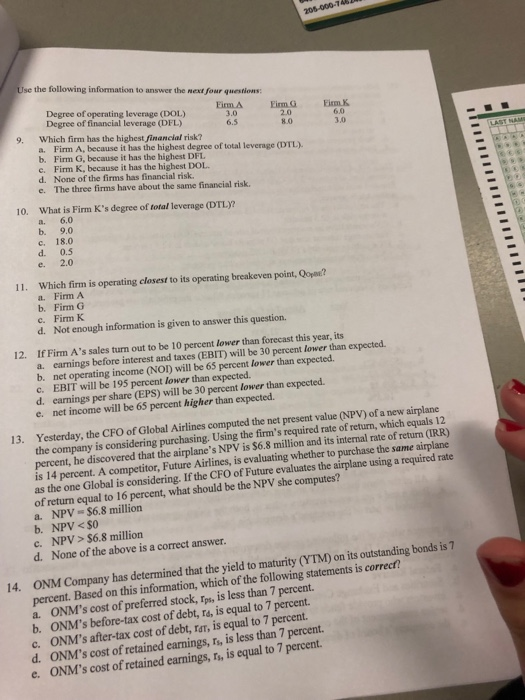

se the following information to answer the next four questions: Degree of operating leverage (DOL) Degree of financial leverage(DFL) 2.0 8.0 6.0 3.0 6.5 9. Which firm has the highest financial risk? a. Firm A, because it has the highest degree of total leverage (DTL) b. Firm G, because it has the highest DFL c. Firm K, because it has the highest DOL d. None of the firms has financial risk. The three firms have about the same financial risk. e. What is Firm K's degree of total leverage (DTL)? 10. a. 6.0 b. 9.0 c. 18.0 d. 0.5 e. 2.0 11. Which firm is operating closest to its operating breakeven point, Qopm? Firm A a. b. Firm G Firm K c. Not enough information is given to answer this question. d. 12. If Firm A's sales turn out to be 10 percent lower than forecast this year, its earnings before interest and taxes (EBIT) will be 30 percent lower than expected. a. b. net operating income (NOI) will be 65 percent lower than expected. EBIT will be 195 percent lower than expected. c. d. earnings per share (EPS) will be 30 percent lower than expected. e. net income will be 65 percent higher than expected. Yesterday, the CFO of Global Airlines computed the net present value (NPV) of a new airplane the company is considering purchasing. Using the firm's required rate of return, which equals 12 percent, he discovered that the airplane's NPV is $6.8 million and its internal rate of return (IRR) is 14 percent. A competitor, Future Airlines, is evaluating whether to purchase the same airplane as the one Global is considering. If the CFO of Future evaluates the airplane using a required rate of return equal to 16 percent, what should be the NPV she computes? a. NPV$6.8 million 13. NPV> $6.8 million c. None of the above is a correct answer. d. ONM Company has determined that the yield to maturity (YTM) on its outstanding bonds is 7 percent. Based on this information, which of the following statements is correct? a. ONM's cost of preferred stock, rps, is less than 7 percent. b. ONM's before-tax cost of debt, ra, is equal to 7 percent. c. ONM's after-tax cost of debt, Tar, is equal to 7 percent d. ONM's cost of retained earnings, rs, is less than 7 percent. e. ONM's cost of retained earnings, r, is equal to 7 percent 14