Answered step by step

Verified Expert Solution

Question

1 Approved Answer

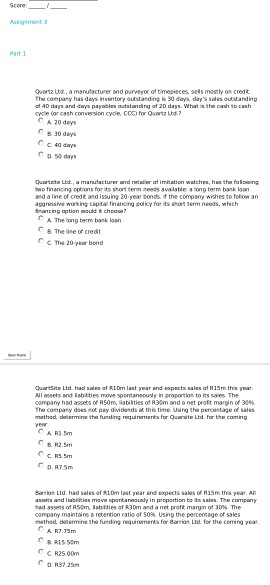

Score Part 1 Quartz Utd. a manutacturer and purveyor of timepieces, sels mostly on credit The company has days inventory outstanding is 50 day, day's

Score Part 1 Quartz Utd. a manutacturer and purveyor of timepieces, sels mostly on credit The company has days inventory outstanding is 50 day, day's sales outstanding of 40 days and days payables outstanding of 20 days. What is the cash to cash cycle lor cash conversion cycle coo for Owartz Ud? c A 20 days QuartziteLbd., a marutacturer and retailer of imitation watches, has the talowing two financing options for its short term needs available a long term bank loan and a line of credit and issuing 20 year bonds if the company wishes to follow an aggressive working capital financing policy for its short term needs, which Inancing option would chou? CA The long term bank loan cred Cc The 20-year bond QuartSite Ltd had sale of R1 Dim last year and expects sales of R25m this year Nilssets and abilities move spontaneously in proportion to its sales. The company had assets of Rom, abilities of 30m and a net profit margin of 30% The company does not pay dividends at this time. Using the percentage of sales method determine the funding requirements for Quarte Ltd. for the coming yer CAR CR5.5m CR75m Barrio Lid. had sales of Rom last year and expects sakso 15m this year. All us and the move spontanusly in proportion bits sales. The company had sets of 50m labilities of Rom and a net proti margin of 30% The company maintains a retention ratio of 50%. Using the percentage of sales method. mine the funding requirements for Barrio Lid for the coming year. CAR 15m CRS 50m C 250m CO3225 Score Part 1 Quartz Utd. a manutacturer and purveyor of timepieces, sels mostly on credit The company has days inventory outstanding is 50 day, day's sales outstanding of 40 days and days payables outstanding of 20 days. What is the cash to cash cycle lor cash conversion cycle coo for Owartz Ud? c A 20 days QuartziteLbd., a marutacturer and retailer of imitation watches, has the talowing two financing options for its short term needs available a long term bank loan and a line of credit and issuing 20 year bonds if the company wishes to follow an aggressive working capital financing policy for its short term needs, which Inancing option would chou? CA The long term bank loan cred Cc The 20-year bond QuartSite Ltd had sale of R1 Dim last year and expects sales of R25m this year Nilssets and abilities move spontaneously in proportion to its sales. The company had assets of Rom, abilities of 30m and a net profit margin of 30% The company does not pay dividends at this time. Using the percentage of sales method determine the funding requirements for Quarte Ltd. for the coming yer CAR CR5.5m CR75m Barrio Lid. had sales of Rom last year and expects sakso 15m this year. All us and the move spontanusly in proportion bits sales. The company had sets of 50m labilities of Rom and a net proti margin of 30% The company maintains a retention ratio of 50%. Using the percentage of sales method. mine the funding requirements for Barrio Lid for the coming year. CAR 15m CRS 50m C 250m CO3225

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started