Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Seadrill Engine Engineering licensed software tool dringturms for s i n addition to providing the ware, the company also provides consulting services and upon to

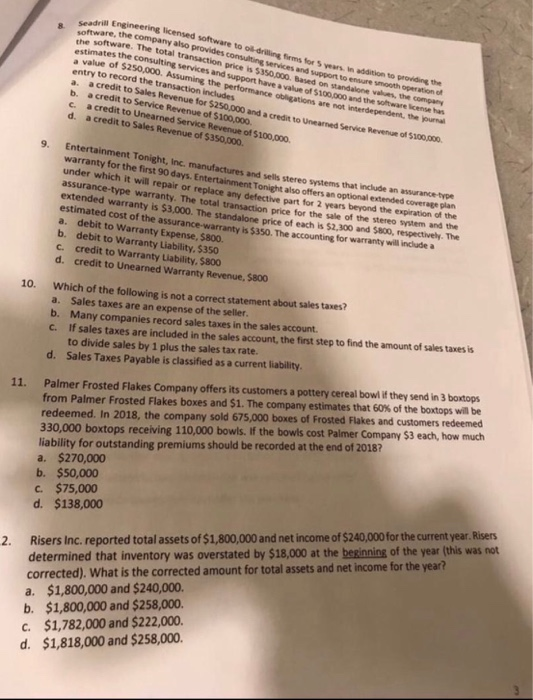

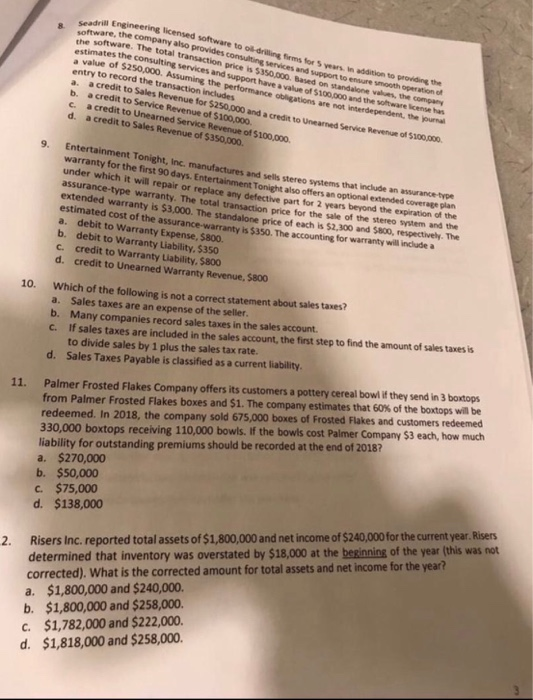

Seadrill Engine Engineering licensed software tool dringturms for s i n addition to providing the ware, the company also provides consulting services and upon to ensure the one be software. The total transaction price is $350.000. Based on and one w es, the com estimates the consulting services and support have value of $100.000 the wet ware licenses value of $250,000. Assuming the performance ons are not interdependent, the journal entry to record the transaction includes a. a credit to Sales Revenue for $250,000 and a credit to Uneared Service Revenue of $100.000 a credit to Service Revenue of $100,000 c a credit to Unearned Service Revenue of $100,000 d. a credit to Sales Revenue of $350,000 Entertainment Tonight, Inc, manufactures and sells stereo systems that include an assurance-type warranty for the first 90 days. Entertainment Ton al offers an optional extended coverageplan under which it will repair or replace any defectheart for 2 years beyond the expiration of the assurance-type warranty. The total transaction price for the sale of the stereo system and the extended warranty is $3,000. The standalone price of each is $2,300 and $800, respectively. The estimated cost of the assurance warranty is $350. The accounting for warranty will include a a. debit to Warranty Expense, $800. b. debit to Warranty Liability. $350 c credit to Warranty Liability. $800 d. credit to Unearned Warranty Revenue. 5800 10. Which of the following is not a correct statement about sales taxes? a. Sales taxes are an expense of the seller. b. Many companies record sales taxes in the sales account. c. If sales taxes are included in the sales account, the first step to find the amount of sales taxes is to divide sales by 1 plus the sales tax rate. d. Sales Taxes Payable is classified as a current liability. 11. Palmer Frosted Flakes Company offers its customers a pottery cereal bowl if they send in 3 boxtops from Palmer Frosted Flakes boxes and $1. The company estimates that 60% of the boxtops will be redeemed. In 2018, the company sold 675,000 boxes of Frosted Flakes and customers redeemed 330,000 boxtops receiving 110,000 bowls. If the bowls cost Palmer Company 53 each, how much liability for outstanding premiums should be recorded at the end of 2018? a. $270,000 b. $50,000 c. $75,000 d. $138,000 Risers Inc. reported total assets of $1,800,000 and net income of $240,000 for the current year. Risers determined that inventory was overstated by $18,000 at the beginning of the year (this was not corrected). What is the corrected amount for total assets and net income for the year? a. $1,800,000 and $240,000. b. $1,800,000 and $258,000. C. $1,782,000 and $222,000. d. $1,818,000 and $258,000

Seadrill Engine Engineering licensed software tool dringturms for s i n addition to providing the ware, the company also provides consulting services and upon to ensure the one be software. The total transaction price is $350.000. Based on and one w es, the com estimates the consulting services and support have value of $100.000 the wet ware licenses value of $250,000. Assuming the performance ons are not interdependent, the journal entry to record the transaction includes a. a credit to Sales Revenue for $250,000 and a credit to Uneared Service Revenue of $100.000 a credit to Service Revenue of $100,000 c a credit to Unearned Service Revenue of $100,000 d. a credit to Sales Revenue of $350,000 Entertainment Tonight, Inc, manufactures and sells stereo systems that include an assurance-type warranty for the first 90 days. Entertainment Ton al offers an optional extended coverageplan under which it will repair or replace any defectheart for 2 years beyond the expiration of the assurance-type warranty. The total transaction price for the sale of the stereo system and the extended warranty is $3,000. The standalone price of each is $2,300 and $800, respectively. The estimated cost of the assurance warranty is $350. The accounting for warranty will include a a. debit to Warranty Expense, $800. b. debit to Warranty Liability. $350 c credit to Warranty Liability. $800 d. credit to Unearned Warranty Revenue. 5800 10. Which of the following is not a correct statement about sales taxes? a. Sales taxes are an expense of the seller. b. Many companies record sales taxes in the sales account. c. If sales taxes are included in the sales account, the first step to find the amount of sales taxes is to divide sales by 1 plus the sales tax rate. d. Sales Taxes Payable is classified as a current liability. 11. Palmer Frosted Flakes Company offers its customers a pottery cereal bowl if they send in 3 boxtops from Palmer Frosted Flakes boxes and $1. The company estimates that 60% of the boxtops will be redeemed. In 2018, the company sold 675,000 boxes of Frosted Flakes and customers redeemed 330,000 boxtops receiving 110,000 bowls. If the bowls cost Palmer Company 53 each, how much liability for outstanding premiums should be recorded at the end of 2018? a. $270,000 b. $50,000 c. $75,000 d. $138,000 Risers Inc. reported total assets of $1,800,000 and net income of $240,000 for the current year. Risers determined that inventory was overstated by $18,000 at the beginning of the year (this was not corrected). What is the corrected amount for total assets and net income for the year? a. $1,800,000 and $240,000. b. $1,800,000 and $258,000. C. $1,782,000 and $222,000. d. $1,818,000 and $258,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started