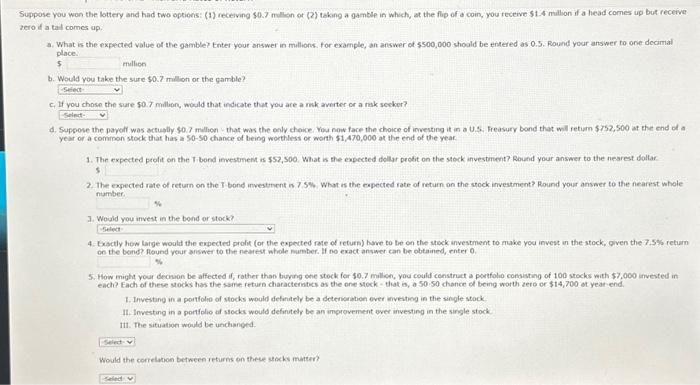

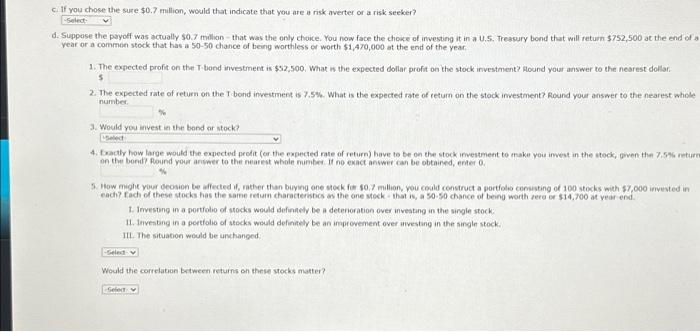

se vou won the lottery and had two options: (1) receiving 50.7 mulion of (2) takng a gamble in which, at the flip of o coin, you receive $1.4 million if a head cornes up but receive i a tal comes up. a. What is the expected value of the gamble? tnter your answer in millons, for example, an answer of $500,000 should be entered as 0.5 . Round your answer to one decimal place. 5 mullion b. Would you take the sure $0.7 million or the gamble? c. If you chose the sure 50.7 millon, would that indicate that you are a mk averter or a mak secker? year of a cominon stock that has a 50 - 50 chance of being worthless or worth $1,470,000 at the end of the year. 5 2. The expected rete of return on the I-bond investurent is 7.5%. What is the expected rate of return on the stock investment? Round your answer to the nearest whole number. 3. Woild vou invest in the bond or stock? 4. Exactly hew large would the expected prolit (or the expected rate of return) have to the on the stock investment to make you invest in the stock, oiven the 7.S\% return an the bend? hiound yeur arswer to the nearest whole mumber. If no exact answer can be obtained, enter 0. each? Each of these stocks has the sarie return charactenatics as the one stock - that is, a 50 - 50 chance of being worth zers or $14,700 ot year end. 1. Investing in a ponfolio of stocks would definaty be a deterionation ever investiog in the single stock II. Investing in a portiplio af stods would defintely be an improvenvent over investing in the single stock. 111. The situation would be unchanged. Would the correlubon between returns on thece stocks matter? If you chose the sure $0.7 million, would that indicate that you are a risk averter or a risk seeker? Suppose the payoff was ectually 50.7 milion - that was the only choice. You now face the chooke of investing it in a U.5. Treasury bond that will return $752,500 at the end of vear or a common stork that has a $5050 chance of being worthless or worth $1,470,000 at the end of the year. 1. The exnected profit on the T-bond invetment is $32,500, What is the expected dollar profit on the stock investment? flound your answer to the nearest dollar. 5 2. The expected rate of return on the T bond investment is 7.5%. What is the expected rate of return on the stock investment? Round your answer to the nearest whole number. 3. Would you invest in the band ar stack? on the bond? Round your answer to the nearest whole number. it no exact answer can be obtaired, enter 0. each? fach of these stocks has the same return characteristics is the one stock. that is, a 50 - 50 chance of being worth fere or $14,700 at year end. 1. Imvesteng in a portiolio of stocks would definfety be a deferioration over investing in the single stock: 11. Inventang in a portfolio of stocks would definitely be an improvement over uvesting in the single stock. III. The situation would be unchanged Would the correlation between returns on these stocks matter