133 2.720 2.261 2.937 2.397 3.172 3.207 4.661 6.848 5.743 10.063 10.286 21.725 1689 1.925 2.195 2502 2.853 3.252 3.707 4.226 4.818 5.492 6.261 7.138 13.743 50.950 10% 1.160 1.346 1.561 1.811 2.100 2.436 2.826 3.278 3.803 4.411 5.117 5.936 6.886 7.988 9.266 19.461 40.874 85.850 378.721 18% 1.180 1.392 1.643 1.939 2288 2.700 3.185 3.759 4.435 5.234 6.176 7.288 8.599 10.147 11.974 27.393 62.669 143.371 750.378 20% 1.200 1.440 1.728 2.074 2.488 2.986 3.583 4.300 5.160 6.192 7.430 8.916 10.699 12.839 15.407 38.338 95 396 237.376 1.469.772 1.886 1.980 2.079 4.887 5.474 . 3.452 3.797 4.177 6.727 17.449 45.259 4282 10.835 25.462 29.960 2.208 7.040 93.051 188.884 Print Done Clear All Check Ans