Answered step by step

Verified Expert Solution

Question

1 Approved Answer

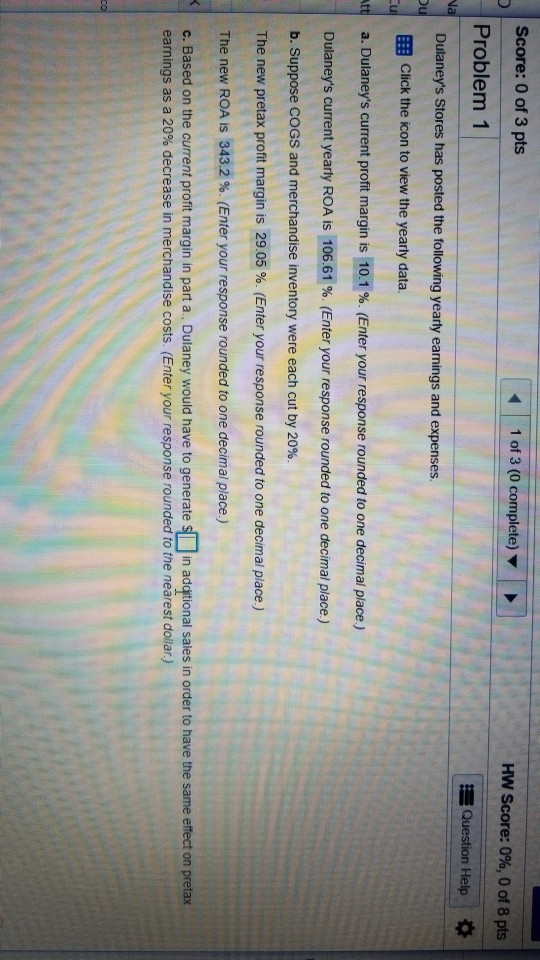

Score: 0 of 3 pts Problem 1 Dulaney's Stores has posted the following yearly earnings and expenses. EEl Click the icon to view the yearly

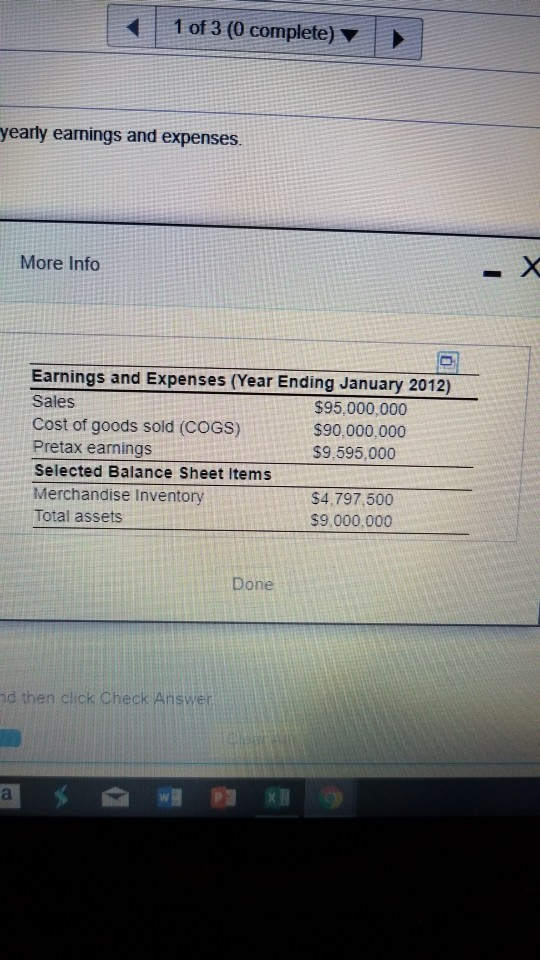

Score: 0 of 3 pts Problem 1 Dulaney's Stores has posted the following yearly earnings and expenses. EEl Click the icon to view the yearly data. a. Dulaney's current profit margin is 40.1 %. (Enter your response rounded to one decimal place ) Dulaney's current yearty ROA is 106.61%. (Enter your response rounded to one decimal place) b. Suppose COGS and merchandise inventory were each cut by 20%. The new pretax profit margin is 29.05 %. (Enter your response rounded to one decimal place.) The new ROA is 343.2 %. (Enter your response rounded to one decimal place.) c. Based on the current profit margin in part a . Dulaney would have to generate in additional sales in order to have the same effect on pretax 1 of 3 (0 complete) HW Score: 0%, 0 of 8 pts Question Help t earnings as a 20% decrease in merchandise costs. (Enteryour response rounded to the nearest dollar) 1 of 3 (0 complete) yearly eanings and expenses More Info Earnings and Expenses (Year Ending January 2012) Sales Cost of goods sold (COGS) Pretax earnings Selected Balance Sheet Items Merchandise Inventory Total assets $95,000,000 $90,000,000 $9,595,000 $4,797,500 $9,000,000 Done d then click Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started