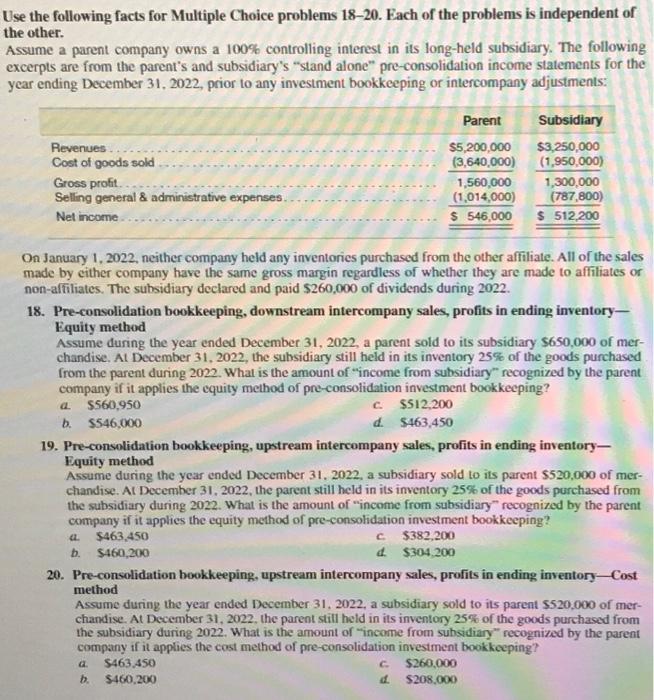

se the following facts for Multiple Choice problems 18-20. Each of the problems is independent of he other. Assume a parent company owns a 100% controlling interest in its long-held subsidiary. The following excerpts are from the parent's and subsidiary"s "stand alone" pre-consolidation income statements for the year ending December 31,2022 , prior to any investment bookkeeping or intercompany adjustments: On January 1, 2022, neither company held any inventories purchased from the other affiliate. All of the sales made by either company have the same gross margin regardless of whether they are made to affiliates or non-affiliates. The subsidiary declared and paid $260,000 of dividends during 2022 . 18. Pre-consolidation bookkeeping, downstream intercompany sales, profits in ending inventoryEquity method Assume during the year ended December 31, 2022, a parent sold to its subsidiary $650,000 of merchandise. At December 31,2022 , the subsidiary still held in its inventory 255 of the goods purchased from the parent during 2022 . What is the amount of "income from subsidiary" recognized by the parent company if it applies the equity method of pre-consolidation investment bookkeeping? a. $560,950 c. $12,200 b. $546,000 d. $463,450 19. Pre-consolidation bookkeeping, upstream intercompany sales, profits in ending inventoryEquity method Assume during the year ended December 31,2022 , a subsidiary sold to its parent $520,000 of merchandise. AI December 31,2022 , the parent still held in its inventory 25% of the goods purchased from the subsidiary during 2022. What is the amount of "income from subsidiary" recognized by the parent company if it applies the equity method of pre-consolidation investment bookkeeping? a. $463,450 c $382,200 b. $460,200 d. $304,200 20. Pre-consolidation bookkeeping, upstream intercompany sales, profits in ending inventory - Cost method Assume during the year ended December 31,2022 , a subsidiary sold to its parent $520,000 of merchandise. At December 31, 2022, the parent still held in its inventory 25% of the goods purchased from the subsidiary during 2022. What is the amount of "income from subsidiary" recognized by the parent company if it applies the cost method of pre-consolidation investment bookkeeping? a. $463,450 c. $260,000 b. $460,200 d. $208,000