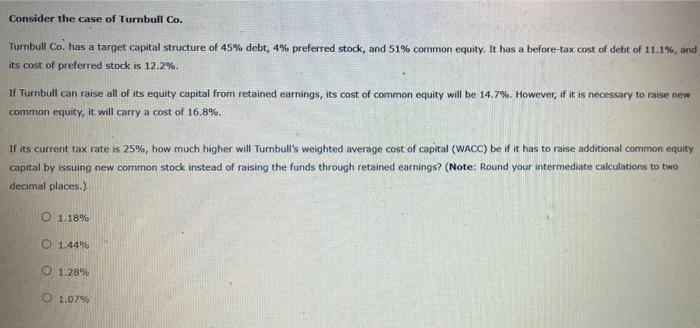

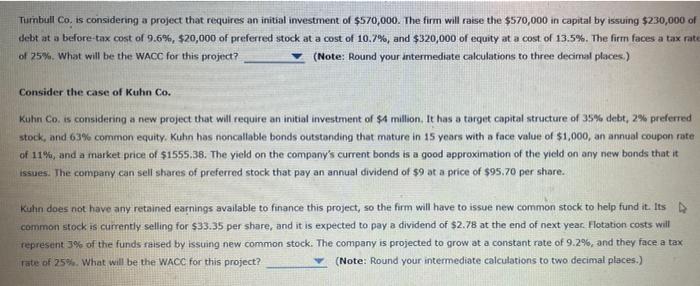

Search FIN 301 Assignment 11-Ch 10. The Cost of Capital X Consider the case of Turno Tools una has a targeta de 45 and 5111, iscent of preferred to 12 Tombull come to set captat from retored in its cost of common cauty will be 10. However, is conuity will contact of 168 sturen trote how much higher will turn weighted west (WAC) it has to radio come al by WC stocked off the funds through reg? (Note: Rond your website to the decimale) t O Titolo sing project that real 7000. The form with $70.000 730.000 Gebt at a before the cost of $20,000 of preferred at a cost 10.320,000 to 3.5 The fact 25. What will be the WACC for this project Nu your meditations to the places Consider the case of Kulin Co. cordering that we atent of the total structure of 25%. Wat will be the WACC for this project? (Note: Hound your intermediate calculations to the decimal places.) Consider the case of Kuhn Co. Kuhn Co. is considering a new project that will require an initial investment of 4 million. It has a target capital structure of 35% de preferred stock, and 63% common equity. Kuhn has noncallable bonds outstanding that mature in 15 years with a face value of $1,000, an annual couponte of 11%, and a market price of $1555.38. The yield on the company's current bonds is a good approximation of the yield on any new bonds that issues. The company can sell shares of preferred stock that pay an annual dividend of $9 at a price of $95.70 per stare Kuhn does not have any retained earnings available to finance this project, so the firm will have to rese new common stock to help fund it, the common stock is currently selling for $33,35 per share, and it is expected to pay a dividend of $2.78 at the end of next year. Hlutation costs will represent 3% of the funds raised by issuing new common stock. The company is projected to grow at a constant rate of 9.2%, and they face aux rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to two decimal places) Grade It Now Save & Continue Continue without saving OL DELL Consider the case of Turnbull Co. Turnbull Co. has a target capital structure of 45% debt, 4% preferred stock, and 51% common equity. It has a before-tax cost of debt of 11.1%, and its cost of preferred stock is 12.2% If Turnbull can raise all of its equity capital from retained earnings, its cost of common equity will be 14.7%. However, if it is necessary to raise new common equity, it will carry a cost of 16.8%. If its current tax rate is 25%, how much higher will Turnbull's weighted average cost of capital (WACC) be if it has to raise additional common equity capital by issuing new common stock instead of raising the funds through retained earnings? (Note: Round your intermediate calculations to two decimal places.) 1.18% 1.4496 O 1.28% 01.07% Turnbull Co. is considering a project that requires an initial investment of $570,000. The firm will raise the $570,000 in capital by issuing $230,000 of debt at a before-tax cost of 9.6%, $20,000 of preferred stock at a cost of 10.7%, and $320,000 of equity at a cost of 13.5%. The firm faces a tax rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to three decimal places) Consider the case of Kuhn Co. Kuhn Co. is considering a new project that will require an initial investment of $1 million. It has a target capital structure of 35% debt, 2% preferred stock, and 63% common equity. Kuhn has noncallable bonds outstanding that mature in 15 years with a face value of $1,000, an annual coupon rate of 11%, and a market price of $1555.38. The yield on the company's current bonds is a good approximation of the yield on any new bonds that it issues. The company can sell shares of preferred stock that pay an annual dividend of $9 at a price of $95.70 per share. Kuhn does not have any retained earnings available to finance this project, so the firm will have to issue new common stock to help fund it. Its common stock is currently selling for $33.35 per share, and it is expected to pay a dividend of $2.78 at the end of next year. Flotation costs will represent 3% of the funds raised by issuing new common stock. The company is projected to grow at a constant rate of 9.2%, and they face a tax rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to two decimal places.)