SCOTTS Miracle Gro Make or Buy Decision NPV Calculate the NPV for outsourcing to a contract manufacturer (CM) in China and for keeping the plant in Temecula. Total Production Costs from Scotts perspective (i.e., the total costs that will be incurred by the CM that will offset what Scotts would have to pay in Temecula):

Additional Info; Scotts used a discount rate of 15% Capital Improvements at Temecula = $500k/yr ($300k/yr at CM) New molds needed at CM = $40k/mold (10 molds)

Additional Info; Scotts used a discount rate of 15% Capital Improvements at Temecula = $500k/yr ($300k/yr at CM) New molds needed at CM = $40k/mold (10 molds)

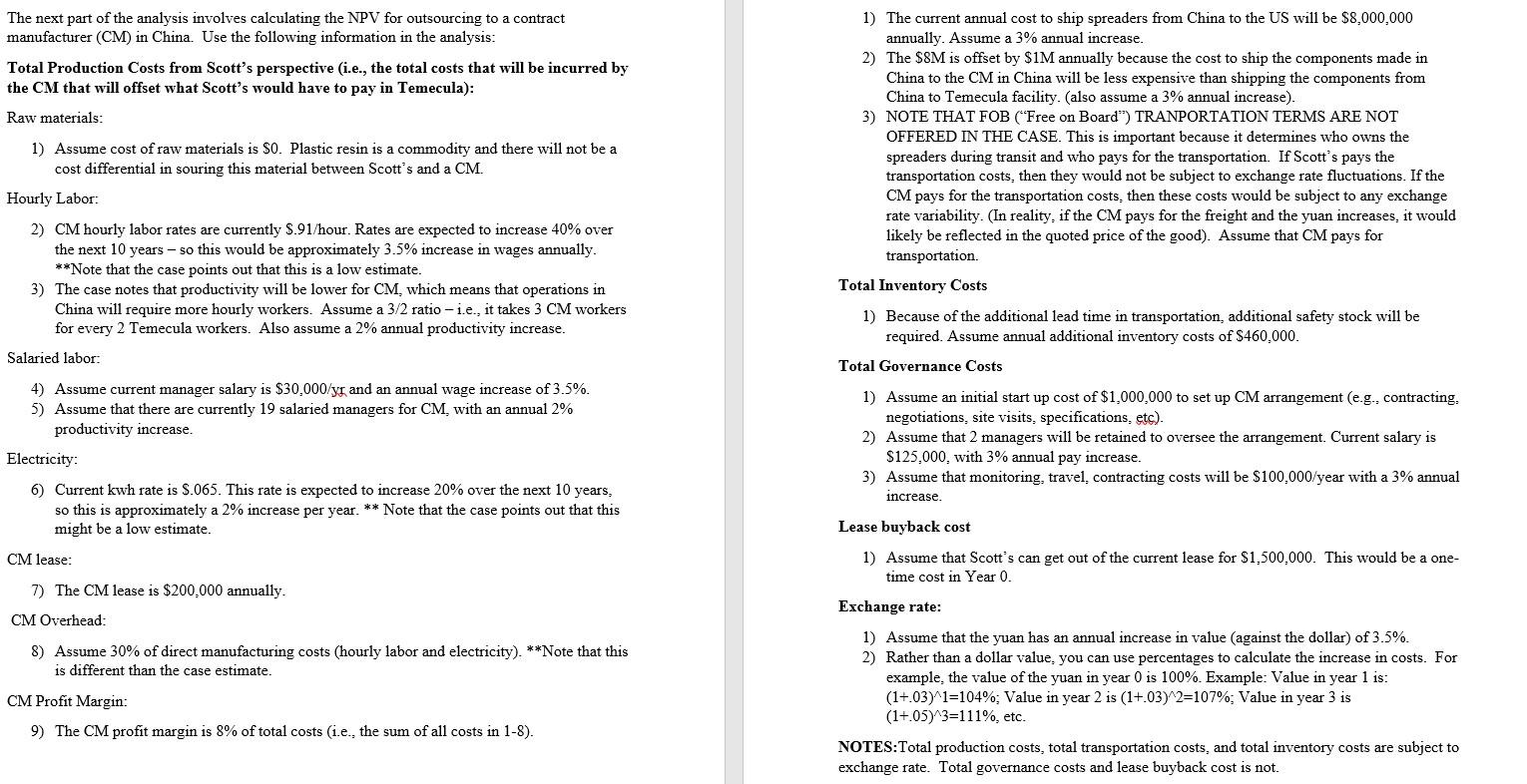

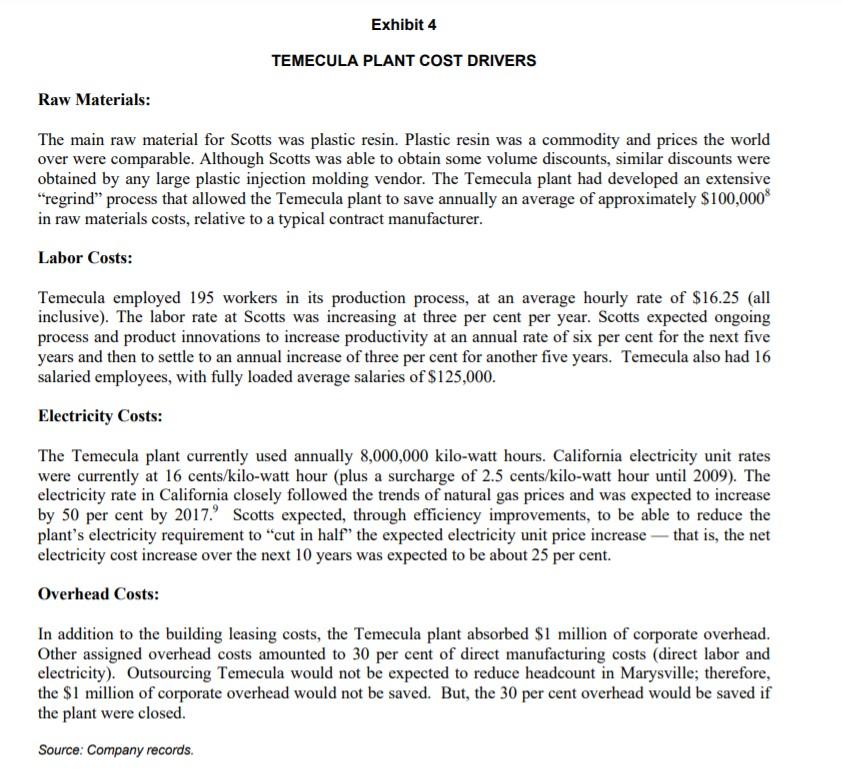

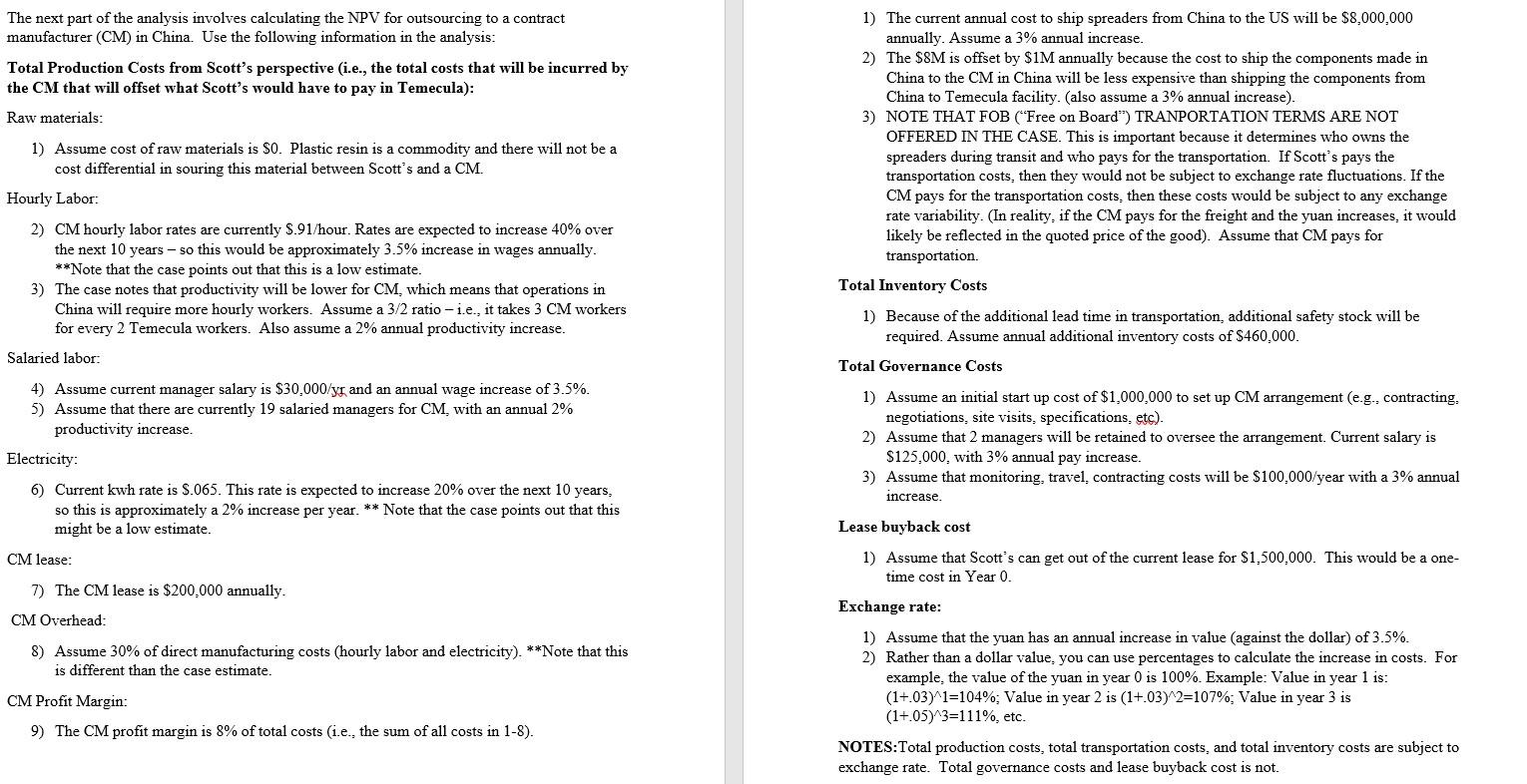

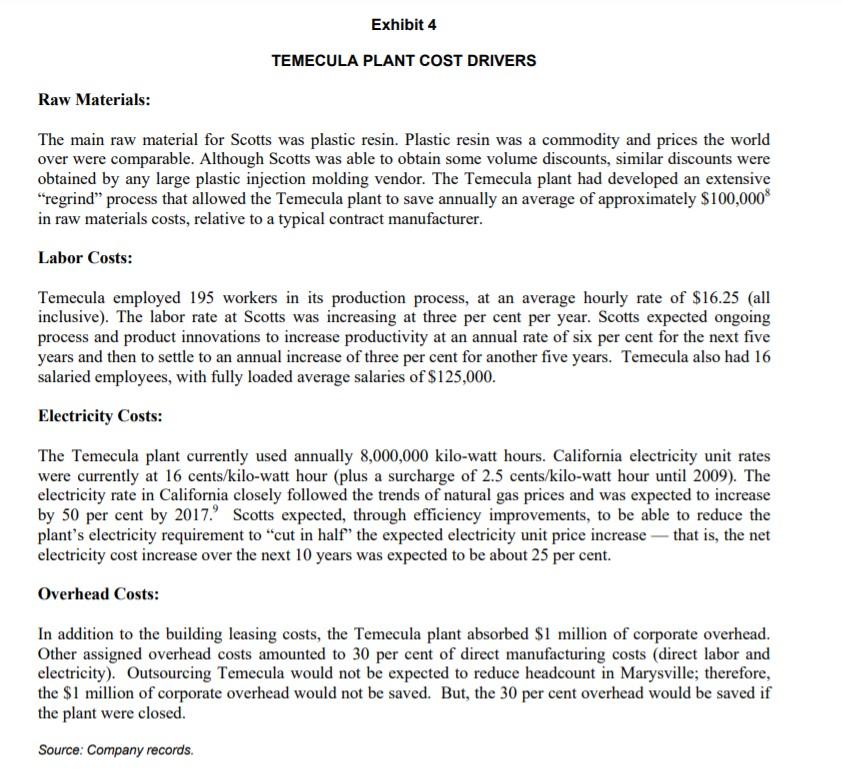

The next part of the analysis involves calculating the NPV for outsourcing to a contract manufacturer (CM) in China. Use the following information in the analysis: Total Production Costs from Scott's perspective (i.e., the total costs that will be incurred by the CM that will offset what Scott's would have to pay in Temecula): Raw materials: 1) Assume cost of raw materials is SO. Plastic resin is a commodity and there will not be a cost differential in souring this material between Scott's and a CM. 1) The current annual cost to ship spreaders from China to the US will be $8,000,000 annually. Assume a 3% annual increase. 2) The $8M is offset by $1M annually because the cost to ship the components made in China to the CM in China will be less expensive than shipping the components from China to Temecula facility. (also assume a 3% annual increase). 3) NOTE THAT FOB ("Free on Board") TRANPORTATION TERMS ARE NOT OFFERED IN THE CASE. This is important because it determines who owns the spreaders during transit and who pays for the transportation. If Scott's pays the transportation costs, then they would not be subject to exchange rate fluctuations. If the CM pays for the transportation costs, then these costs would be subject to any exchange rate variability. (In reality, if the CM pays for the freight and the yuan increases, it would likely be reflected in the quoted price of the good). Assume that CM pays for transportation. Total Inventory Costs Hourly Labor: 2) CM hourly labor rates are currently 5.91/hour. Rates are expected to increase 40% over the next 10 years - so this would be approximately 3.5% increase in wages annually. **Note that the case points out that this is a low estimate. 