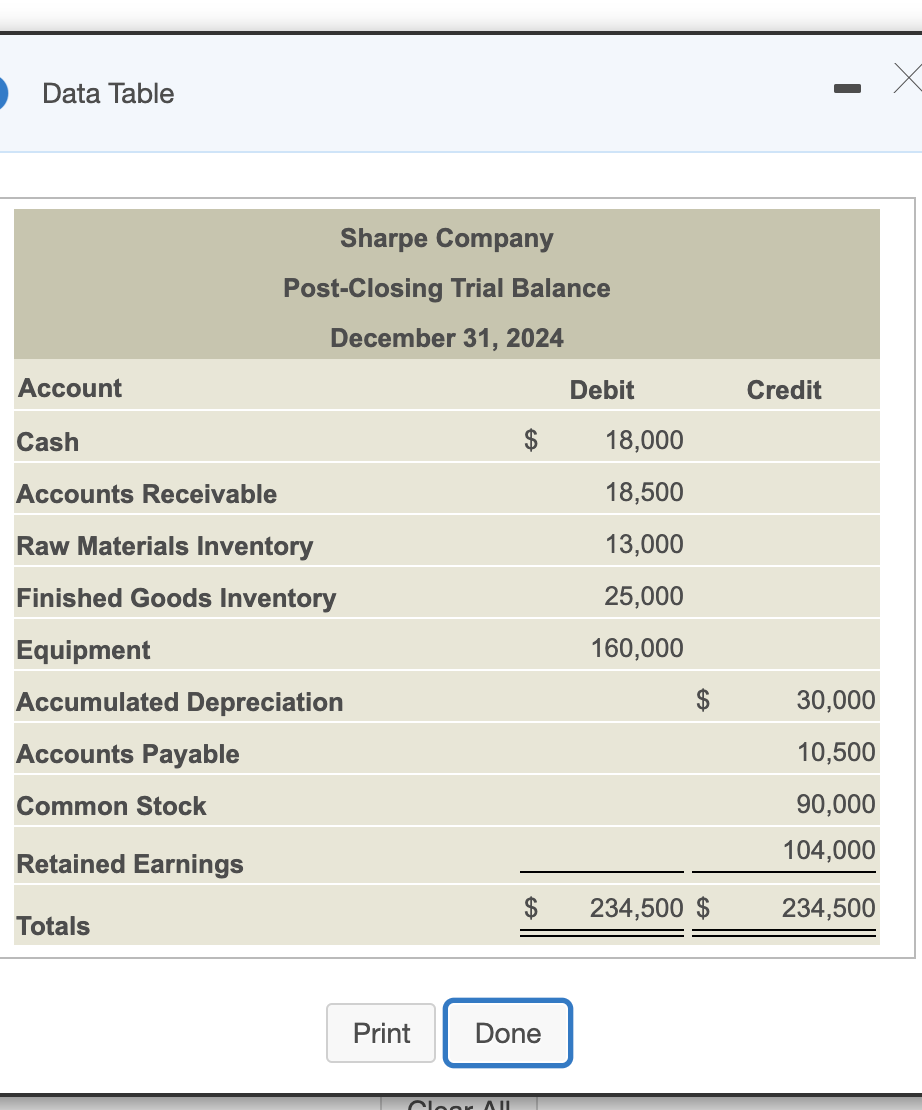

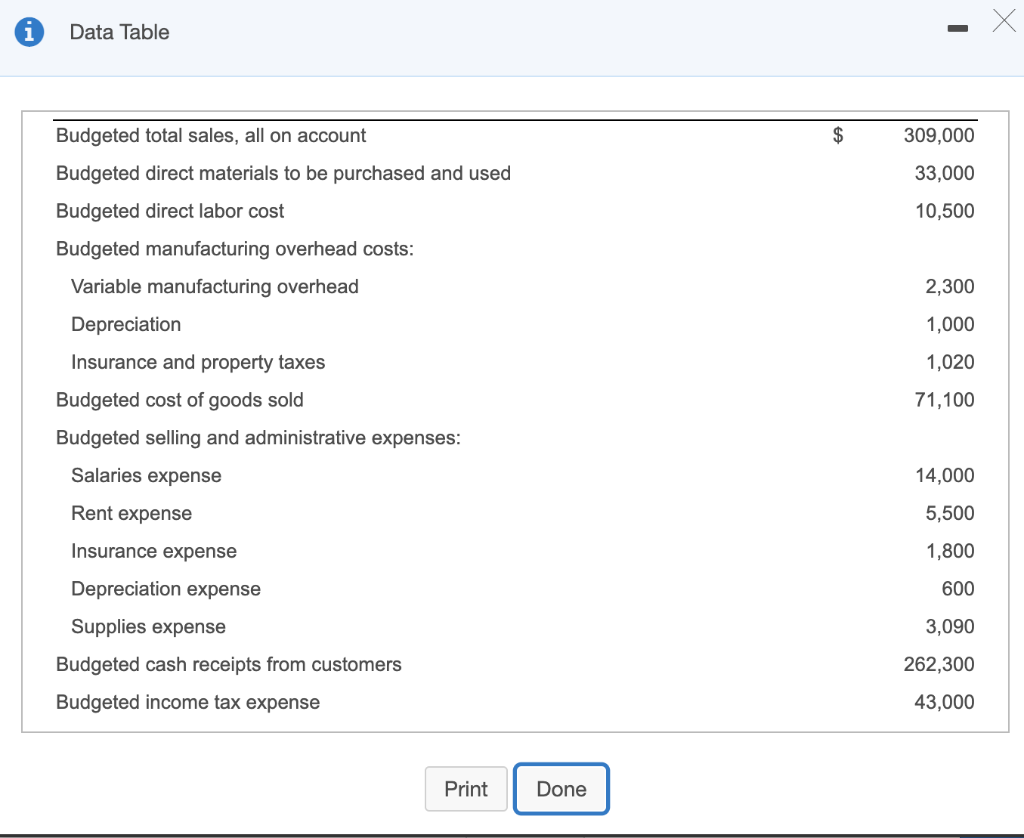

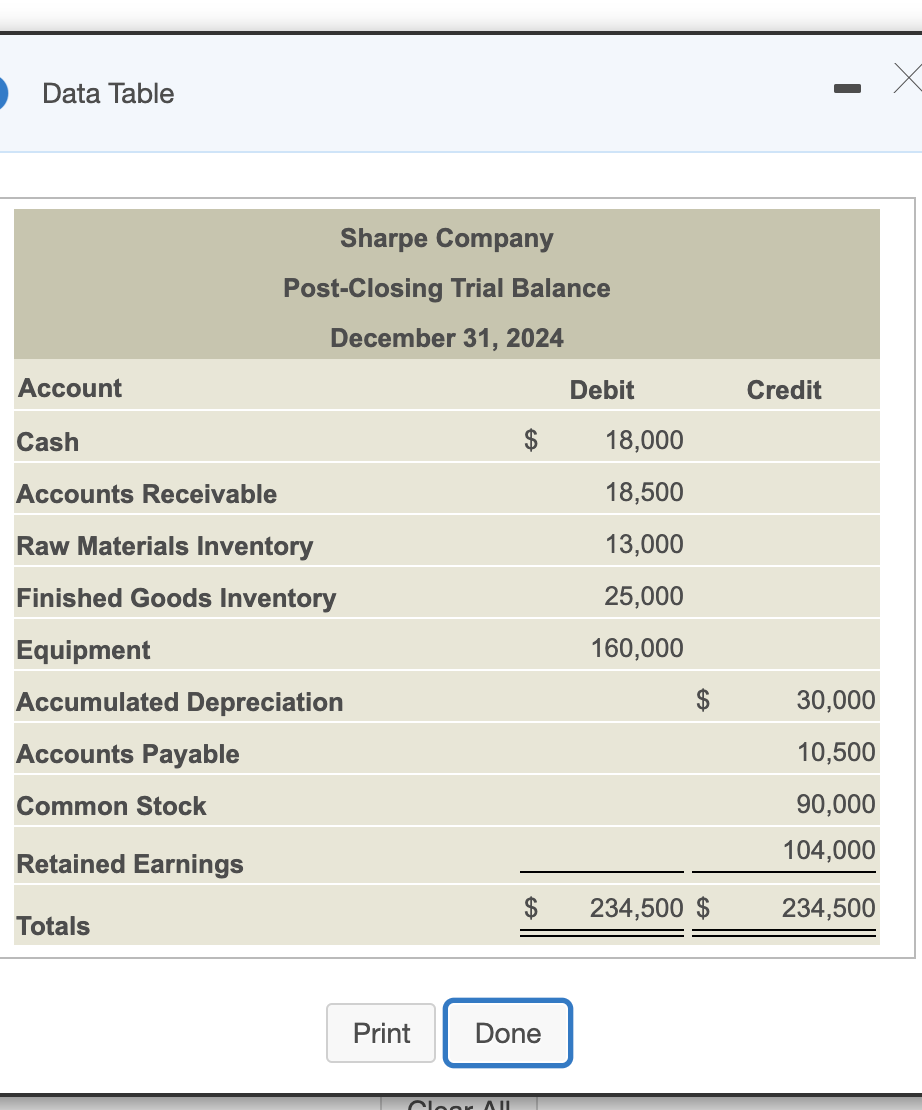

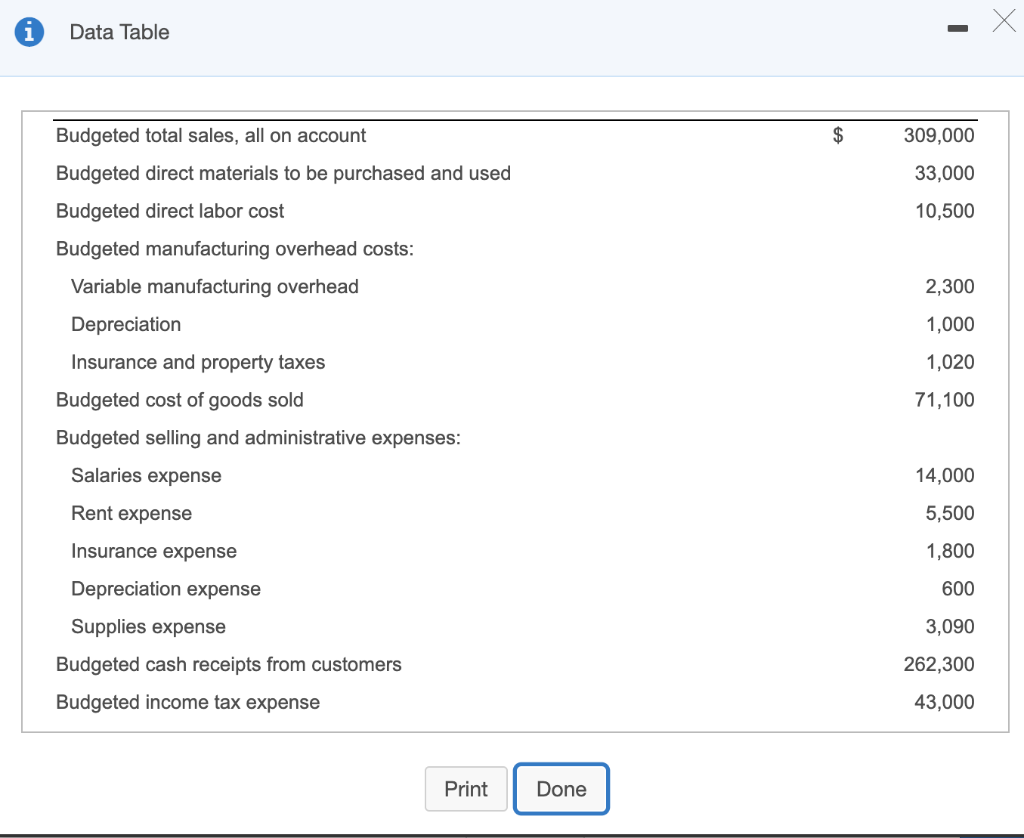

Score: 0 of 8 pts 1 of 1 (0 complete) HW Score: 0%, 0 of 8 pt PM7-40A (similar to) Question Help o Sharpe Company has the following post-closing trial balance on December 31, 2024: (Click the icon to view the post-closing trial balance.) a. Additional information: Direct materials purchases are paid 50% in the quarter purchased and 50% in the next quarter. b. Direct labor, manufacturing overhead, selling and administrative costs, and income tax expense are paid in the quarter incurred. Accounts payable at December 31, 2024 are paid in the first quarter of 2025 The company's accounting