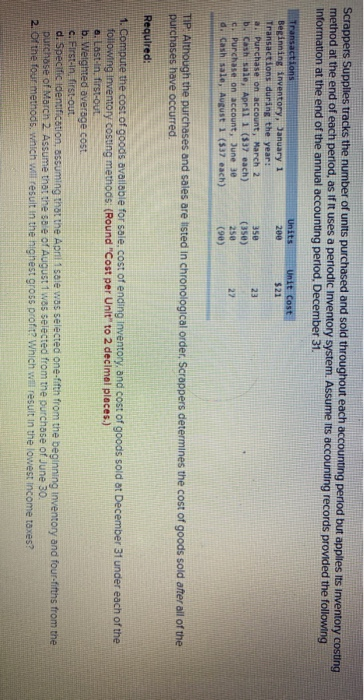

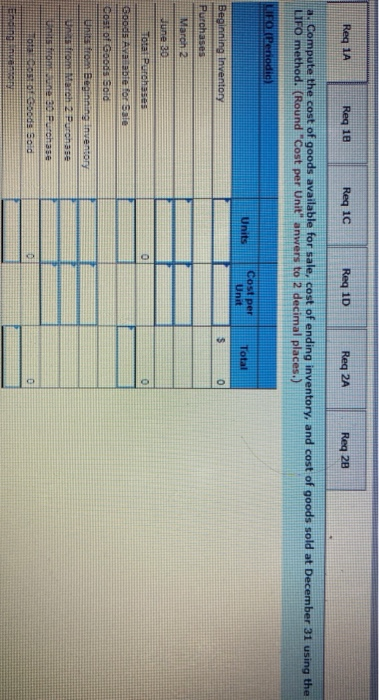

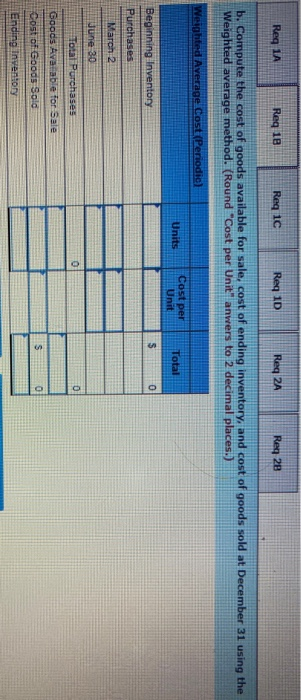

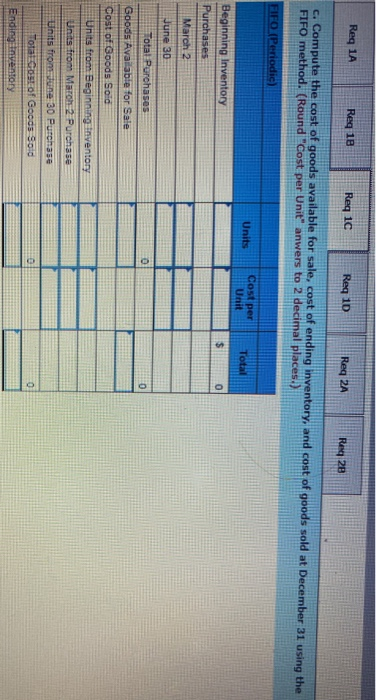

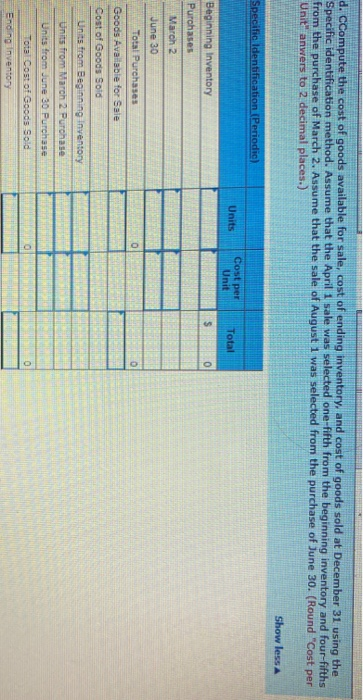

Scrappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies Its Inventory costing method at the end of each period, as if it uses a periodic Inventory system. Assume its accounting records provided the following Information at the end of the annual accounting period, December 31, Units 200 Unit Cost $21 Transactions Beginning inventory, January 1 Transactions during the year: Purchase on account, March 2 b. Cash sale, April 1 (537 each) c. Purchase on account, June 30 d. Cash sale, August 1 (537 each) 23 350 (350) 250 (90) 22 TIP: Although the purchases and sales are listed in chronological order. Scrappers determines the cost of goods sold after all of the purchases have occurred. Required: 1. Compute the cost of goods available for sale, cost of ending Inventory, and cost of goods sold at December 31 under each of the following Inventory costing methods: (Round "Cost per Unit" to 2 decimal places.) a. Last-In, first-out b. Weighted average cost. c. First-in, first-out d. Specific identification, assuming that the April 1 sale was selected one-fifth from the beginning inventory and four-fifths from the purchase of March 2. Assume that the sale of August 1 was selected from the purchase of June 30. 2. Of the four methods, which will result in the highest gross profit? Which will result in the lowest income taxes? Reg 1A Reg 18 Req 1C Reg 10 Reg 2A Reg 28 a. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 using the LIFO method. (Round "Cost per Unit" anwers to 2 decimal places.) LIFO (Penodie) Units Cost per Unit Total 0 Beginning Inventory Purchases March 2 June 30 0 Total Purchases Goods Avatable for Sale Cost of Goods Soid Units Beginning inventory uns from Match 2 Purchase s fronte 30 Purchase 3660 Sold 0 F. Reg 1A Reg 18 Req 1C Req 10 Red 2A Reg 28 b. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 using the Weighted average method. (Round "Cost per Unit" anwers to 2 decimal places.) Weighted Average Cost (Periodic Units Cost per Unit Total $ 0 Beginning Inventory Purchases March 2 June 30 0 Total Purchases Goods Avatable for Sale s 0 Cost of Goods Sold Ending Inventory Reg 1A Reg 10 Req 10 Reg 10 Reg 2A Reg 20 c. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 using the FIFO method. (Round "Cost per Unit" anwers to 2 decimal places.) FIFO (Periodic) Units Cost per Unit Total Beginning Inventory Purchases $ 0 March 2 June 30 Total Purchases Goods Available for Sale 0 Cost of Goods Sold Units from Beginning inventory Units from March 2 Purchase Units from June 30 Purchase Total cost of Goods Sold Ending inventory 0 d. CCompute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 using the Specific identification method. Assume that the April 1 sale was selected one-fifth from the beginning inventory and four-fifths from the purchase of March 2. Assume that the sale of August 1 was selected from the purchase of June 30. (Round "Cost per Unit" anwers to 2 decimal places.) Show less Specific Identification (Periodic) Units Cost per Unit Total 0 Beginning Inventory Purchases March 2 June 30 Total Purchases Goods Available for Sale Cost of Goods Sold Units from Beginning Inventory Units from March 2 Purchase Units from June 30 Purchase Total Cost of Goods Sold Ending inventory