3) The case notes that productivity will be lower for CM, which means that operations in China will require more hourly workers. Assume a 3/2 ratio- i.e., it takes 3 CM workers for every 2 Temecula workers. Also assume a 2% annual productivity increase. 1) Because of the additional lead time in transportation, additional safety stock will be required. Assume annual additional inventory costs of $460.000. Salaried labor: Total Governance Costs 4) Assume current manager salary is $30,000/y; and an annual wage increase of 3.5%. 5) Assume that there are currently 19 salaried managers for CM, with an annual 2% productivity increase. Electricity: 6) Current kwh rate is $.065. This rate is expected to increase 20% over the next 10 years, so this is approximately a 2% increase per year. ** Note that the case points out that this might be a low estimate. 1) Assume an initial start up cost of $1,000,000 to set up CM arrangement (e.g., contracting, negotiations, site visits, specifications, etc). 2) Assume that 2 managers will be retained to oversee the arrangement. Current salary is $125,000, with 3% annual pay increase. 3) Assume that monitoring, travel, contracting costs will be $100.000/year with a 3% annual increase. Lease buyback cost CM lease: 1) Assume that Scott's can get out of the current lease for $1,500,000. This would be a one- time cost in Year 0. 7) The CM lease is $200,000 annually. CM Overhead: 8) Assume 30% of direct manufacturing costs (hourly labor and electricity). **Note that this is different than the case estimate. Exchange rate: 1) Assume that the yuan has an annual increase in value (against the dollar) of 3.5%. 