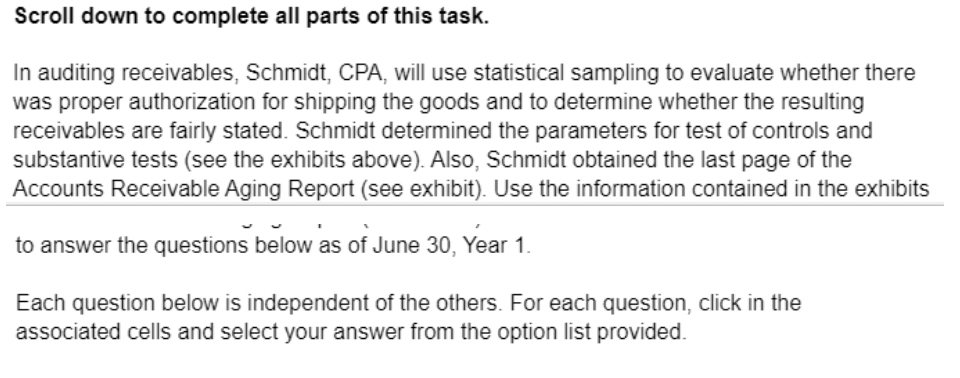

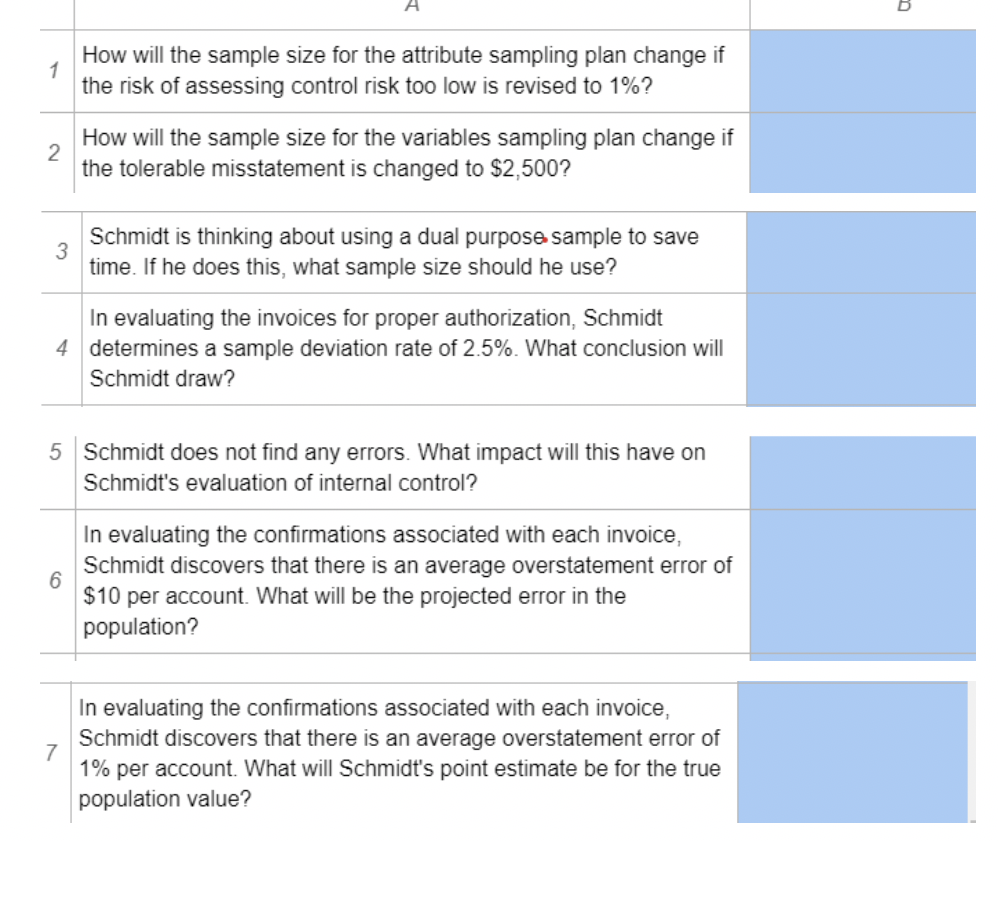

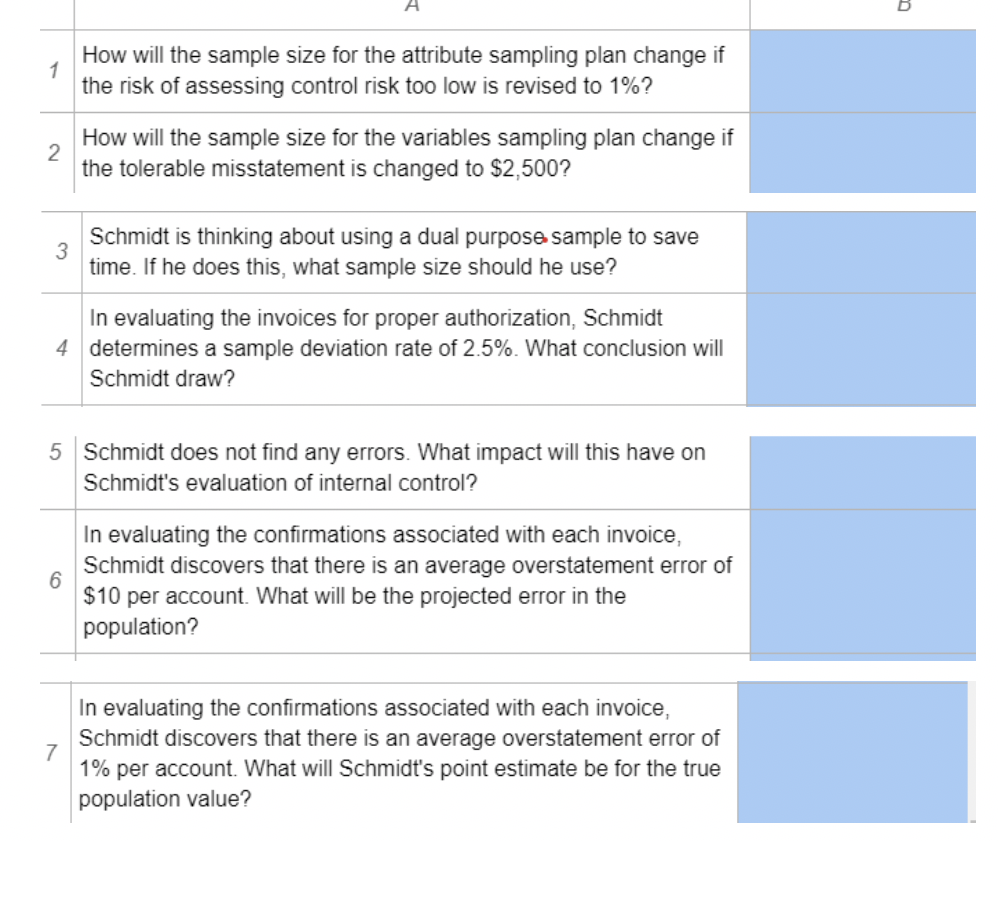

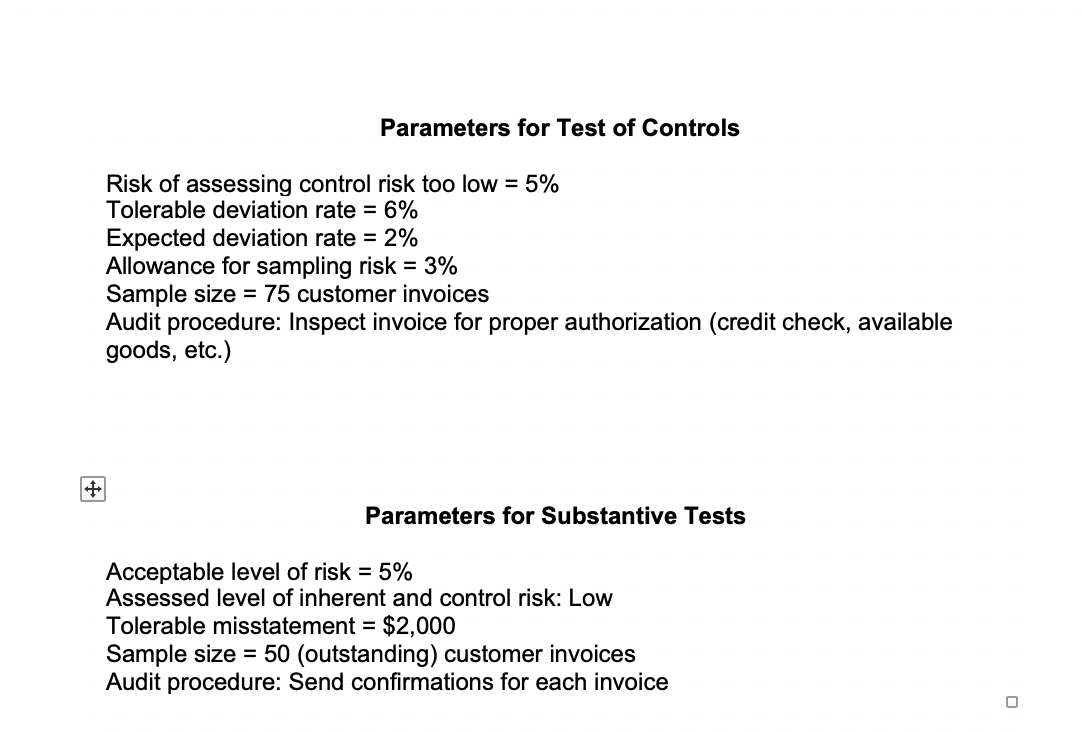

Scroll down to complete all parts of this task. In auditing receivables, Schmidt, CPA, will use statistical sampling to evaluate whether there was proper authorization for shipping the goods and to determine whether the resulting receivables are fairly stated. Schmidt determined the parameters for test of controls and substantive tests (see the exhibits above). Also, Schmidt obtained the last page of the Accounts Receivable Aging Report (see exhibit). Use the information contained in the exhibits to answer the questions below as of June 30, Year 1. Each question below is independent of the others. For each question, click in the associated cells and select your answer from the option list provided. B 1 How will the sample size for the attribute sampling plan change if the risk of assessing control risk too low is revised to 1%? How will the sample size for the variables sampling plan change if the tolerable misstatement is changed to $2,500? 2. 3 Schmidt is thinking about using a dual purpose sample to save time. If he does this, what sample size should he use? In evaluating the invoices for proper authorization, Schmidt 4 determines a sample deviation rate of 2.5%. What conclusion will Schmidt draw? 5 Schmidt does not find any errors. What impact will this have on Schmidt's evaluation of internal control? In evaluating the confirmations associated with each invoice, Schmidt discovers that there is an average overstatement error of 6 $10 per account. What will be the projected error in the population? 