Answered step by step

Verified Expert Solution

Question

1 Approved Answer

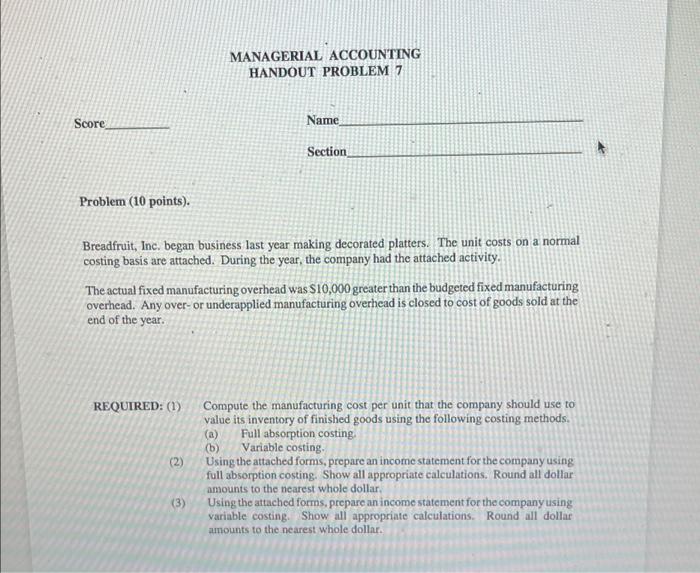

Score Problem (10 points). REQUIRED: (1) MANAGERIAL ACCOUNTING HANDOUT PROBLEM 7 Breadfruit, Inc. began business last year making decorated platters. The unit costs on a

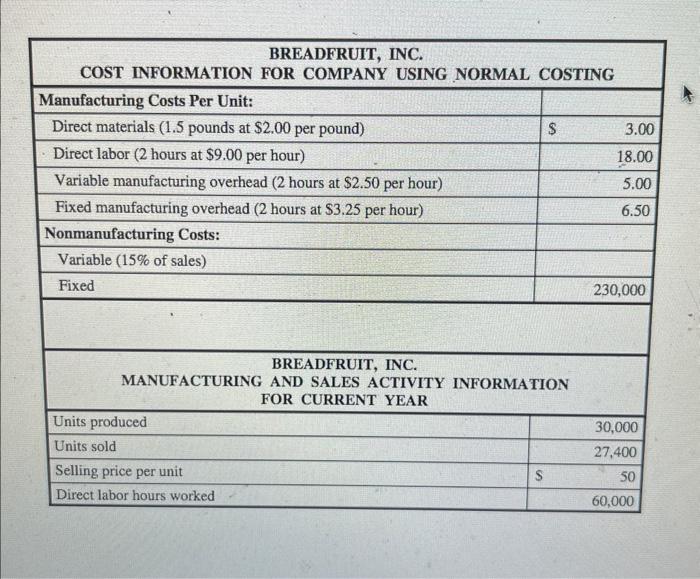

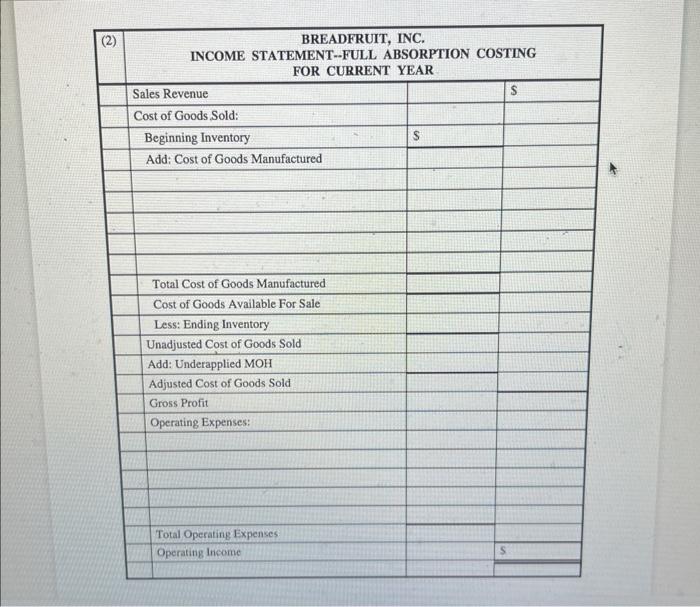

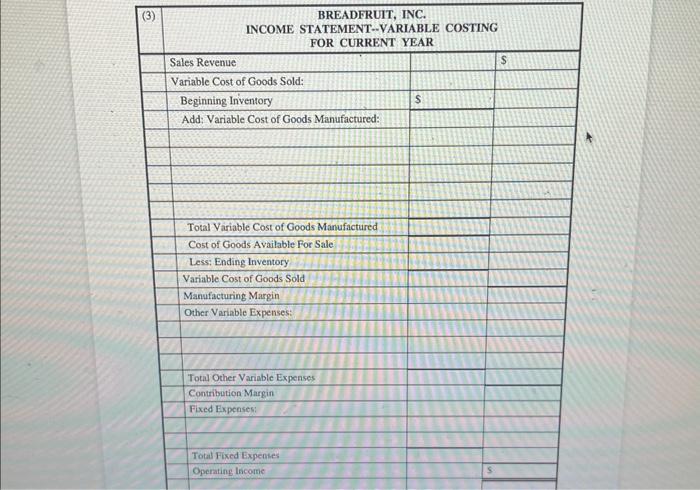

Score Problem (10 points). REQUIRED: (1) MANAGERIAL ACCOUNTING HANDOUT PROBLEM 7 Breadfruit, Inc. began business last year making decorated platters. The unit costs on a normal costing basis are attached. During the year, the company had the attached activity. (2) Name The actual fixed manufacturing overhead was $10,000 greater than the budgeted fixed manufacturing overhead. Any over- or underapplied manufacturing overhead is closed to cost of goods sold at the end of the year. (3) Section Compute the manufacturing cost per unit that the company should use to value its inventory of finished goods using the following costing methods. (a) Full absorption costing. (b) Variable costing. Using the attached forms, prepare an income statement for the company using full absorption costing. Show all appropriate calculations. Round all dollar amounts to the nearest whole dollar. Using the attached forms, prepare an income statement for the company using variable costing. Show all appropriate calculations. Round all dollar amounts to the nearest whole dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started