2) Rather than a dollar value, you can use percentages to calculate the increase in costs. For example, the value of the yuan in year 0 is 100%. Example: Value in year 1 is: (1+.03)^1=104%; Value in year 2 is (1+.03)^2=107%; Value in year 3 is (1+.05)^3=111%, etc. NOTES:Total production costs, total transportation costs, and total inventory costs are subject to exchange rate. Total governance costs and lease buyback cost is not. CM Profit Margin: 9) The CM profit margin is 8% of total costs (i.e., the sum of all costs in 1-8). Exhibit 4 TEMECULA PLANT COST DRIVERS Raw Materials: The main raw material for Scotts was plastic resin. Plastic resin was a commodity and prices the world over were comparable. Although Scotts was able to obtain some volume discounts, similar discounts were obtained by any large plastic injection molding vendor. The Temecula plant had developed an extensive "regrind" process that allowed the Temecula plant to save annually an average of approximately $100,000$ in raw materials costs, relative to a typical contract manufacturer. Labor Costs: Temecula employed 195 workers in its production process, at an average hourly rate of $16.25 (all inclusive). The labor rate at Scotts was increasing at three per cent per year. Scotts expected ongoing process and product innovations to increase productivity at an annual rate of six per cent for the next five years and then to settle to an annual increase of three per cent for another five years. Temecula also had 16 salaried employees, with fully loaded average salaries of $125,000. Electricity Costs: The Temecula plant currently used annually 8,000,000 kilo-watt hours. California electricity unit rates were currently at 16 cents/kilo-watt hour (plus a surcharge of 2.5 cents/kilo-watt hour until 2009). The electricity rate in California closely followed the trends of natural gas prices and was expected to increase by 50 per cent by 2017.? Scotts expected, through efficiency improvements, to be able to reduce the plant's electricity requirement to "cut in half the expected electricity unit price increase -- that is, the net electricity cost increase over the next 10 years was expected to be about 25 per cent. Overhead Costs: In addition to the building leasing costs, the Temecula plant absorbed $1 million of corporate overhead. Other assigned overhead costs amounted to 30 per cent of direct manufacturing costs (direct labor and