Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Score: 0 of 2 pts 5 of 5 (2 complete) HW Score: 13 25%, 1.59 of 12 pts 11end_summary (similar to) Question Help Aldia Health

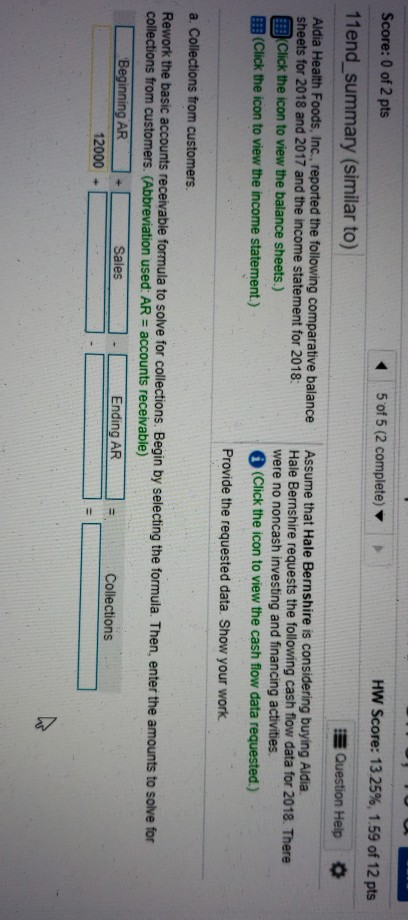

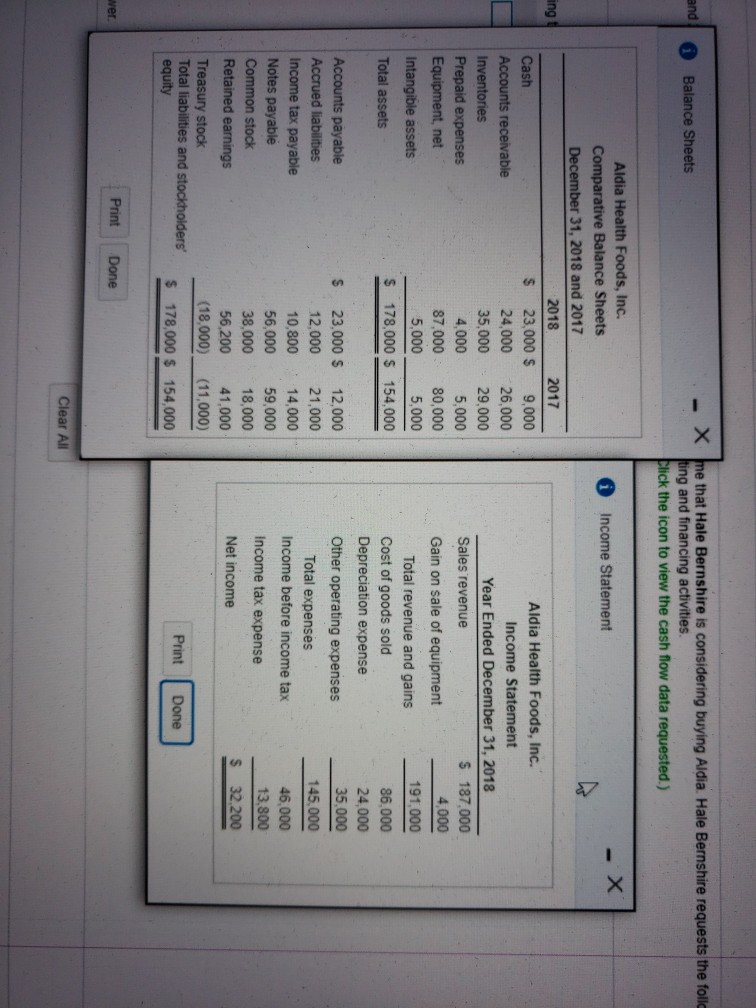

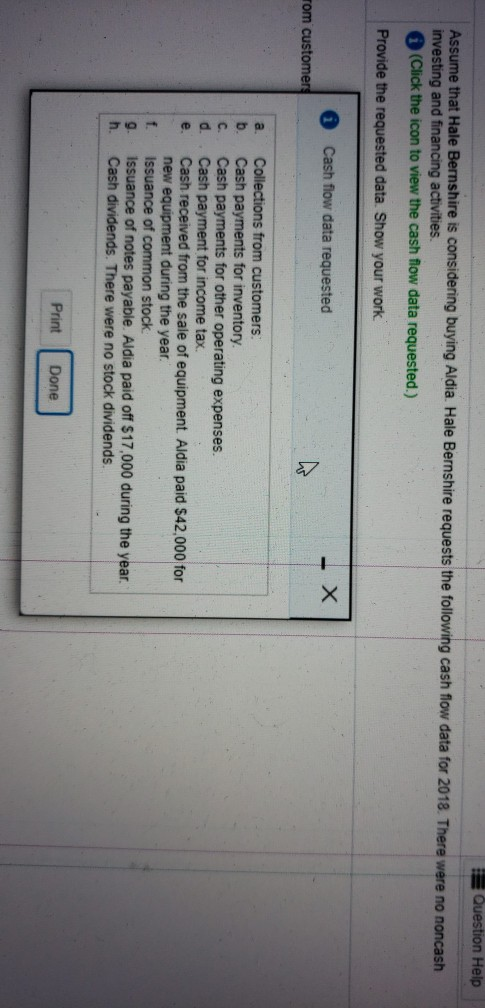

Score: 0 of 2 pts 5 of 5 (2 complete) HW Score: 13 25%, 1.59 of 12 pts 11end_summary (similar to) Question Help Aldia Health Foods, Inc., reported the following comparative balance sheets for 2018 and 2017 and the income statement for 2018: Click the icon to view the balance sheets.) (Click the icon to view the income statement.) Assume that Hale Bernshire is considering buying Aldia Hale Bernshire requests the following cash flow data for 2018. There were no noncash investing and financing activities (Click the icon to view the cash flow data requested.) Provide the requested data. Show your work a. Collections from customers. Rework the basic accounts receivable formula to solve for collections. Begin by selecting the formula. Then, enter the amounts to solve for collections from customers. (Abbreviation used: AR = accounts receivable) Beginning AR Sales Ending AR Collections 12000 11 and Balance Sheets x me that Hale Bernshire is considering buying Aldia. Hale Bernshire requests the folic fting and financing activities Click the icon to view the cash flow data requested.) Income Statement ing Aldia Health Foods, Inc. Comparative Balance Sheets December 31, 2018 and 2017 2018 2017 Cash $ 23,000 $ 9,000 Accounts receivable 24,000 26.000 Inventories 