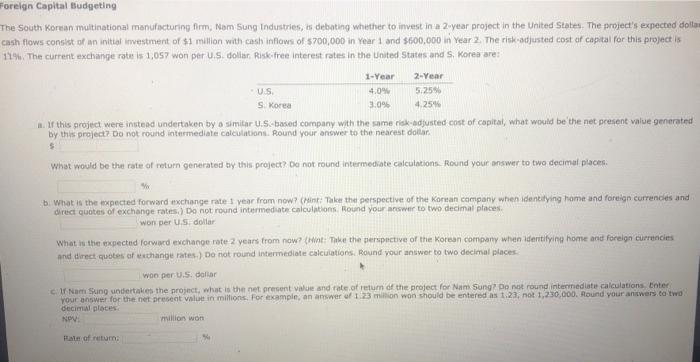

Se South Korean multinational manufacturing firm, Nom Sung Industries, is debating whether to invest in a 2 -year project in the United States. The project's expected dolla ash flows consiot of an initial irwestment of $1 million with cash inflows of 5700,000 in Year 1 and $600,000 in Year 2. The risk-adjusted cost af capital for this project is 14. The current exchange rate is 1,057 won per U.5. doliar. Riskifree interest rates in the United States and S, Korea are: a. If this aroject were instead undertaken by a simitar U.S.-based company with the ame riak-adjusted cost of capital, what would be the net present value generated by this orolect? Do not round intermediate calcilations. Round your answer to the nearest dollar. What would be the rate of return generated thy this project? De not round intermediate calcuiations found your answer to two decimal piaces. b. What is the expected forward mxchange rate 1 year fram now? (Hint: Take the perspective of the Korean campany when idenkitying hame and foreign currences and direct aubtas of exchange rates,) Do not round intermediate calculations. Round your ansere to two decimal places. won per U.5, doliar What is the expected forward exchange rote 2 years from naw? Whint: Take the perspective of the korean company when identifying home and foreign currencies And direct quotes of esthange rates.) Do not round intermediate calcuiations. Round your answor to two doeimal places. C. If Nam Suing untertakes the project, what is the net oresent value and rate. of letum of the profect for Nam susg? Do nat round intenthediati calculations. Enter secimin alates. Nipe milios wion Pate of return: Se South Korean multinational manufacturing firm, Nom Sung Industries, is debating whether to invest in a 2 -year project in the United States. The project's expected dolla ash flows consiot of an initial irwestment of $1 million with cash inflows of 5700,000 in Year 1 and $600,000 in Year 2. The risk-adjusted cost af capital for this project is 14. The current exchange rate is 1,057 won per U.5. doliar. Riskifree interest rates in the United States and S, Korea are: a. If this aroject were instead undertaken by a simitar U.S.-based company with the ame riak-adjusted cost of capital, what would be the net present value generated by this orolect? Do not round intermediate calcilations. Round your answer to the nearest dollar. What would be the rate of return generated thy this project? De not round intermediate calcuiations found your answer to two decimal piaces. b. What is the expected forward mxchange rate 1 year fram now? (Hint: Take the perspective of the Korean campany when idenkitying hame and foreign currences and direct aubtas of exchange rates,) Do not round intermediate calculations. Round your ansere to two decimal places. won per U.5, doliar What is the expected forward exchange rote 2 years from naw? Whint: Take the perspective of the korean company when identifying home and foreign currencies And direct quotes of esthange rates.) Do not round intermediate calcuiations. Round your answor to two doeimal places. C. If Nam Suing untertakes the project, what is the net oresent value and rate. of letum of the profect for Nam susg? Do nat round intenthediati calculations. Enter secimin alates. Nipe milios wion Pate of return