electricity). Outsourcing Temecula would not be expected to reduce headcount in Marysville; therefore, the $1 million of corporate overhead would not be saved. But, the 30 per cent overhead would be saved if the plant were closed. Source: Company records. The next part of the analysis involves calculating the NPV for outsourcing to a contract manufacturer (CM) in China. Use the following information in the analysis: Total Production Costs from Scott's perspective (i.e., the total costs that will be incurred by the CM that will offset what Scott's would have to pay in Temecula): Raw materials: 1) Assume cost of raw materials is SO. Plastic resin is a commodity and there will not be a cost differential in souring this material between Scott's and a CM. 1) The current annual cost to ship spreaders from China to the US will be $8,000,000 annually. Assume a 3% annual increase. 2) The $8M is offset by $1M annually because the cost to ship the components made in China to the CM in China will be less expensive than shipping the components from China to Temecula facility. (also assume a 3% annual increase). 3) NOTE THAT FOB ("Free on Board") TRANPORTATION TERMS ARE NOT OFFERED IN THE CASE. This is important because it determines who owns the spreaders during transit and who pays for the transportation. If Scott's pays the transportation costs, then they would not be subject to exchange rate fluctuations. If the CM pays for the transportation costs, then these costs would be subject to any exchange rate variability. (In reality, if the CM pays for the freight and the yuan increases, it would likely be reflected in the quoted price of the good). Assume that CM pays for transportation. Total Inventory Costs Hourly Labor: 2) CM hourly labor rates are currently 5.91/hour. Rates are expected to increase 40% over the next 10 years - so this would be approximately 3.5% increase in wages annually. **Note that the case points out that this is a low estimate. 3) The case notes that productivity will be lower for CM, which means that operations in China will require more hourly workers. Assume a 3/2 ratio- i.e., it takes 3 CM workers for every 2 Temecula workers. Also assume a 2% annual productivity increase. 