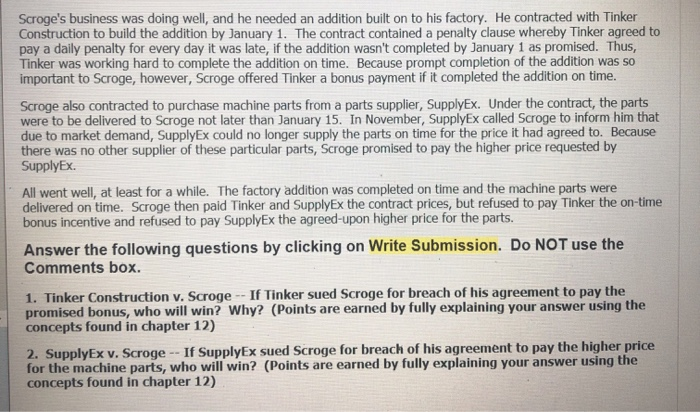

Scroge's business was doing well, and he needed an addition built on to his factory. He contracted with Tinker Construction to build the addition by January 1. The contract contained a penalty clause whereby Tinker agreed to pay a daily penalty for every day it was late, if the addition wasn't completed by January 1 as promised. Thus, Tinker was working hard to complete the addition on time. Because prompt completion of the addition was so important to Scroge, however, Scroge offered Tinker a bonus payment if it completed the addition on time. Scroge also contracted to purchase machine parts from a parts supplier, SupplyEx. Under the contract, the parts were to be delivered to Scroge not later than January 15. In November, SupplyEx called Scroge to inform him that due to market demand, SupplyEx could no longer supply the parts on time for the price it had agreed to. Because there was no other supplier of these particular parts, Scroge promised to pay the higher price requested by SupplyEx. All went well, at least for a while. The factory addition was completed on time and the machine parts were delivered on time. Scroge then paid Tinker and SupplyEx the contract prices, but refused to pay Tinker the on-time bonus incentive and refused to pay SupplyEx the agreed-upon higher price for the parts. Answer the following questions by clicking on Write Submission. Do NOT use the Comments box. 1. Tinker Construction v. Scroge -- If Tinker sued Scroge for breach of his agreement to pay the promised bonus, who will win? Why? (Points are earned by fully explaining your answer using the concepts found in chapter 12) 2. SupplyEx v. Scroge -- If SupplyEx sued Scroge for breach of his agreement to pay the higher price for the machine parts, who will win? (Points are earned by fully explaining your answer using the concepts found in chapter 12) Scroge's business was doing well, and he needed an addition built on to his factory. He contracted with Tinker Construction to build the addition by January 1. The contract contained a penalty clause whereby Tinker agreed to pay a daily penalty for every day it was late, if the addition wasn't completed by January 1 as promised. Thus, Tinker was working hard to complete the addition on time. Because prompt completion of the addition was so important to Scroge, however, Scroge offered Tinker a bonus payment if it completed the addition on time. Scroge also contracted to purchase machine parts from a parts supplier, SupplyEx. Under the contract, the parts were to be delivered to Scroge not later than January 15. In November, SupplyEx called Scroge to inform him that due to market demand, SupplyEx could no longer supply the parts on time for the price it had agreed to. Because there was no other supplier of these particular parts, Scroge promised to pay the higher price requested by SupplyEx. All went well, at least for a while. The factory addition was completed on time and the machine parts were delivered on time. Scroge then paid Tinker and SupplyEx the contract prices, but refused to pay Tinker the on-time bonus incentive and refused to pay SupplyEx the agreed-upon higher price for the parts. Answer the following questions by clicking on Write Submission. Do NOT use the Comments box. 1. Tinker Construction v. Scroge -- If Tinker sued Scroge for breach of his agreement to pay the promised bonus, who will win? Why? (Points are earned by fully explaining your answer using the concepts found in chapter 12) 2. SupplyEx v. Scroge -- If SupplyEx sued Scroge for breach of his agreement to pay the higher price for the machine parts, who will win? (Points are earned by fully explaining your answer using the concepts found in chapter 12)