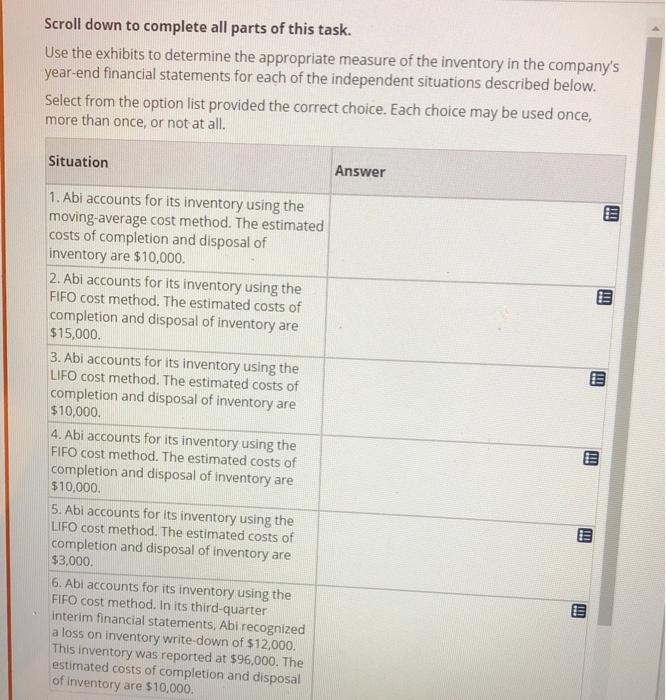

Scroll down to complete all parts of this task. Use the exhibits to determine the appropriate measure of the inventory in the company's year-end financial statements for each of the independent situations described below. Select from the option list provided the correct choice. Each choice may be used once, more than once, or not at all. Situation Answer III 1. Abi accounts for its inventory using the moving average cost method. The estimated costs of completion and disposal of inventory are $10,000. 2. Abi accounts for its inventory using the FIFO cost method. The estimated costs of completion and disposal of inventory are $15,000. 3. Abi accounts for its inventory using the LIFO cost method. The estimated costs of completion and disposal of inventory are $10,000. 4. Abi accounts for its inventory using the FIFO cost method. The estimated costs of completion and disposal of inventory are $10,000. 5. Abi accounts for its inventory using the LIFO cost method. The estimated costs of completion and disposal of inventory are $3,000. 6. Abi accounts for its inventory using the FIFO cost method. In its third-quarter interim financial statements, Abi recognized a loss on inventory write-down of $12,000. This inventory was reported at $96,000. The estimated costs of completion and disposal of inventory are $10,000. Am E Scroll down to complete all parts of this task. Use the exhibits to determine the appropriate measure of the inventory in the company's year-end financial statements for each of the independent situations described below. Select from the option list provided the correct choice. Each choice may be used once, more than once, or not at all. Situation Answer III 1. Abi accounts for its inventory using the moving average cost method. The estimated costs of completion and disposal of inventory are $10,000. 2. Abi accounts for its inventory using the FIFO cost method. The estimated costs of completion and disposal of inventory are $15,000. 3. Abi accounts for its inventory using the LIFO cost method. The estimated costs of completion and disposal of inventory are $10,000. 4. Abi accounts for its inventory using the FIFO cost method. The estimated costs of completion and disposal of inventory are $10,000. 5. Abi accounts for its inventory using the LIFO cost method. The estimated costs of completion and disposal of inventory are $3,000. 6. Abi accounts for its inventory using the FIFO cost method. In its third-quarter interim financial statements, Abi recognized a loss on inventory write-down of $12,000. This inventory was reported at $96,000. The estimated costs of completion and disposal of inventory are $10,000. Am E