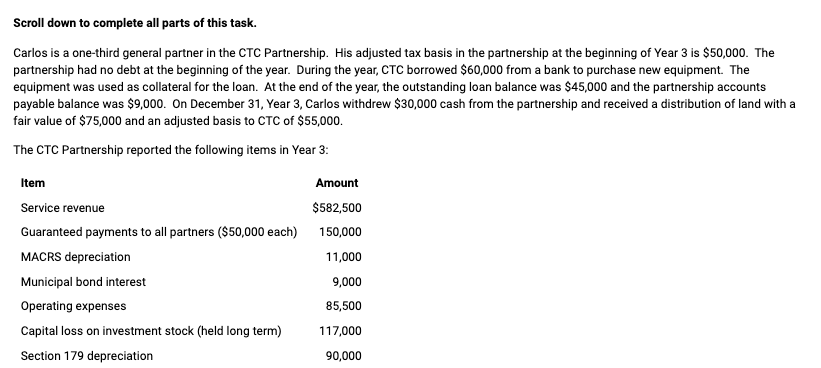

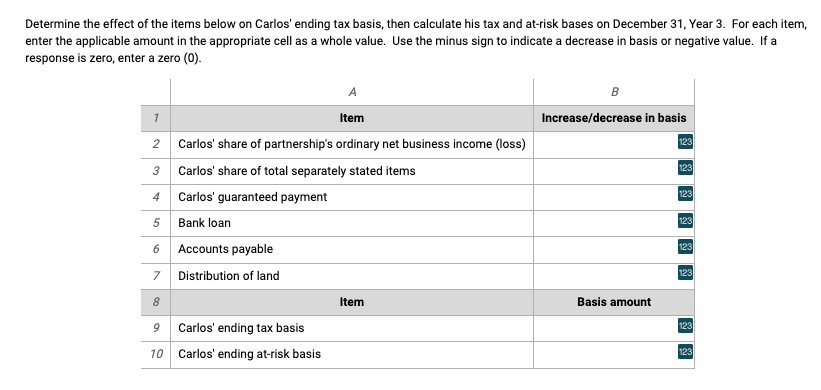

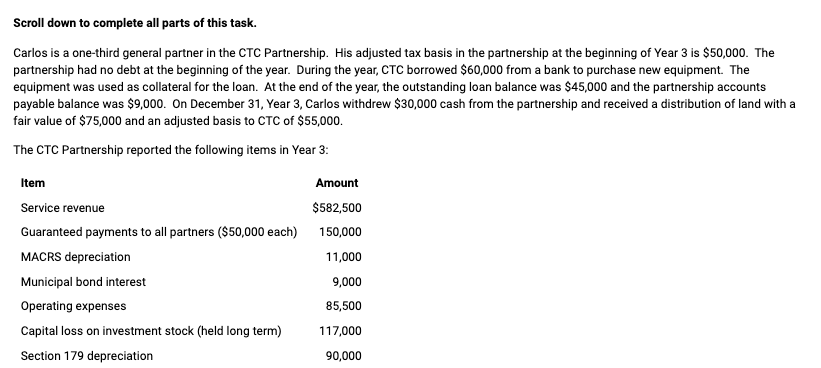

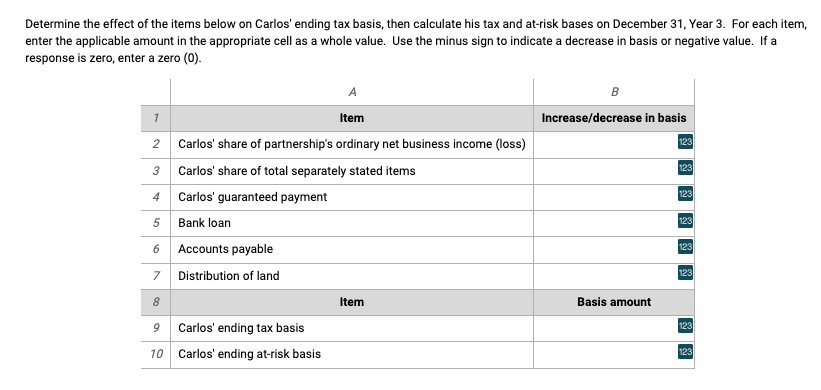

Scroll down to complete all parts of this task. Carlos is a one-third general partner in the CTC Partnership. His adjusted tax basis in the partnership at the beginning of Year 3 is $50,000. The partnership had no debt at the beginning of the year. During the year, CTC borrowed $60,000 from a bank to purchase new equipment. The equipment was used as collateral for the loan. At the end of the year, the outstanding loan balance was $45,000 and the partnership accounts payable balance was $9,000. On December 31, Year 3, Carlos withdrew $30,000 cash from the partnership and received a distribution of land with a fair value of $75,000 and an adjusted basis to CTC of $55,000. The CTC Partnership reported the following items in Year 3: Amount $582,500 150,000 11,000 Item Service revenue Guaranteed payments to all partners ($50,000 each) MACRS depreciation Municipal bond interest Operating expenses Capital loss on investment stock (held long term) Section 179 depreciation 9,000 85,500 117,000 90,000 Determine the effect of the items below on Carlos' ending tax basis, then calculate his tax and at-risk bases on December 31, Year 3. For each item, enter the applicable amount in the appropriate cell as a whole value. Use the minus sign to indicate a decrease in basis or negative value. If a response is zero, enter a zero (0). B Increase/decrease in basis 2 123 123 A 1 Item 2 Carlos' share of partnership's ordinary net business income (loss) 3 Carlos' share of total separately stated items 4 Carlos' guaranteed payment 5 Bank loan 6 Accounts payable 7 Distribution of land 123 5 123 123 123 8 Item Basis amount 123 9 Carlos' ending tax basis 10 Carlos' ending at-risk basis 123 Scroll down to complete all parts of this task. Carlos is a one-third general partner in the CTC Partnership. His adjusted tax basis in the partnership at the beginning of Year 3 is $50,000. The partnership had no debt at the beginning of the year. During the year, CTC borrowed $60,000 from a bank to purchase new equipment. The equipment was used as collateral for the loan. At the end of the year, the outstanding loan balance was $45,000 and the partnership accounts payable balance was $9,000. On December 31, Year 3, Carlos withdrew $30,000 cash from the partnership and received a distribution of land with a fair value of $75,000 and an adjusted basis to CTC of $55,000. The CTC Partnership reported the following items in Year 3: Amount $582,500 150,000 11,000 Item Service revenue Guaranteed payments to all partners ($50,000 each) MACRS depreciation Municipal bond interest Operating expenses Capital loss on investment stock (held long term) Section 179 depreciation 9,000 85,500 117,000 90,000 Determine the effect of the items below on Carlos' ending tax basis, then calculate his tax and at-risk bases on December 31, Year 3. For each item, enter the applicable amount in the appropriate cell as a whole value. Use the minus sign to indicate a decrease in basis or negative value. If a response is zero, enter a zero (0). B Increase/decrease in basis 2 123 123 A 1 Item 2 Carlos' share of partnership's ordinary net business income (loss) 3 Carlos' share of total separately stated items 4 Carlos' guaranteed payment 5 Bank loan 6 Accounts payable 7 Distribution of land 123 5 123 123 123 8 Item Basis amount 123 9 Carlos' ending tax basis 10 Carlos' ending at-risk basis 123