Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sean (age 75 at end of 2016) retired five years ago. The balance in his 401(k) account on December 31, 2015 was $1,800,000 and the

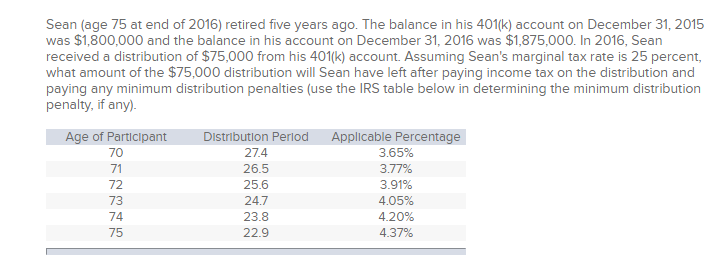

Sean (age 75 at end of 2016) retired five years ago. The balance in his 401(k) account on December 31, 2015 was $1,800,000 and the balance in his account on December 31, 2016 was $1,875,000. In 2016, Sean received a distribution of $75,000 from his 401(k) account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $75,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the IRS table below in determining the minimum distribution penalty, if any).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started