Answered step by step

Verified Expert Solution

Question

1 Approved Answer

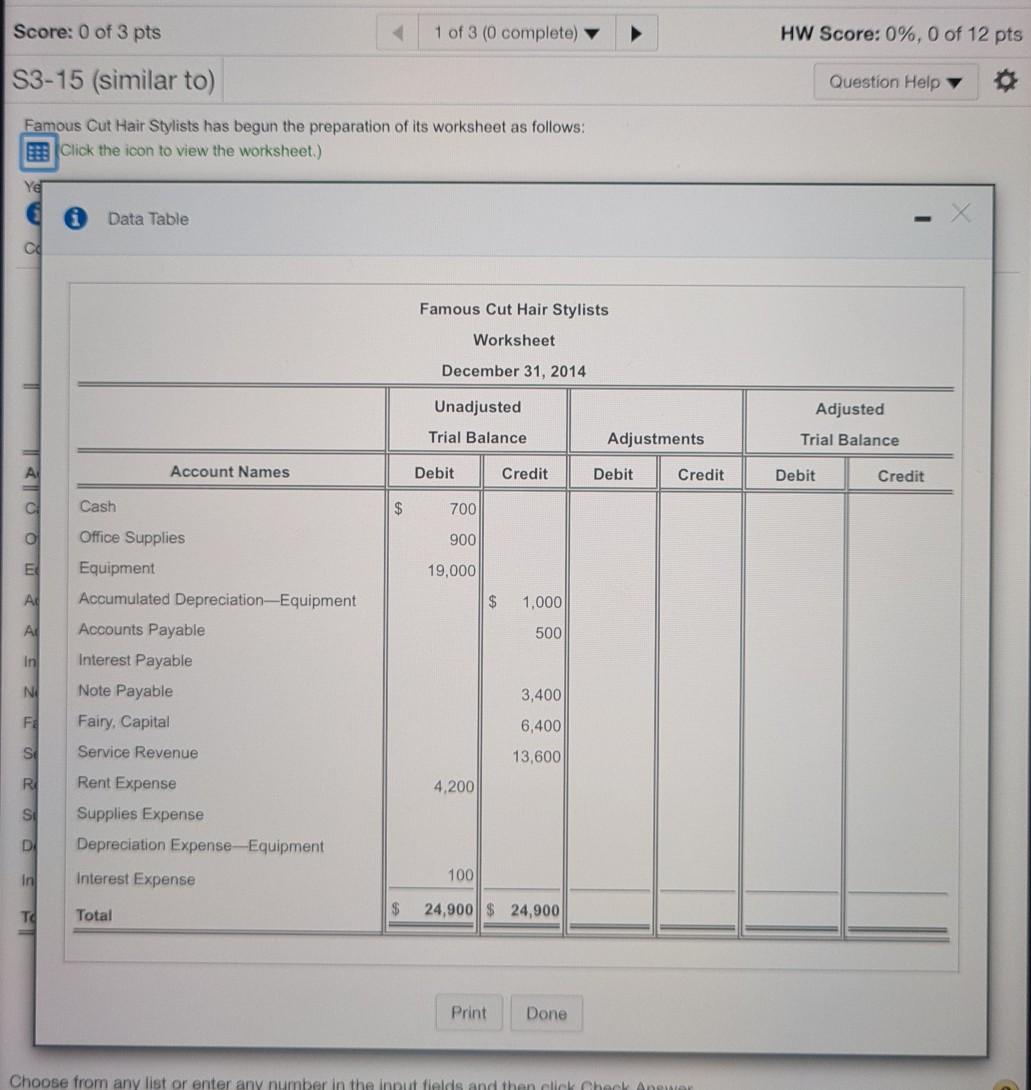

Score: 0 of 3 pts 1 of 3 (0 complete) HW Score: 0%, 0 of 12 pts S3-15 (similar to) Question Help Famous Cut Hair