department has gathered the following budgeting information for the first quarter of 2025: (Click the icon to view the budgeting information.) c. Read the requirements. Requirement 1. Prepare Sharpe Company's budgeted income statement the first quarter of 2025. Sharpe Company Budgeted Income Statement For the Quarter Ended March 31, 2025 Sales Revenue Cost of Goods Sold Gross Profit Selling and Administrative Expenses Income before Income Taxes Income Tax Expense Net Income Enter any number in the edit fields and then click Check Answer. part remaining Clear All Check Answer Data Table Sharpe Company Post-Closing Trial Balance December 31, 2024 Account Debit Credit Cash 18,000 18,500 13,000 Accounts Receivable Raw Materials Inventory Finished Goods Inventory Equipment Accumulated Depreciation 25,000 160,000 30,000 Accounts Payable 10,500 Common Stock 90,000 104,000 Retained Earnings 234,500 $ 234,500 Totals Print Done Coor Data Table $ 309,000 33,000 10,500 Budgeted total sales, all on account Budgeted direct materials to be purchased and used Budgeted direct labor cost Budgeted manufacturing overhead costs: Variable manufacturing overhead Depreciation Insurance and property taxes Budgeted cost of goods sold 2,300 1,000 1,020 71,100 Budgeted selling and administrative expenses: Salaries expense 14,000 Rent expense 5,500 1,800 Insurance expense Depreciation expense Supplies expense 600 3,090 Budgeted cash receipts from customers 262,300 Budgeted income tax expense 43,000 Print Done