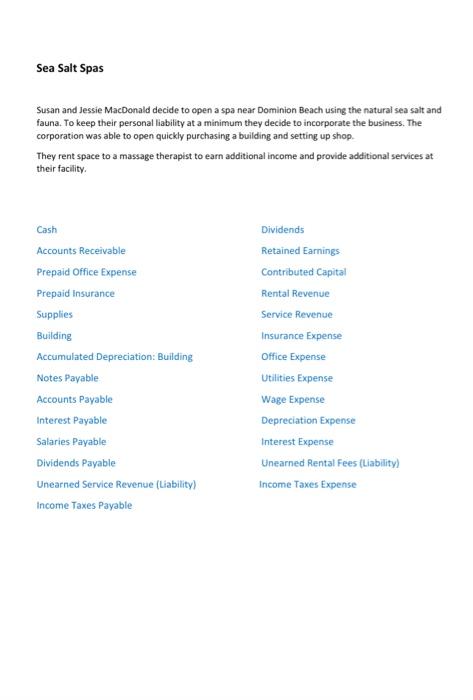

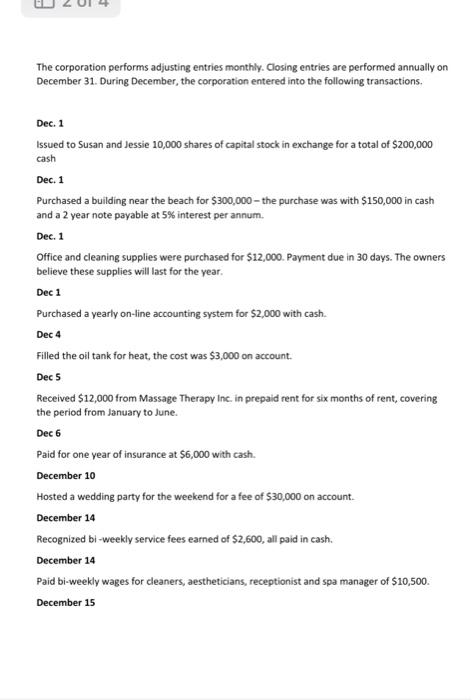

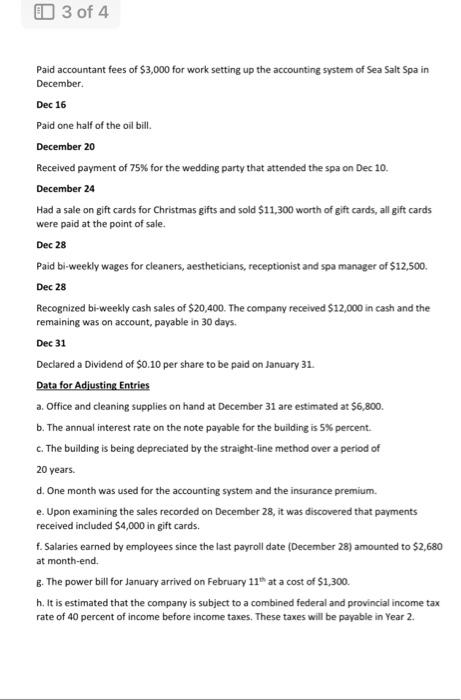

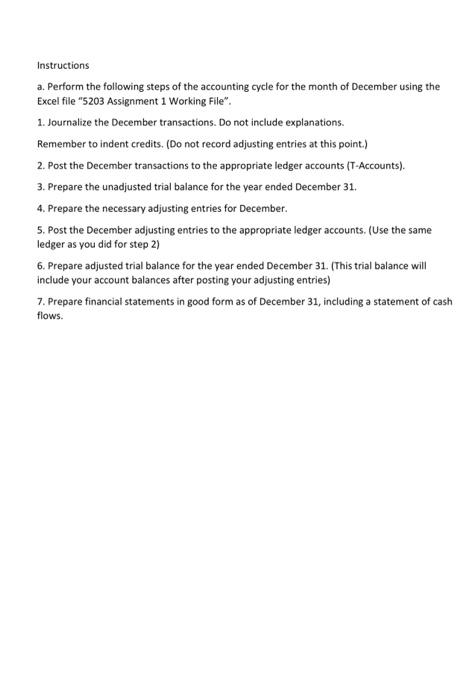

Sea Salt Spas Susan and Jessie MacDonald decide to open a spa near Dominion Beach using the natural sea salt and fauna. To keep their personal liability at a minimum they decide to incorporate the business. The corporation was able to open quickly purchasing a building and setting up shop. They rent space to a massage therapist to earn additional income and provide additional services at their facility. The corporation performs adjusting entries monthly. Closing entries are performed annually on December 31. During December, the corporation entered into the following transactions. Dec. 1 Issued to Susan and Jessie 10,000 shares of capital stock in exchange for a total of $200,000 cash Dec. 1 Purchased a building near the beach for $300,000 - the purchase was with $150,000 in cash and a 2 year note payable at 5% interest per annum. Dec. 1 Office and cleaning supplies were purchased for $12,000. Payment due in 30 days. The owners believe these supplies will last for the year. Dec 1 Purchased a yearly on-line accounting system for $2,000 with cash. Dec 4 Filled the oil tank for heat, the cost was $3,000 on account. Dec5 Received $12,000 from Massage Therapy Inc. in prepaid rent for six months of rent, covering the period from January to June. Dec 6 Paid for one year of insurance at $6,000 with cash. December 10 Hosted a wedding party for the weekend for a fee of $30,000 on account. December 14 Recognized bi -weekly service fees earned of $2,600, all paid in cash. December 14 Paid bi-weekly wages for cleaners, aestheticians, receptionist and spa manager of $10,500. December 15 Paid accountant fees of $3,000 for work setting up the accounting system of Sea Salt Spa in December. Dec 16 Paid one half of the oil bill. December 20 Received payment of 75% for the wedding party that attended the spa on Dec 10. December 24 Had a sale on gift cards for Christmas gifts and sold $11,300 worth of gift cards, all