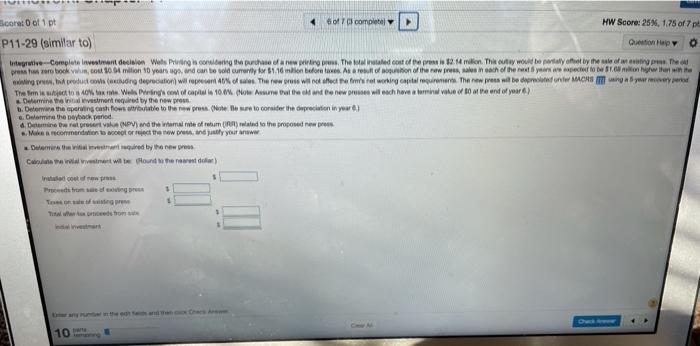

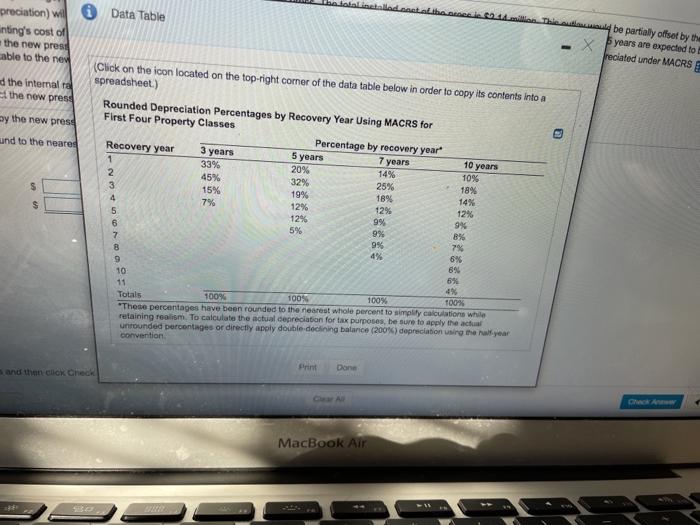

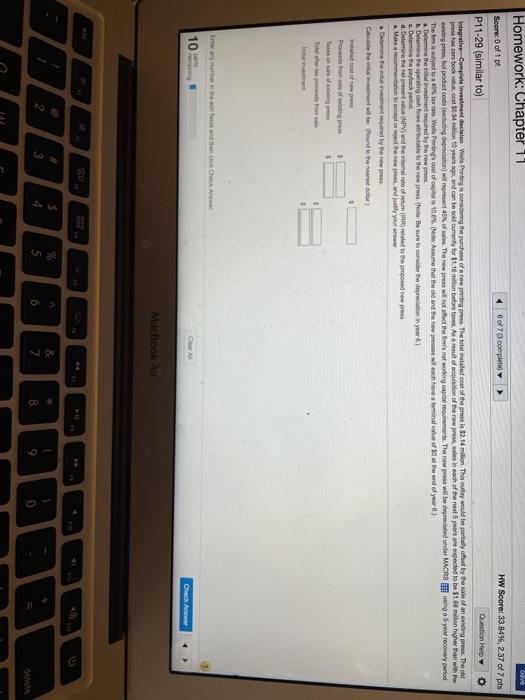

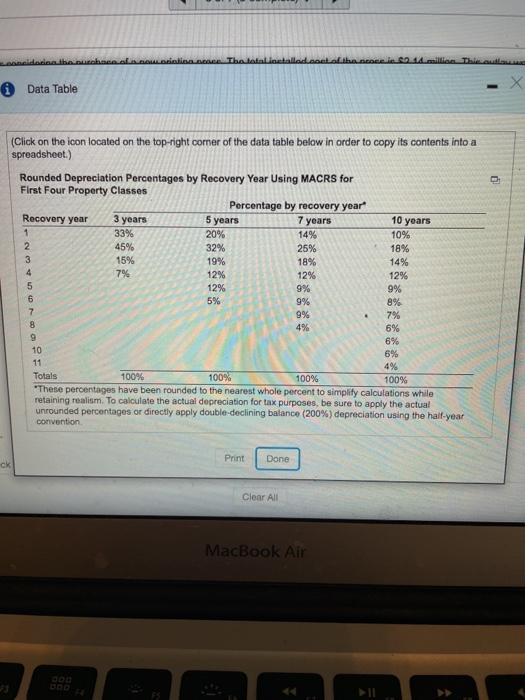

Score: Dot 1 pt of completely HW Score: 25%, 1.75 of 7 pt P11-29 (similar to) Question tegrative-Complain investat del Wels Piring has conting the purch einer. The world cost of the promis 12.4 milion. The only would be portal cut by the emple pressure books 10 milion 10 years and can be sold currently $1.16 min before we are lotion of the new reseach of the decorate www.prong depreciation will off. The rewoss will not affect the wrot working capitare. The new press will be done CHS ngayon The missie Wels Piring capital is 10.0 (Now Assume altre cand new wilach have abominal value of and of you) in the entered by the new press Dema the princesh footbale to ure proche lle sure to consider the preciation in your ) Oleme the payback period a mineralpreventh (NPVand the heat rite of renom(R) rated to the proposed rew Mencomendation to low in your www Duomen the equired by the new preus Ce weer we found the water) 1 Prestige Tease 10 adet olib Data Table preciation) will inting's cost of the new prest able to the new be partially offset by the years are expected to reciated under MACRS E d the Internal the new press by the new pres und to the neared 3 years 10 years S S (Click on the icon located on the top right corner of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Recovery year Percentage by recovery year 5 years 1 33% 7 years 20% 2 14% 45% 10% 32% 3 25% 15% 18% 19% 4 18% 7% 12% 5 12% 12% 12% 6 9% 9% 5% 7 9% 8% 99 8 7% 4% 9 6% 69 10 6% 11 4% Totals 100% 100% 100% TOOX *These percentages have been founded to the nearest whole percent to simplity calculations while retaining room. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double declining balance (2005) depreciation using the year convention Print Done and the Cok Check COM MacBook Air Enter any number in the edit fields and then click Check Answer 10 parts remaining Homework: Chapter 11 5dve Score: 0 of 1 pt 8 of 73 complete HW Score: 33.849,237 of 7 pts P11-29 (similar to) Oon Help Integrative Complete Investment decision Wels Printing in consider the purchase of a new printing. The total installed cost of the press is 2.4 million. This outley would be purity offset by the sale of an express. The old press has zero book value 64 million tona, dan to old current or $1.16 million before. As a result of equition of the new press, sales in each of the natynors are expected to be $1.6 million higher than with the but product coding to wiper 40% ofan. The new prowiec the firm's net working capital requirements. The new rest will be deprecated under MACRS sing a year recovery period Thermistis 40% toute Wels Piring cost of capitala100% sure that the old and the represes will each how atminal of 50 M the end of year 6) Determine the cured by a rowe b. Determine the operating cash flow tutte to the newest (ole: Beste come the duration in your Determine the paper a. Determine the net value (NPV)and more of related to the proposed now press Make some toward stly your Det er mined by the new Call the water will be order mo Procesom 10 Check Aw MacBook AS So 4 2 3 4 & 7 6 8 9 0 Data Table 5 years (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Porcentage by recovery year Recovery year 3 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 4% 6% 6% 10 6% 11 4% Totals 100% 100% 100% 100% "These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention 8 9 Print Done Clear All MacBook Air