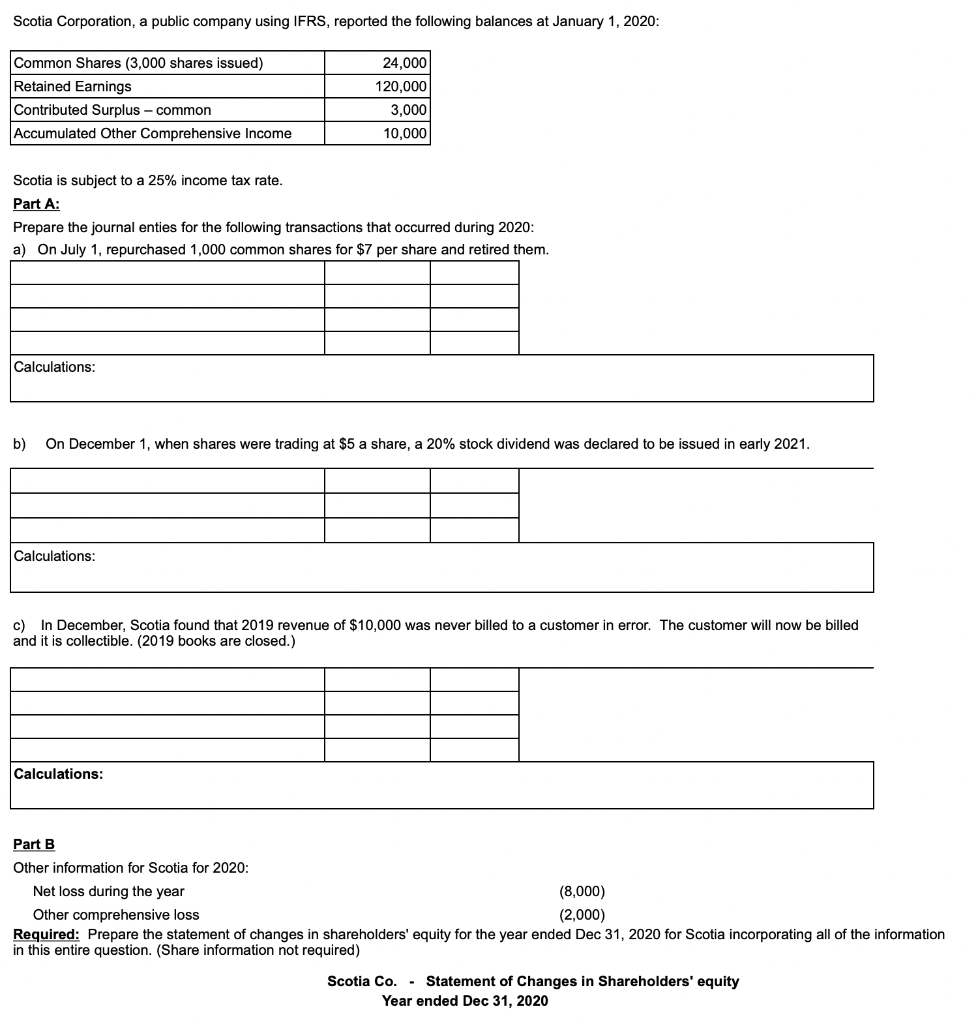

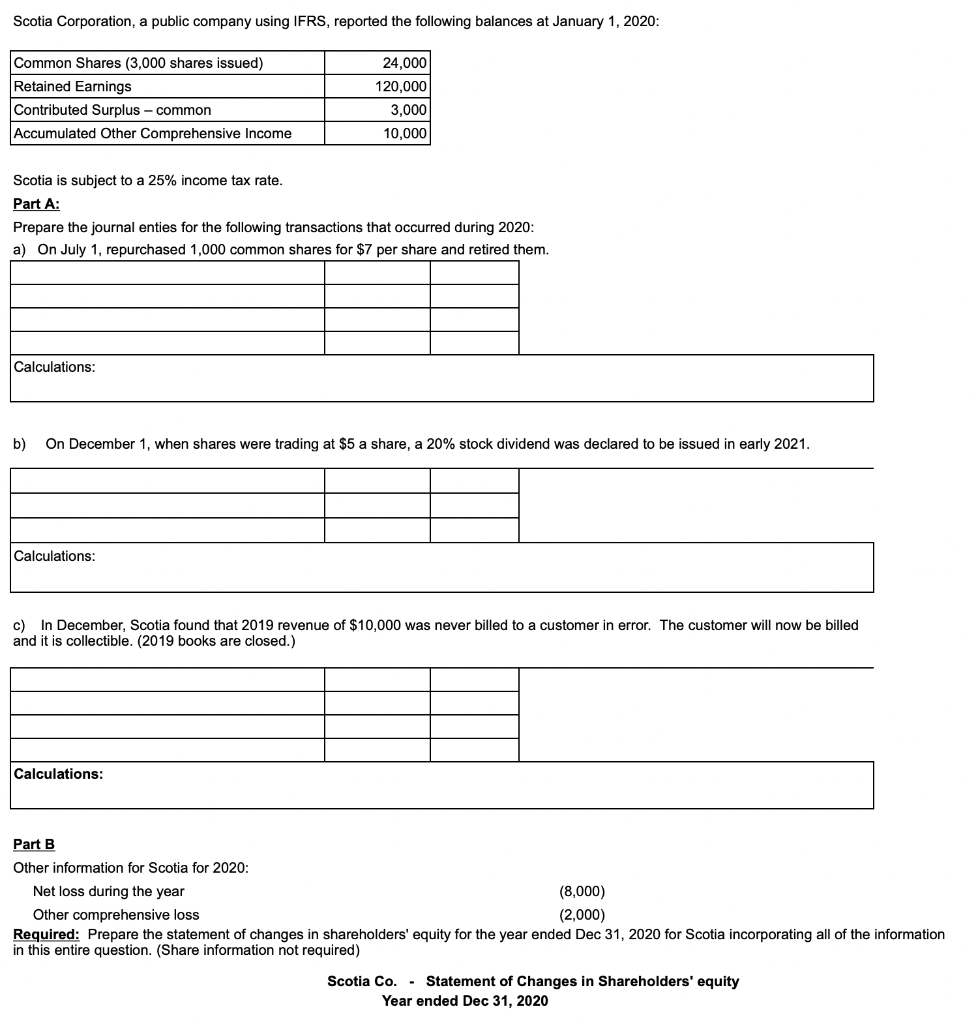

Scotia Corporation, a public company using IFRS, reported the following balances at January 1, 2020: 24,000 Common Shares (3,000 shares issued) Retained Earnings Contributed Surplus - common Accumulated Other Comprehensive Income 120,000 3,000 10,000 Scotia is subject to a 25% income tax rate. Part A: Prepare the journal enties for the following transactions that occurred during 2020: a) On July 1, repurchased 1,000 common shares for $7 per share and retired them. Calculations: b) On December 1, when shares were trading at $5 a share, a 20% stock dividend was declared to be issued in early 2021. Calculations: c) In December, Scotia found that 2019 revenue of $10,000 was never billed to a customer in error. The customer will now be billed and it is collectible. (2019 books are closed.) Calculations: Part B Other information for Scotia for 2020: Net loss during the year (8,000) Other comprehensive loss (2,000) Required: Prepare the statement of changes in shareholders' equity for the year ended Dec 31, 2020 for Scotia incorporating all of the information in this entire question. (Share information not required) Scotia Co. - Statement of Changes in Shareholders' equity Year ended Dec 31, 2020 Scotia Corporation, a public company using IFRS, reported the following balances at January 1, 2020: 24,000 Common Shares (3,000 shares issued) Retained Earnings Contributed Surplus - common Accumulated Other Comprehensive Income 120,000 3,000 10,000 Scotia is subject to a 25% income tax rate. Part A: Prepare the journal enties for the following transactions that occurred during 2020: a) On July 1, repurchased 1,000 common shares for $7 per share and retired them. Calculations: b) On December 1, when shares were trading at $5 a share, a 20% stock dividend was declared to be issued in early 2021. Calculations: c) In December, Scotia found that 2019 revenue of $10,000 was never billed to a customer in error. The customer will now be billed and it is collectible. (2019 books are closed.) Calculations: Part B Other information for Scotia for 2020: Net loss during the year (8,000) Other comprehensive loss (2,000) Required: Prepare the statement of changes in shareholders' equity for the year ended Dec 31, 2020 for Scotia incorporating all of the information in this entire question. (Share information not required) Scotia Co. - Statement of Changes in Shareholders' equity Year ended Dec 31, 2020