35,000 29,000 Prepaid expenses 4,000 5,000 Equipment, net 87,000 80,000 Intangible assets 5.000 5,000 Total assets $ 178,000 $ 154,000 Aldia Health Foods, Inc. Income Statement Year Ended December 31, 2018 Sales revenue $ 187,000 4,000 Gain on sale of equipment 191.000 Total revenue and gains Cost of goods sold 86.000 Depreciation expense 24,000 Other operating expenses 35.000 Total expenses 145.000 Income before income tax 46,000 Income tax expense 13,800 s Net income 32.200 $ Accounts payable Accrued liabilities Income tax payable Notes payable Common stock Retained earnings Treasury stock Total liabilities and stockholders equity 23.000 $ 12.000 10.800 56,000 38,000 56,200 (18,000) 12,000 21,000 14,000 59,000 18,000 41,000 (11,000) Print Done $ 178,000 $ 154,000 wer Print Done Clear All Question Help Assume that Hale Bernshire is considering buying Aldia. Hale Bernshire requests the following cash flow data for 2018. There were no noncash investing and financing activities (Click the icon to view the cash flow data requested.) Provide the requested data. Show your work. Cash flow data requested rom customers a b. d e Collections from customers Cash payments for inventory. Cash payments for other operating expenses. Cash payment for income tax Cash received from the sale of equipment. Aldia paid $42,000 for new equipment during the year. Issuance of common stock Issuance of notes payable. Aldia paid off $17,000 during the year. Cash dividends. There were no stock dividends. 9 h Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started