7 In evaluating the confirmations associated with each invoice, Schmidt discovers that there is an average overstatement error of 1% per account. What will Schmidt's point estimate be for the true population value? Parameters for Test of Controls Risk of assessing control risk too low = 5% Tolerable deviation rate = 6% Expected deviation rate = 2% Allowance for sampling risk = 3% Sample size = 75 customer invoices Audit procedure: Inspect invoice for proper authorization (credit check, available goods, etc.) + Parameters for Substantive Tests Acceptable level of risk = 5% Assessed level of inherent and control risk: Low Tolerable misstatement = $2,000 Sample size = 50 (outstanding) customer invoices Audit procedure: Send confirmations for each invoice Scroll down to complete all parts of this task. In auditing receivables, Schmidt, CPA, will use statistical sampling to evaluate whether there was proper authorization for shipping the goods and to determine whether the resulting receivables are fairly stated. Schmidt determined the parameters for test of controls and substantive tests (see the exhibits above). Also, Schmidt obtained the last page of the Accounts Receivable Aging Report (see exhibit). Use the information contained in the exhibits to answer the questions below as of June 30, Year 1. Each question below is independent of the others. For each question, click in the associated cells and select your answer from the option list provided. B 1 How will the sample size for the attribute sampling plan change if the risk of assessing control risk too low is revised to 1%? How will the sample size for the variables sampling plan change if the tolerable misstatement is changed to $2,500? 2. 3 Schmidt is thinking about using a dual purpose sample to save time. If he does this, what sample size should he use? In evaluating the invoices for proper authorization, Schmidt 4 determines a sample deviation rate of 2.5%. What conclusion will Schmidt draw? 5 Schmidt does not find any errors. What impact will this have on Schmidt's evaluation of internal control? In evaluating the confirmations associated with each invoice, Schmidt discovers that there is an average overstatement error of 6 $10 per account. What will be the projected error in the population? 7 In evaluating the confirmations associated with each invoice, Schmidt discovers that there is an average overstatement error of 1% per account. What will Schmidt's point estimate be for the true population value? Parameters for Test of Controls Risk of assessing control risk too low = 5% Tolerable deviation rate = 6% Expected deviation rate = 2% Allowance for sampling risk = 3% Sample size = 75 customer invoices Audit procedure: Inspect invoice for proper authorization (credit check, available goods, etc.) + Parameters for Substantive Tests Acceptable level of risk = 5% Assessed level of inherent and control risk: Low Tolerable misstatement = $2,000 Sample size = 50 (outstanding) customer invoices Audit procedure: Send confirmations for each invoice