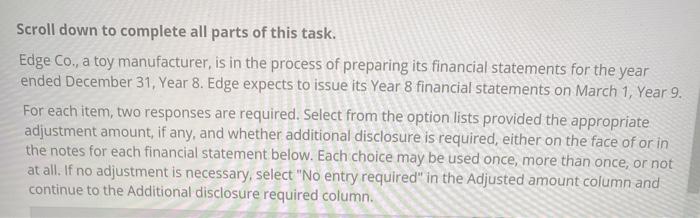

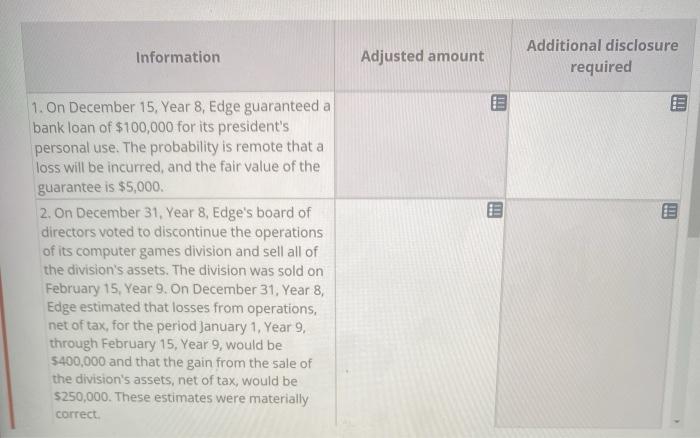

Scroll down to complete all parts of this task. Edge Co., a toy manufacturer, is in the process of preparing its financial statements for the year ended December 31, Year 8. Edge expects to issue its Year 8 financial statements on March 1, Year 9. For each item, two responses are required. Select from the option lists provided the appropriate adjustment amount, if any, and whether additional disclosure is required, either on the face of or in the notes for each financial statement below. Each choice may be used once, more than once, or not at all. If no adjustment is necessary, select "No entry required" in the Adjusted amount column and continue to the Additional disclosure required column. Information Adjusted amount Additional disclosure required 1. On December 15, Year 8, Edge guaranteed a bank loan of $100,000 for its president's personal use. The probability is remote that a loss will be incurred, and the fair value of the guarantee is $5,000. 2. On December 31, Year 8, Edge's board of directors voted to discontinue the operations of its computer games division and sell all of the division's assets. The division was sold on February 15, Year 9. on December 31, Year 8, Edge estimated that losses from operations, net of tax, for the period January 1, Year 9, through February 15, Year 9, would be $400,000 and that the gain from the sale of the division's assets, net of tax, would be $250,000. These estimates were materially correct m 3. On January 5, Year 9, a warehouse containing a substantial portion of Edge's inventory was destroyed by fire. Edge expects to recover the entire loss, except for a $ 250,000 deductible, from insurance. 4. On January 24, Year 9, inventory purchased FOB shipping point from a foreign country was detained at that country's border because of political unrest. The shipment is valued at $150,000. Edge's attorneys have stated that it is probable that Edge will be able to obtain the shipment 5. On January 30, Year 9, Edge issued $10 million bonds at a premium of $500,000. 6. On February 4, Year 8, the IRS assessed Edge an additional $400,000 for the Year 4 tax year. Edge's tax attorneys and tax accountants have stated that it is likely that the IRS will agree to a $100,000 settlement Scroll down to complete all parts of this task. Edge Co., a toy manufacturer, is in the process of preparing its financial statements for the year ended December 31, Year 8. Edge expects to issue its Year 8 financial statements on March 1, Year 9. For each item, two responses are required. Select from the option lists provided the appropriate adjustment amount, if any, and whether additional disclosure is required, either on the face of or in the notes for each financial statement below. Each choice may be used once, more than once, or not at all. If no adjustment is necessary, select "No entry required" in the Adjusted amount column and continue to the Additional disclosure required column. Information Adjusted amount Additional disclosure required 1. On December 15, Year 8, Edge guaranteed a bank loan of $100,000 for its president's personal use. The probability is remote that a loss will be incurred, and the fair value of the guarantee is $5,000. 2. On December 31, Year 8, Edge's board of directors voted to discontinue the operations of its computer games division and sell all of the division's assets. The division was sold on February 15, Year 9. on December 31, Year 8, Edge estimated that losses from operations, net of tax, for the period January 1, Year 9, through February 15, Year 9, would be $400,000 and that the gain from the sale of the division's assets, net of tax, would be $250,000. These estimates were materially correct m 3. On January 5, Year 9, a warehouse containing a substantial portion of Edge's inventory was destroyed by fire. Edge expects to recover the entire loss, except for a $ 250,000 deductible, from insurance. 4. On January 24, Year 9, inventory purchased FOB shipping point from a foreign country was detained at that country's border because of political unrest. The shipment is valued at $150,000. Edge's attorneys have stated that it is probable that Edge will be able to obtain the shipment 5. On January 30, Year 9, Edge issued $10 million bonds at a premium of $500,000. 6. On February 4, Year 8, the IRS assessed Edge an additional $400,000 for the Year 4 tax year. Edge's tax attorneys and tax accountants have stated that it is likely that the IRS will agree to a $100,000 settlement