Answered step by step

Verified Expert Solution

Question

1 Approved Answer

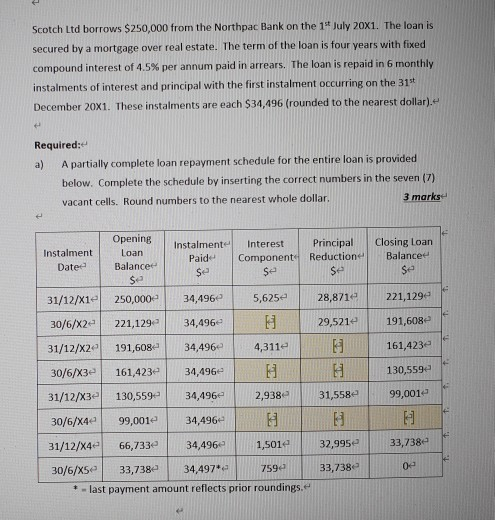

Scotch Ltd borrows $250,000 from the Northpac Bank on the 1st July 20X1. The loan is secured by a mortgage over real estate. The term

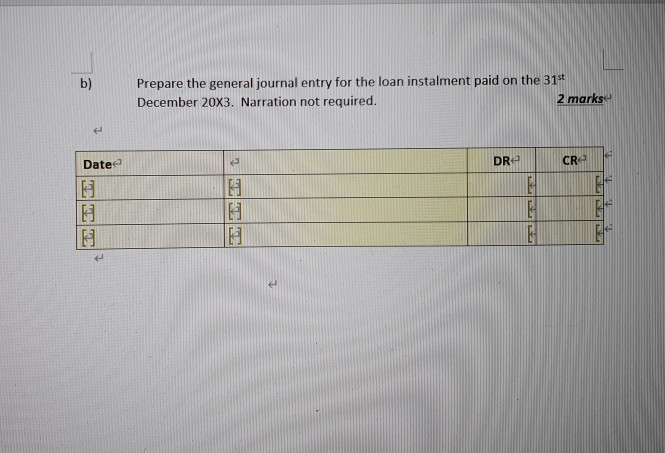

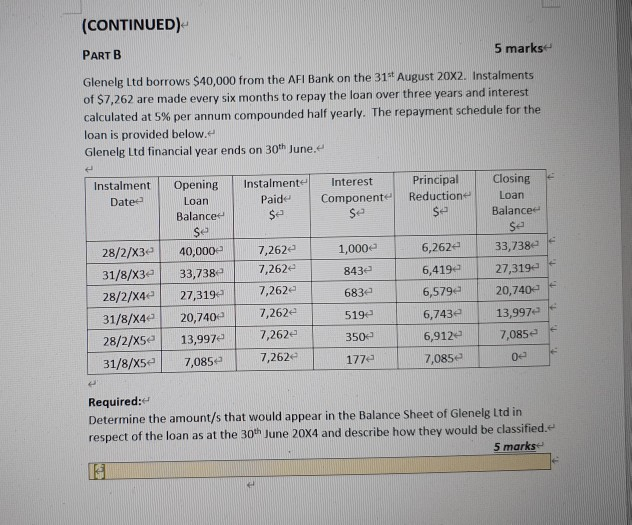

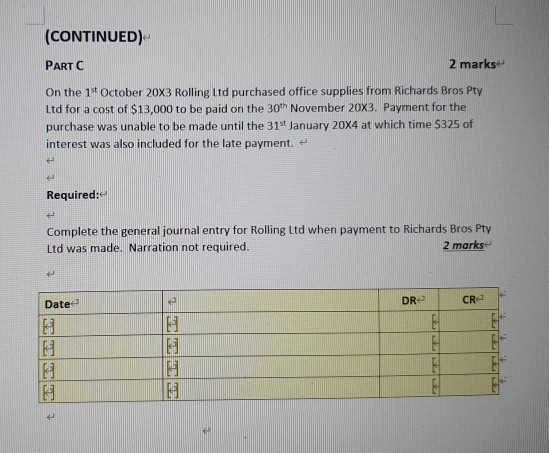

Scotch Ltd borrows $250,000 from the Northpac Bank on the 1st July 20X1. The loan is secured by a mortgage over real estate. The term of the loan is four years with fixed compound interest of 4.5% per annum paid in arrears. The loan is repaid in 6 monthly instalments of interest and principal with the first instalment occurring on the 31st December 20X1. These instalments are each $34,496 (rounded to the nearest dollar). Required: a) A partially complete loan repayment schedule for the entire loan is provided below. Complete the schedule by inserting the correct numbers in the seven (7) vacant cells. Round numbers to the nearest whole dollar 3 marks Instalment Date Opening Loan Balance $ 250,000 Instalmente Paide $ Interest Principal Components Reductione $a Se Closing Loan Balance Se 31/12/X12 34,496 28,871 221,129 5,6252 H 30/6/X2 221,129 34,496 191,6082 31/12/X2 191,608 34,496 4,311 29,5212 H H 161,423 30/6/X3e 161,423 34,496 H 130,559 31/12/x3e 130,559 34,496 2,938e 31,558 99,001 30/6/X4 99,001 34,496 H H 31/12/X4 66,733e 34,496 1,501 32,995e 33,738 7592 33,738 0 30/6/X50 33,738 34,497 - last payment amount reflects prior roundings. + b) Prepare the general journal entry for the loan instalment paid on the 31st December 20X3. Narration not required. 2 markse 5 DR CR Date H || H H H (CONTINUED) 5 marks PART B Glenelg Ltd borrows $40,000 from the AFI Bank on the 31st August 20x2. Instalments of $7,262 are made every six months to repay the loan over three years and interest calculated at 5% per annum compounded half yearly. The repayment schedule for the loan is provided below. Glenelg Ltd financial year ends on 30th June. Instalment Date Instalmente Paide Interest Componente Se Principal Reduction Se $ Opening Loan Balance Se 40,000 33,738 27,319 20,740 13,9972 7,085 1,000 8432 28/2/X3 31/8/X3 28/2/X4 31/8/X40 28/2/xse 31/8/15 683e 7,262 7,262- 7,262 7,262e 7,262 7,262 Closing Loan Balance $ 33,738 27,319 20,7402 13,9972 7,0852 6,2624 6,4192 6,5792 6,743e 6,912 7,0852 519 3502 177e 02 Required: Determine the amount/s that would appear in the Balance Sheet of Glenelg Ltd in respect of the loan as at the 30th June 20x4 and describe how they would be classified. 5 marks (CONTINUED) PARTC 2 marks On the 1st October 20x3 Rolling Ltd purchased office supplies from Richards Bros Pty Ltd for a cost of $13,000 to be paid on the 30th November 20X3. Payment for the purchase was unable to be made until the 31st January 2004 at which time $325 of interest was also included for the late payment. Required:- Complete the general journal entry for Rolling Ltd when payment to Richards Bros Pty Ltd was made. Narration not required. 2 marks Date DR. CR H H H H E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started