1) Because of the additional lead time in transportation, additional safety stock will be required. Assume annual additional inventory costs of $460.000. Salaried labor: Total Governance Costs 4) Assume current manager salary is $30,000/y; and an annual wage increase of 3.5%. 5) Assume that there are currently 19 salaried managers for CM, with an annual 2% productivity increase. Electricity: 6) Current kwh rate is $.065. This rate is expected to increase 20% over the next 10 years, so this is approximately a 2% increase per year. ** Note that the case points out that this might be a low estimate. 1) Assume an initial start up cost of $1,000,000 to set up CM arrangement (e.g., contracting, negotiations, site visits, specifications, etc). 2) Assume that 2 managers will be retained to oversee the arrangement. Current salary is $125,000, with 3% annual pay increase. 3) Assume that monitoring, travel, contracting costs will be $100.000/year with a 3% annual increase. Lease buyback cost CM lease: 1) Assume that Scott's can get out of the current lease for $1,500,000. This would be a one- time cost in Year 0. 7) The CM lease is $200,000 annually. CM Overhead: 8) Assume 30% of direct manufacturing costs (hourly labor and electricity). **Note that this is different than the case estimate. Exchange rate: 1) Assume that the yuan has an annual increase in value (against the dollar) of 3.5%. 2) Rather than a dollar value, you can use percentages to calculate the increase in costs. For example, the value of the yuan in year 0 is 100%. Example: Value in year 1 is: (1+.03)^1=104%; Value in year 2 is (1+.03)^2=107%; Value in year 3 is (1+.05)^3=111%, etc. NOTES:Total production costs, total transportation costs, and total inventory costs are subject to exchange rate. Total governance costs and lease buyback cost is not. CM Profit Margin: 9) The CM profit margin is 8% of total costs (i.e., the sum of all costs in 1-8). Exhibit 4 TEMECULA PLANT COST DRIVERS Raw Materials: The main raw material for Scotts was plastic resin. Plastic resin was a commodity and prices the world over were comparable. Although Scotts was able to obtain some volume discounts, similar discounts were obtained