gift cards were paid at the point of sale. Dec 28 Paid bi-weekly wages for cleaners, aestheticians, receptionist and spa manager of $12,500. Dec 28 Recognized bi-weekly cash sales of $20,400. The company received $12,000 in cash and the remaining was on account, payable in 30 days. Dec 31 Declared a Dividend of $0.10 per share to be paid on January 31. Data for Adjusting Entries a. Office and cleaning supplies on hand at December 31 are estimated at $6,800. b. The annual interest rate on the note payable for the building is 5% percent. c. The building is being depreciated by the straight-line method over a period of 20 years. d. One month was used for the accounting system and the insurance premium. e. Upon examining the sales recorded on December 28 , it was discovered that payments received included $4,000 in gift cards. f. Salaries earned by employees since the last payroll date (December 28 ) amounted to $2,680 at month-end. B. The power bill for January arrived on February 11th at a cost of $1,300. h. It is estimated that the company is subject to a combined federal and provincial income tax rate of 40 percent of income before income taxes, These taxes will be payable in Year 2. Instructions a. Perform the following steps of the accounting cycle for the month of December using the Excel file "5203 Assignment 1 Working File". 1. Journalize the December transactions. Do not include explanations. Remember to indent credits. (Do not record adjusting entries at this point.) 2. Post the December transactions to the appropriate ledger accounts (T-Accounts). 3. Prepare the unadjusted trial balance for the year ended December 31 . 4. Prepare the necessary adjusting entries for December. 5. Post the December adjusting entries to the appropriate ledger accounts. (Use the same ledger as you did for step 2) 6. Prepare adjusted trial balance for the year ended December 31. (This trial balance will include your account balances after posting your adjusting entries) 7. Prepare financial statements in good form as of December 31 , including a statement of cash flows