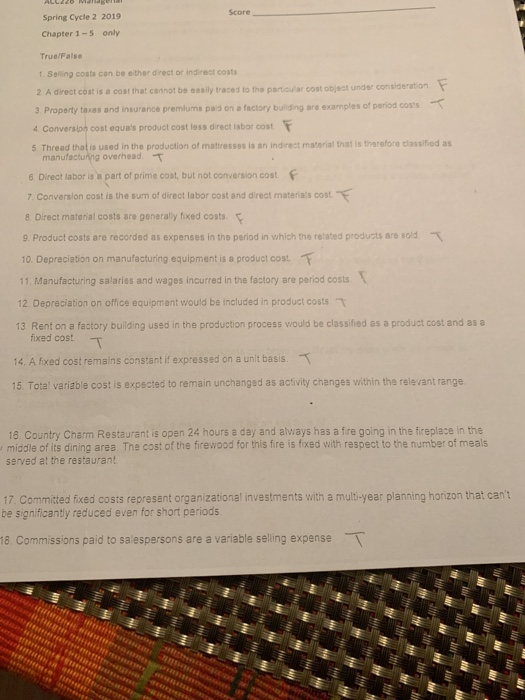

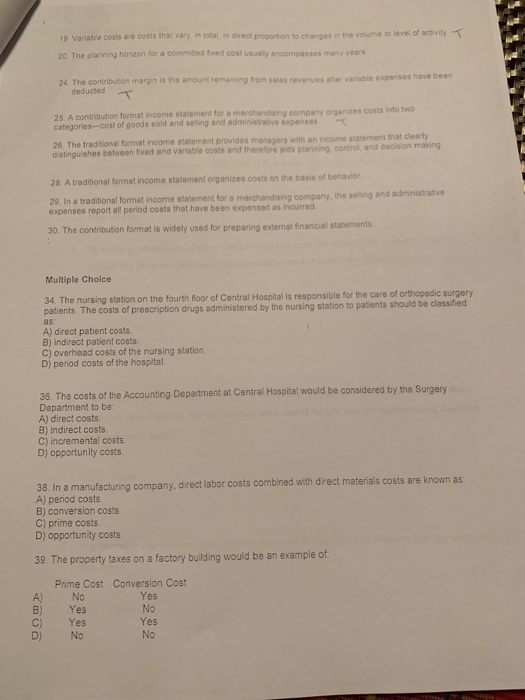

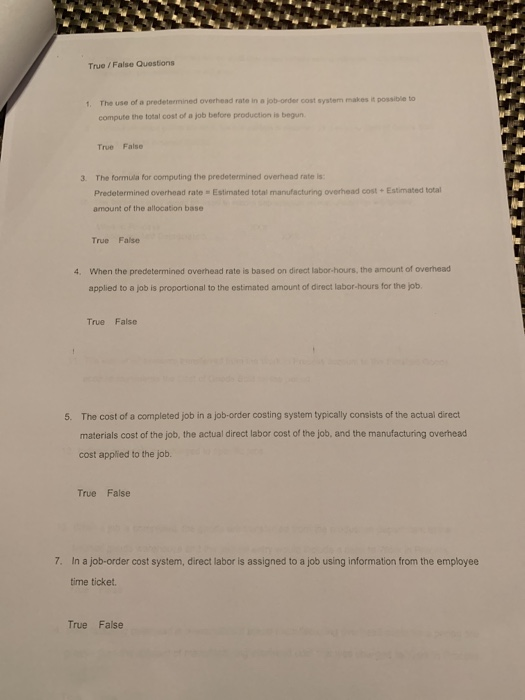

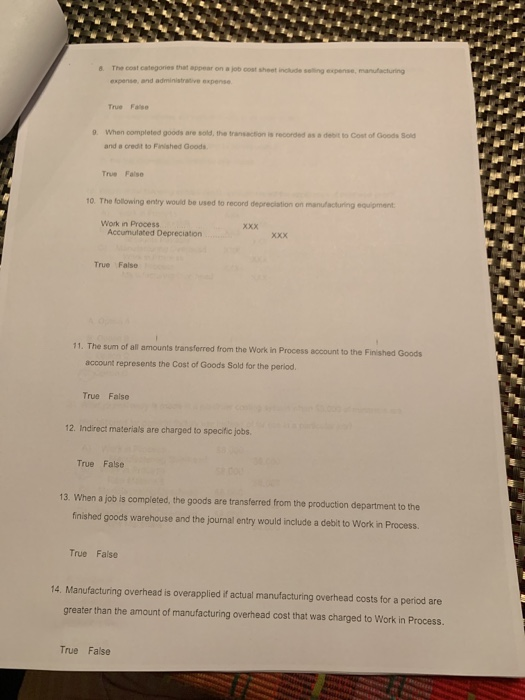

Score Spring Cycle 2 2019 Chapter 1-5 only True/False T. Seling costs can be either direct or indireat costs 2 A direct cost is a cost that cannot be easily traced to the partioular cost object under consideration 3 Property taxes and insurance premlums pais on a factory building are examples of period costs cost equa's product cost less direct labor cost 5 Thread that is used in the production of mattresses is an indirect material that is tharefore classified as overhead manu 6 Direct labor is a part of prime cost, but not conversion cost Conversion cost is the sum of direct labor cost and direct materials cost. 8. Direct material costs are generaly fixed costs. v 9 Product costs are recorded as expenses in the period in which ths related pro 10. Depreciation on manufacturing equipment is a product cost. 11. Manufacturing salaries and wages incurred in the factory are period costs 12. Depreciation on office equipment would be included in product costs 13. Rent on a factory building used in the production process would be classified as a product cost and as a are fixed cost 14. A fixed cost remains constant if expressed on a unit basis. 15 Tota' variable cost is expected to remain unchanged as activity changes within the relevant range 16 Country Charm Restaurant is open 24 hours a day and always has a fire going in the fireplace in the middle of its dining area The cost of the firewood for this fire is fixed with respect to the number of meals served at the restaurant 17 Committed fixed costs represent organizational investments with a multi-year planning horizon that can't be significantly reduced even for short pariods 18 Commissions paid to salespersons are a variable selling expense True /False Questions 1. The use of a predetermined overhead rate in a job-order cost system makes it possible to compute the total cost of a job before production is begun True False 3. The formula for computing the predetermined overhead rate is Predetermined overhead rate Estimated total manufacturing overhead cost Estimated total amount of the allocation base True False When the predetermined overhead rate is based on direct labor-hours, the amount of overhead applied to a job is proportional to the estimated amount of direct labor-hours for the job 4. True False The cost of a completed job in a job-order costing system typically consists of the actual direct materials cost of the job, the actual direct labor cost of the job, and the manufacturing overhead cost applied to the job. 5. True False 7. In a job-order cost system, direct labor is assigned to a job using information from the employee time ticket True False