by any large plastic injection molding vendor. The Temecula plant had developed an extensive "regrind" process that allowed the Temecula plant to save annually an average of approximately $100,000$ in raw materials costs, relative to a typical contract manufacturer. Labor Costs: Temecula employed 195 workers in its production process, at an average hourly rate of $16.25 (all inclusive). The labor rate at Scotts was increasing at three per cent per year. Scotts expected ongoing process and product innovations to increase productivity at an annual rate of six per cent for the next five years and then to settle to an annual increase of three per cent for another five years. Temecula also had 16 salaried employees, with fully loaded average salaries of $125,000. Electricity Costs: The Temecula plant currently used annually 8,000,000 kilo-watt hours. California electricity unit rates were currently at 16 cents/kilo-watt hour (plus a surcharge of 2.5 cents/kilo-watt hour until 2009). The electricity rate in California closely followed the trends of natural gas prices and was expected to increase by 50 per cent by 2017.? Scotts expected, through efficiency improvements, to be able to reduce the plant's electricity requirement to "cut in half the expected electricity unit price increase -- that is, the net electricity cost increase over the next 10 years was expected to be about 25 per cent. Overhead Costs: In addition to the building leasing costs, the Temecula plant absorbed $1 million of corporate overhead. Other assigned overhead costs amounted to 30 per cent of direct manufacturing costs (direct labor and electricity). Outsourcing Temecula would not be expected to reduce headcount in Marysville; therefore, the $1 million of corporate overhead would not be saved. But, the 30 per cent overhead would be saved if the plant were closed. Source: Company records

Additional Info; Scotts used a discount rate of 15% Capital Improvements at Temecula = $500k/yr ($300k/yr at CM) New molds needed at CM = $40k/mold (10 molds)

Additional Info; Scotts used a discount rate of 15% Capital Improvements at Temecula = $500k/yr ($300k/yr at CM) New molds needed at CM = $40k/mold (10 molds)