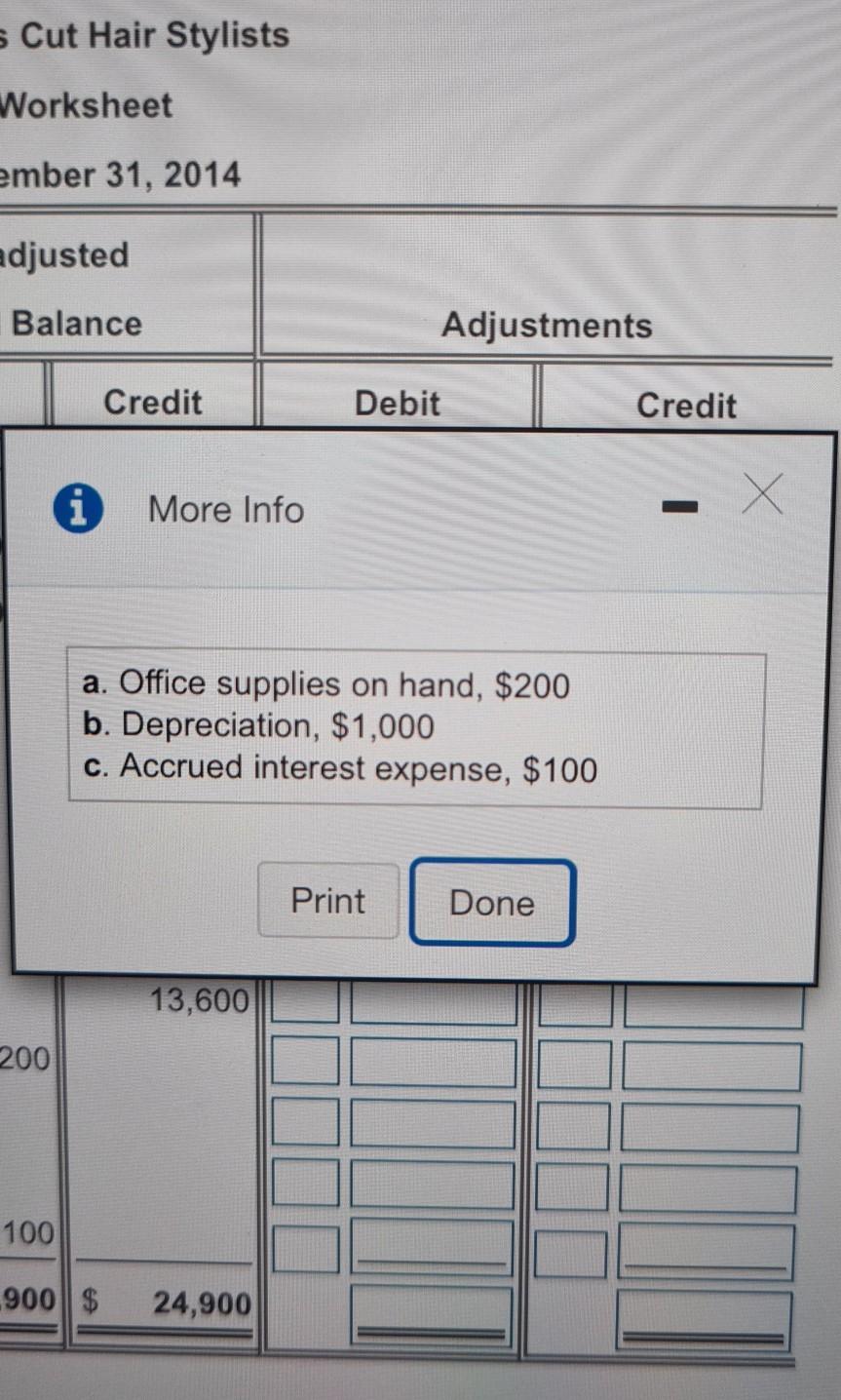

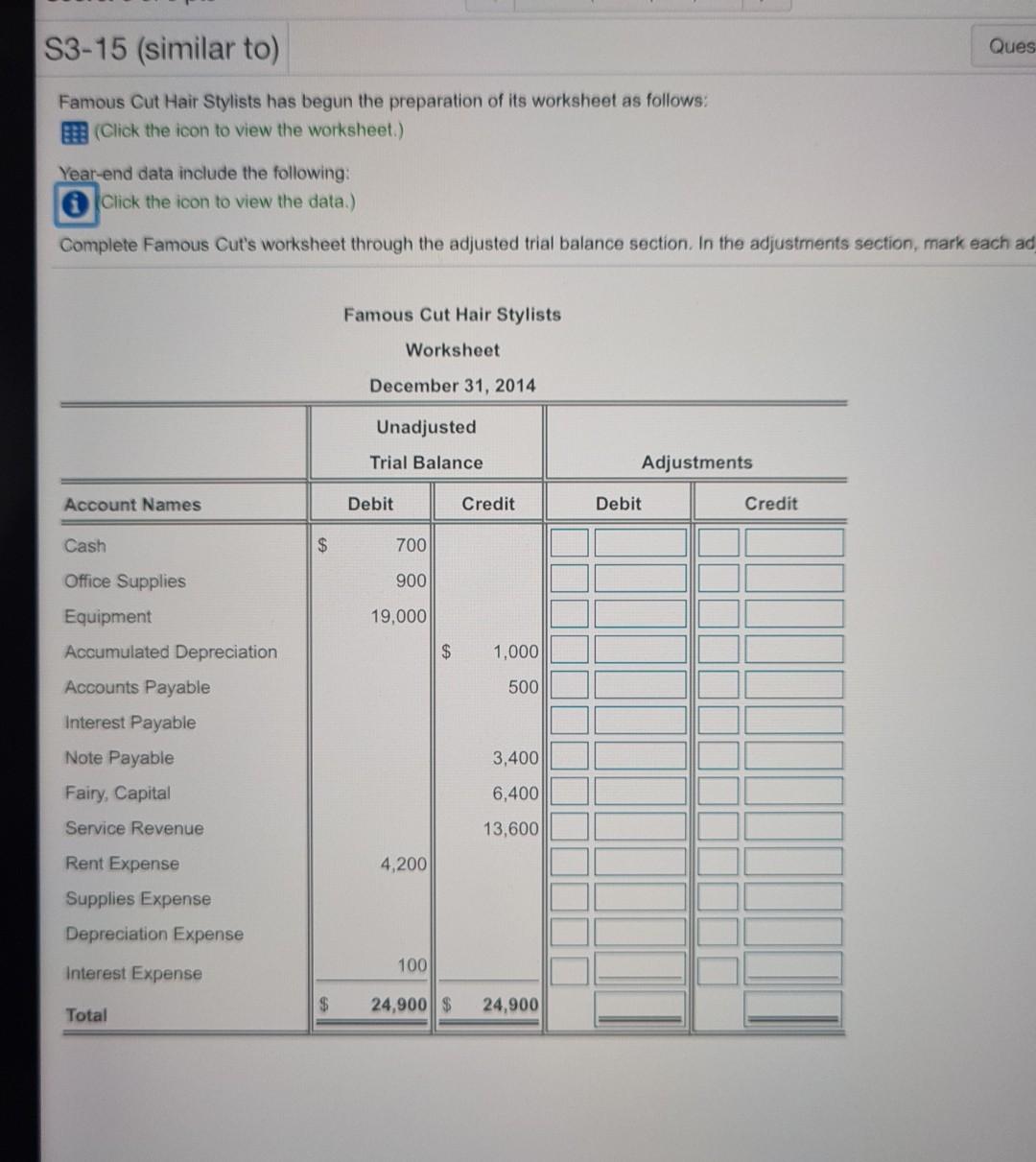

Score: 0 of 3 pts 1 of 3 (0 complete) HW Score: 0%, 0 of 12 pts S3-15 (similar to) Question Help Famous Cut Hair Stylists has begun the preparation of its worksheet as follows: Click the icon to view the worksheet.) Yel Data Table Famous Cut Hair Stylists Worksheet December 31, 2014 Adjusted Unadjusted Trial Balance Adjustments Trial Balance Account Names Debit Credit Debit Credit Debit Credit Cash $ 700 900 E Office Supplies Equipment Accumulated Depreciation Equipment 19,000 $ 1,000 A Accounts Payable 500 In N 3,400 Interest Payable Note Payable Fairy, Capital Service Revenue F 6,400 SO 13,600 R Rent Expense 4,200 Si DI Supplies Expense Depreciation Expense ---Equipment Interest Expense in 100 Total $ 24,900 $ 24,900 TC Print Done Choose from any list or enter any number in the input fields and then clickCheck And Cut Hair Stylists Worksheet ember 31, 2014 adjusted Balance Adjustments Credit Debit Credit i X More Info a. Office supplies on hand, $200 b. Depreciation, $1,000 c. Accrued interest expense, $100 Print Done 13,600 200 100 900||$ 24,900 S3-15 (similar to) Ques Famous Cut Hair Stylists has begun the preparation of its worksheet as follows: (Click the icon to view the worksheet.) Year-end data include the following: Click the icon to view the data.) Complete Famous Cut's worksheet through the adjusted trial balance section. In the adjustments section, mark each ad Famous Cut Hair Stylists Worksheet December 31, 2014 Unadjusted Trial Balance Adjustments Account Names Debit Credit Debit Credit Cash $ 700 Office Supplies 900 19,000 $ 1,000 Equipment Accumulated Depreciation Accounts Payable Interest Payable 500 Note Payable 3,400 Fairy, Capital 6,400 Service Revenue 13,600 Rent Expense 4,200 Supplies Expense Depreciation Expense 100 Interest Expense $ 24,900 $ 24,900 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started