Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sean Ltd manufactures specialised 3D printers for both sale and lease. On 1 July 2020, Sean Ltd leased one of these printers to John

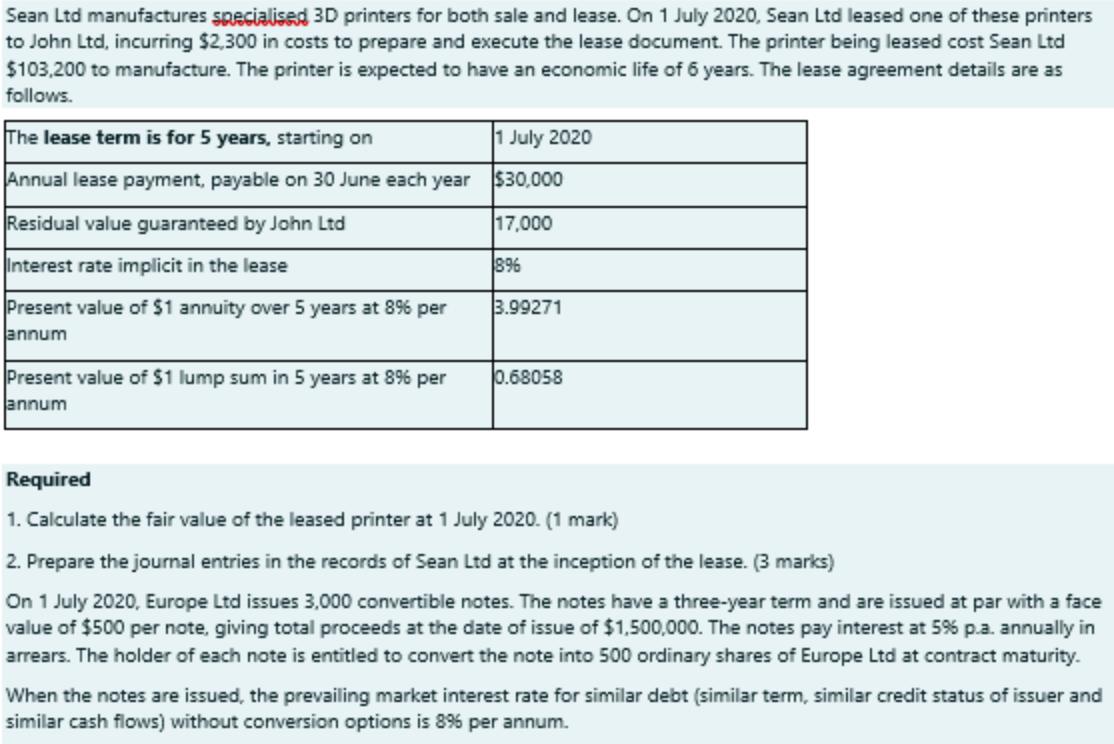

Sean Ltd manufactures specialised 3D printers for both sale and lease. On 1 July 2020, Sean Ltd leased one of these printers to John Ltd, incurring $2,300 in costs to prepare and execute the lease document. The printer being leased cost Sean Ltd $103,200 to manufacture. The printer is expected to have an economic life of 6 years. The lease agreement details are as follows. The lease term is for 5 years, starting on July 2020 Annual lease payment, payable on 30 June each year $30,000 Residual value guaranteed by John Ltd 17,000 Interest rate implicit in the lease 89% Present value of $1 annuity over 5 years at 8% per annum 3.99271 Present value of $1 lump sum in 5 years at 8% per 0.68058 annum Required 1. Calculate the fair value of the leased printer at 1 July 2020. (1 mark) 2. Prepare the journal entries in the records of Sean Ltd at the inception of the lease. (3 marks) On 1 July 2020, Europe Ltd issues 3,000 convertible notes. The notes have a three-year term and are issued at par with a face value of $500 per note, giving total proceeds at the date of issue of $1,500,000. The notes pay interest at 5% p.a. annually in arrears. The holder of each note is entitled to convert the note into 500 ordinary shares of Europe Ltd at contract maturity. When the notes are issued, the prevailing market interest rate for similar debt (similar term, similar credit status of issuer and similar cash flows) without conversion options is 8% per annum.

Step by Step Solution

★★★★★

3.24 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Fair value of the leased Printer At Inception would be equals ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started