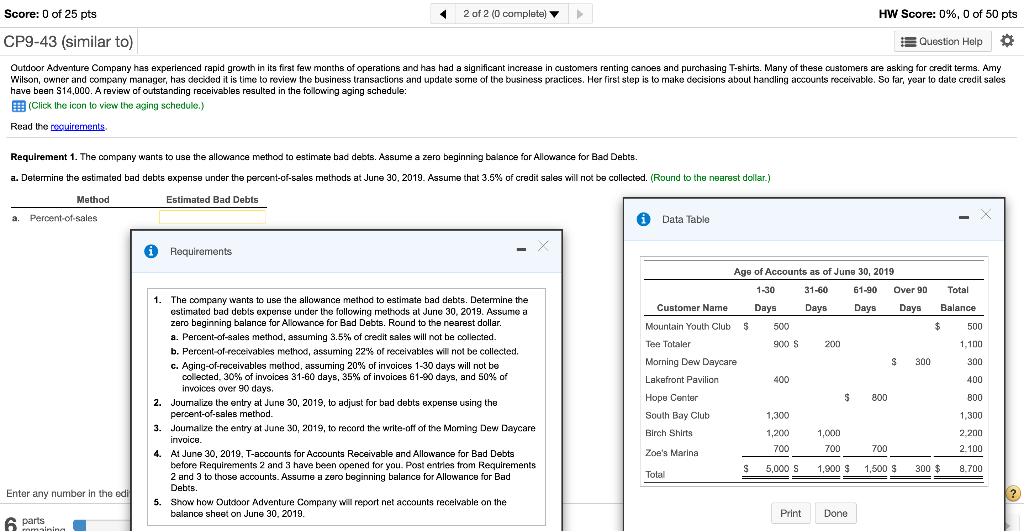

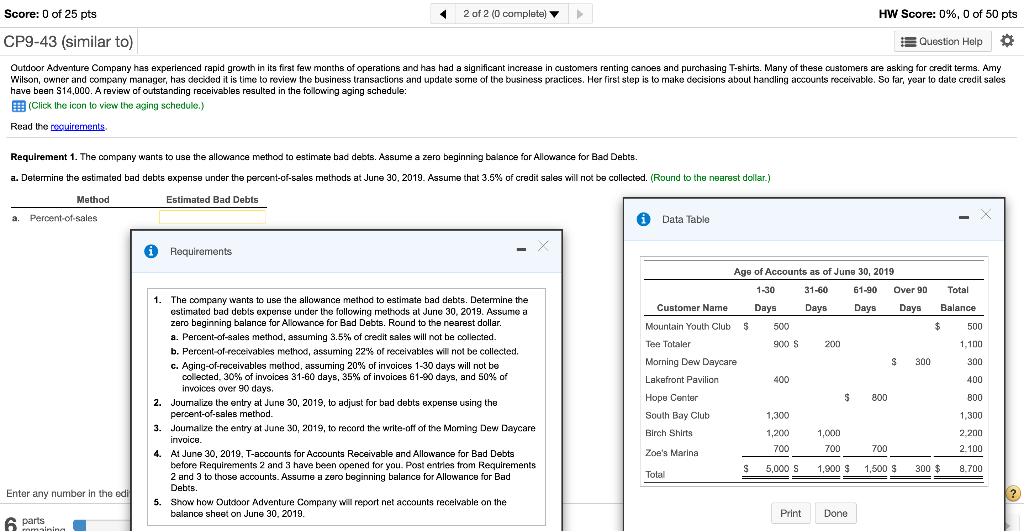

Score: 0 of 25 pts 2 of 2 (0 complete) HW Score: 0%, 0 of 50 pts CP9-43 (similar to) Question Help O Outdoor Adventure Company has experienced rapid growth in its first few months of operations and has had a significant increase in customers renting canoes and purchasing T-shirts. Many of these customers are asking for credit terms. Amy Wilson, owner and company manager, has decided it is time to review the business transactions and update some of the business practices. Her first step is to make decisions about handling accounts receivable. So far, year to date credit sales have been $14,000. A review of outstanding receivables resulted in the following aging schedule: (Click the icon to view the aging schedule.) Read the resuirements Requirement 1. The company wants to use the allowance method to estimate bad debts. Assume a zero beginning balance for Allowance for Bad Debts. a. Determine the estimated bad debts expense under the percent-of-sales methods at June 30, 2019. Assume that 3.5% of credit sales will not be collected. (Round to the nearest dollar.) Method Estimated Bad Debts a. Percent of sales i Data Table X Requirements Age of Accounts as of June 30, 2019 1-30 31-60 61-90 Over 90 Total Days Days Days Balance $ Days 500 900 S $ 500 200 1,100 S 300 300 Customer Name Mountain Youth Club Tee Totaler Morning Dew Daycare Lakefront Pavilion Hope Center South Bay Club Birch Shirts 400 400 $ 800 1. The company wants to use the allowance method to estimate bad debts. Determine the estimated bad debis expense under the following methods at June 30, 2019. Assume a zero beginning balance for Allowance for Bad Debts. Round to the nearest dollar. a. Percent-of-sales method, assuming 3.5% of credit sales will not be collected. b. Percent-of-receivables method, assuming 22% of receivables will not be collected. c. Aging-of-receivables method, assuming 20% of invoices 1-30 days will not be collected, 30% of invoices 31-60 days, 35% of invoices 61-90 days, and 50% of invoices over 90 days 2. Joumalize the entry at June 30, 2019, to adjust for bad debts expense using the percent-of-sales method. 3. Joumalize the entry at June 30, 2019, to record the write-off of the Moming Dew Daycare invoice 4. At June 30, 2019, T-accounts for Accounts Receivable and Allowance for Bad Debts before Requirements 2 and 3 have been opened for you. Post entries from Requirements 2 and 3 to those accounts. Assume a zero beginning balance for Allowance for Bad Debts 5. Show how Outdoor Adventure Company will report net accounts receivable on the balance sheet on June 30, 2019 800 1.300 1,300 1,200 700 1,000 700 2.200 2.100 Zoe's Marina 700 S 5,000 S 1,900 S Total 1,500 $ 300 $ 8.700 Enter any number in the edi ? Print Done 6 parts Fernarina