Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Scott Investors, Inc., is considering the purchase of a $360,000 computer with an economic life of five years. The computer will be fully depreciated

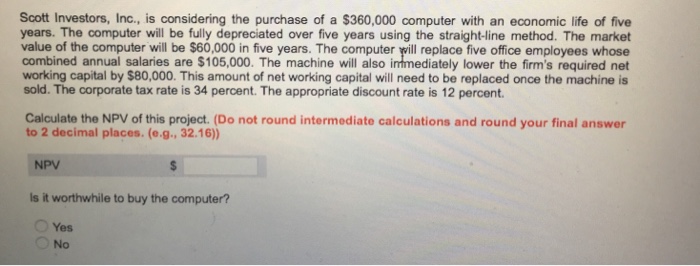

Scott Investors, Inc., is considering the purchase of a $360,000 computer with an economic life of five years. The computer will be fully depreciated over five years using the straight-line method. The market value of the computer will be $60,000 in five years. The computer will replace five office employees whose combined annual salaries are $105,000. The machine will also immediately lower the firm's required net working capital by $80,000. This amount of net working capital will need to be replaced once the machine is sold. The corporate tax rate is 34 percent. The appropriate discount rate is 12 percent. Calculate the NPV of this project. (Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) NPV $ Is it worthwhile to buy the computer? Yes No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the NPV of the project we need to follow these steps Step 1 Calculate the Annual Depreciation The computer is depreciated over 5 years us...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started