Question

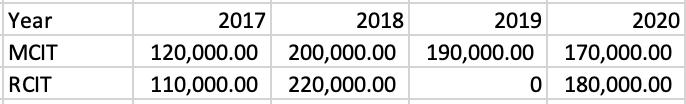

Scotch corporation had the following historical MCIT and RCIT data: Base solely on the information provided, what is the tax due and payable respectively

Scotch corporation had the following historical MCIT and RCIT data:

- Base solely on the information provided, what is the tax due and payable respectively in 2019 and 2020?

- What is the tax due and payable respectively in 2019 and 2020?

- What is the tax due and payable respectively in 2017 and 2018?

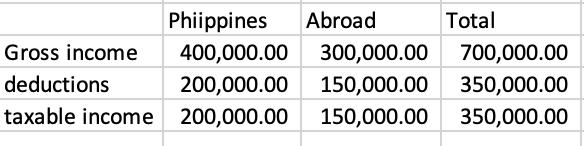

Brady corporation reported the following gross income and expenses in 2019:

What is the income tax due if the corporation is a government owned and controlled corporation?

What is the income tax due if the corporation is a government owned and controlled corporation?

What is the income tax due if the corporation is a non-resident cinematographic film owner, distributor or lessor?

What is the income tax due if the corporation is an international carrier?

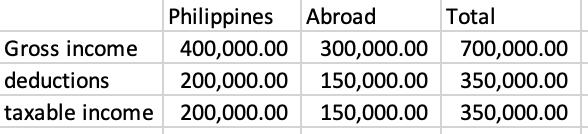

Vernyce corporation reported the following gross income and expenses 2020?

How much is the income tax due if the corporation is a resident foreign corporation?

How much is the income tax due if the corporation is a resident foreign corporation?

How much is income tax due if the corporation is an offshore banking unit?

HOw much is the income tax due if the corporation is a government owned and controlled corporation?

Year MCIT RCIT 2017 120,000.00 110,000.00 220,000.00 2018 2019 200,000.00 190,000.00 2020 170,000.00 0 180,000.00

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

It seems there is an issue with the information provided for the Vernon corporation as the image for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started