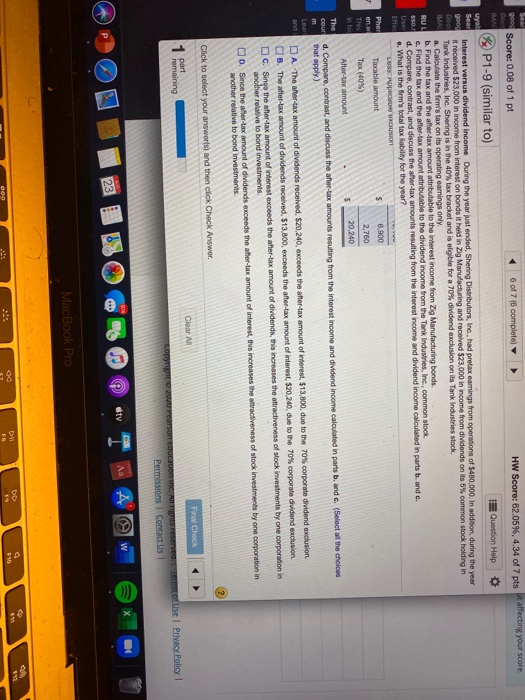

Sear goo Score: 0.08 of 1 pt 6 of 76 complete) Coo HW Score: 62.05%, 4.34 of 7 pts ut affecting your score. IMAS P1-9 (similar to) Question Help uyal Sear Interest versus dividend income During the year just ended, Shering Distributors, Inc., had pretax earnings from operations of $400,000. In addition, during the year good it received $23,000 in income from interest on bonds it held in Zig Manufacturing and received $23,000 in income from dividends on its 5% common stock holding in GOO Tank Industries, Inc. Shering is in the 40% tax bracket and is eligible for a 70% dividend exclusion on its Tank Industries stock MA a. Calculate the firm's tax on its operating earnings only RU b. Find the tax and the after-tax amount attributable to the interest income from Zig Manufacturing bonds 5501 c. Find the tax and the after-tax amount attributable to the dividend income from the Tank Industries, Inc. common stock d. Compare, contrast, and discuss the after-tax amounts resulting from the interest income and dividend income calculated in parts b. and c. Effee e. What is the firm's total tax liability for the year? SARRUKOUSTON Pher Taxable amount $ 6.900 en.w This Tax (40%) 2,760 In be After-tax amount 20.240 The cour d. Compare, contrast, and discuss the after-tax amounts resulting from the interest income and dividend income calculated in parts b. and c. (Select all the choices that apply) Lear and DA. The after tax amount of dividends received, $20,240, exceeds the after-tax amount of Interest, $13,800, due to the 70% corporate dividend exclusion B. The after-tax amount of dividends received, $13,800, exceeds the after-tax amount of interest, $20,240, due to the 70% corporate dividend exclusion DC Sing the after-tax amount of interest exceeds the after-tax amount of dividends, this increases the attractiveness of stock investments by one corporation in another relative to bond investments D. Since the after-tax amount of dividends exceeds the after-tax amount of Interest, this increases the attractiveness of stock investments by one corporation in another relative to bond investments Click to select your answers) and then click Check Answer. Final Check Clear All 1 part remaining Copyrig ZU Pearson cation Inc. All rights reserved. Terms of Use Privacy Policy Permissions Contact Us dtv Aa 23 MacBook Pro DW