SD 1.08893

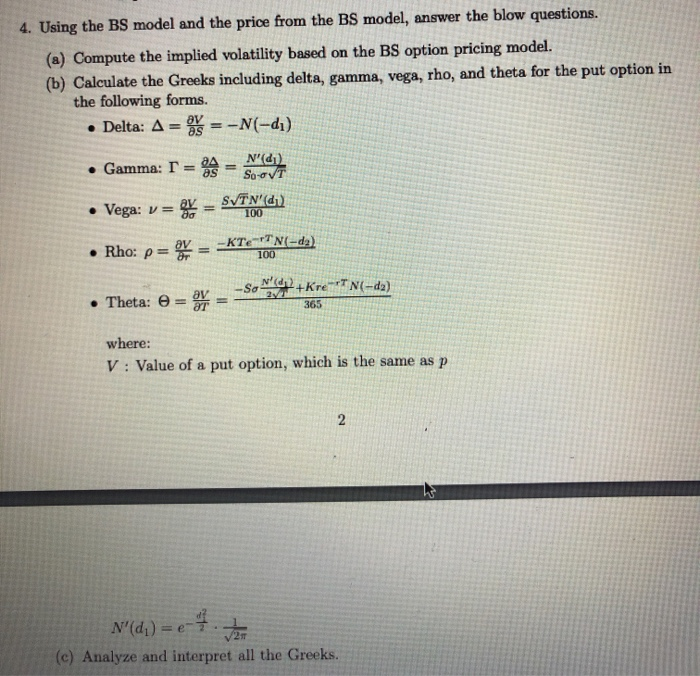

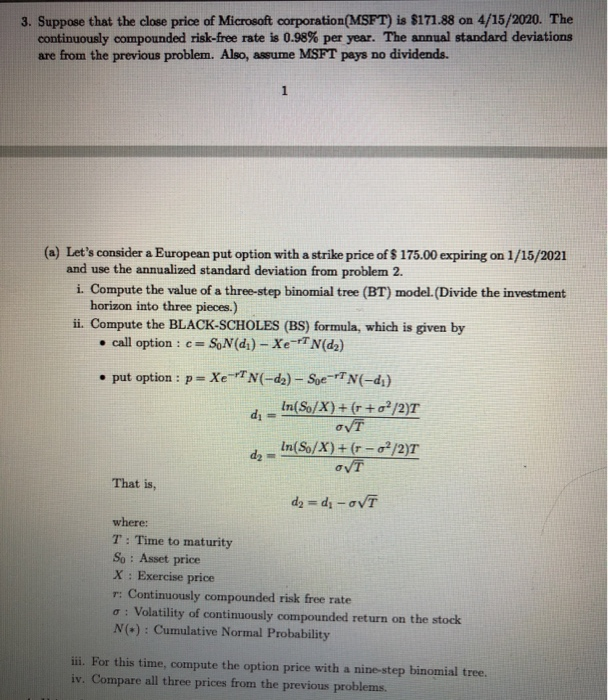

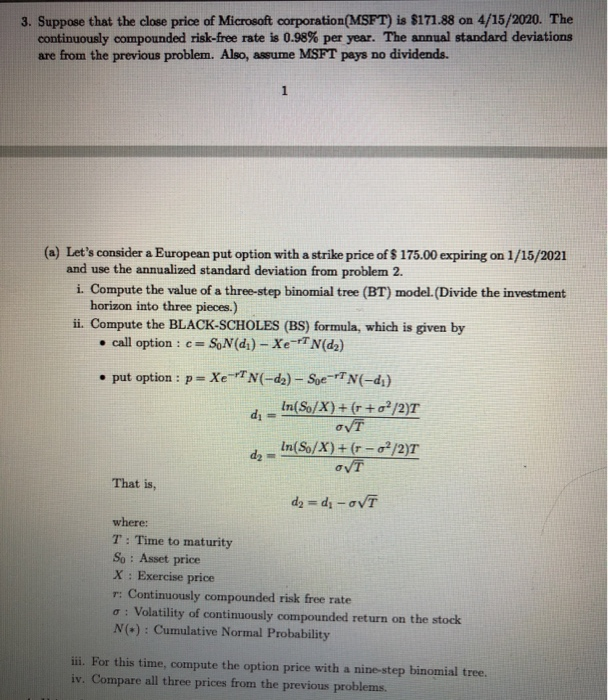

4. Using the BS model and the price from the BS model, answer the blow questions. (a) Compute the implied volatility based on the BS option pricing model. (b) Calculate the Greeks including delta, gamma, vega, rho, and theta for the put option in the following forms. Delta: A = = -N(-d) N'd) Gamma: T= = %= So-OVT SVTN'(d) Vega: v= 100 Rho: p= - KTE-TN-da) 100 Som +Kre-** N(-da) Theta: 8 = * = 365 where: V: Value of a put option, which is the same as p 2 N'(d) = e (c) Analyze and interpret all the Greeks. 3. Suppose that the close price of Microsoft corporation(MSFT) is $171.88 on 4/15/2020. The continuously compounded risk-free rate is 0.98% per year. The annual standard deviations are from the previous problem. Also, assume MSFT pays no dividends. 1 (a) Let's consider a European put option with a strike price of $ 175.00 expiring on 1/15/2021 and use the annualized standard deviation from problem 2. i. Compute the value of a three-step binomial tree (BT) model. (Divide the investment horizon into three pieces.) ii. Compute the BLACK-SCHOLES (BS) formula, which is given by call option : c= SoN(di) - Xe-PT N(d) put option : P = Xe TN(-da) Soc-N(-d) di In(So/X) + (r + o2/2)T OVT In(So/X)+(r - 02/2)T d2 - T That is, dy =d, -ovT where: T: Time to maturity So : Asset price X: Exercise price T: Continuously compounded risk free rate 0 : Volatility of continuously compounded return on the stock NO) : Cumulative Normal Probability iii. For this time, compute the option price with a nine-step binomial tree. iv. Compare all three prices from the previous problems. 4. Using the BS model and the price from the BS model, answer the blow questions. (a) Compute the implied volatility based on the BS option pricing model. (b) Calculate the Greeks including delta, gamma, vega, rho, and theta for the put option in the following forms. Delta: A = = -N(-d) N'd) Gamma: T= = %= So-OVT SVTN'(d) Vega: v= 100 Rho: p= - KTE-TN-da) 100 Som +Kre-** N(-da) Theta: 8 = * = 365 where: V: Value of a put option, which is the same as p 2 N'(d) = e (c) Analyze and interpret all the Greeks. 3. Suppose that the close price of Microsoft corporation(MSFT) is $171.88 on 4/15/2020. The continuously compounded risk-free rate is 0.98% per year. The annual standard deviations are from the previous problem. Also, assume MSFT pays no dividends. 1 (a) Let's consider a European put option with a strike price of $ 175.00 expiring on 1/15/2021 and use the annualized standard deviation from problem 2. i. Compute the value of a three-step binomial tree (BT) model. (Divide the investment horizon into three pieces.) ii. Compute the BLACK-SCHOLES (BS) formula, which is given by call option : c= SoN(di) - Xe-PT N(d) put option : P = Xe TN(-da) Soc-N(-d) di In(So/X) + (r + o2/2)T OVT In(So/X)+(r - 02/2)T d2 - T That is, dy =d, -ovT where: T: Time to maturity So : Asset price X: Exercise price T: Continuously compounded risk free rate 0 : Volatility of continuously compounded return on the stock NO) : Cumulative Normal Probability iii. For this time, compute the option price with a nine-step binomial tree. iv. Compare all three prices from the previous problems