Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Screenshot all call report schedules and sub-schedules you used as well as the UBPR pages you used. Highlight all values/ratios you use to answer the

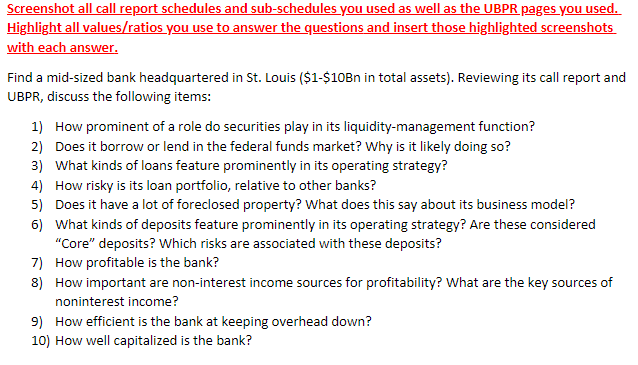

Screenshot all call report schedules and sub-schedules you used as well as the UBPR pages you used. Highlight all values/ratios you use to answer the questions and insert those highlighted screenshots with each answer. Find a mid-sized bank headquartered in St. Louis ( $1$10Bn in total assets). Reviewing its call report and UBPR, discuss the following items: 1) How prominent of a role do securities play in its liquidity-management function? 2) Does it borrow or lend in the federal funds market? Why is it likely doing so? 3) What kinds of loans feature prominently in its operating strategy? 4) How risky is its loan portfolio, relative to other banks? 5) Does it have a lot of foreclosed property? What does this say about its business model? 6) What kinds of deposits feature prominently in its operating strategy? Are these considered "Core" deposits? Which risks are associated with these deposits? 7) How profitable is the bank? 8) How important are non-interest income sources for profitability? What are the key sources of noninterest income? 9) How efficient is the bank at keeping overhead down? 10) How well capitalized is the bank

Screenshot all call report schedules and sub-schedules you used as well as the UBPR pages you used. Highlight all values/ratios you use to answer the questions and insert those highlighted screenshots with each answer. Find a mid-sized bank headquartered in St. Louis ( $1$10Bn in total assets). Reviewing its call report and UBPR, discuss the following items: 1) How prominent of a role do securities play in its liquidity-management function? 2) Does it borrow or lend in the federal funds market? Why is it likely doing so? 3) What kinds of loans feature prominently in its operating strategy? 4) How risky is its loan portfolio, relative to other banks? 5) Does it have a lot of foreclosed property? What does this say about its business model? 6) What kinds of deposits feature prominently in its operating strategy? Are these considered "Core" deposits? Which risks are associated with these deposits? 7) How profitable is the bank? 8) How important are non-interest income sources for profitability? What are the key sources of noninterest income? 9) How efficient is the bank at keeping overhead down? 10) How well capitalized is the bank Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started