Question

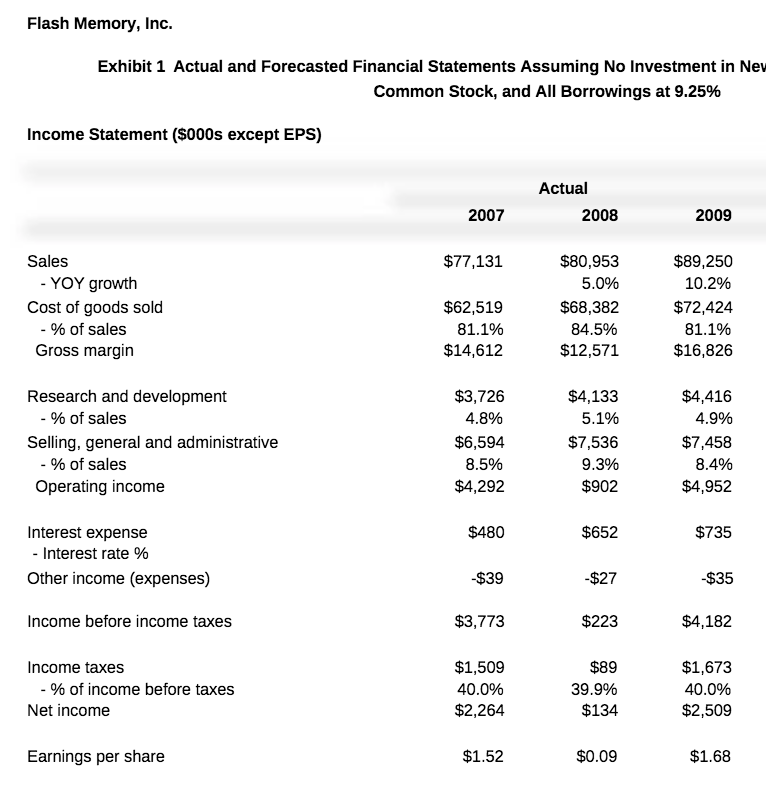

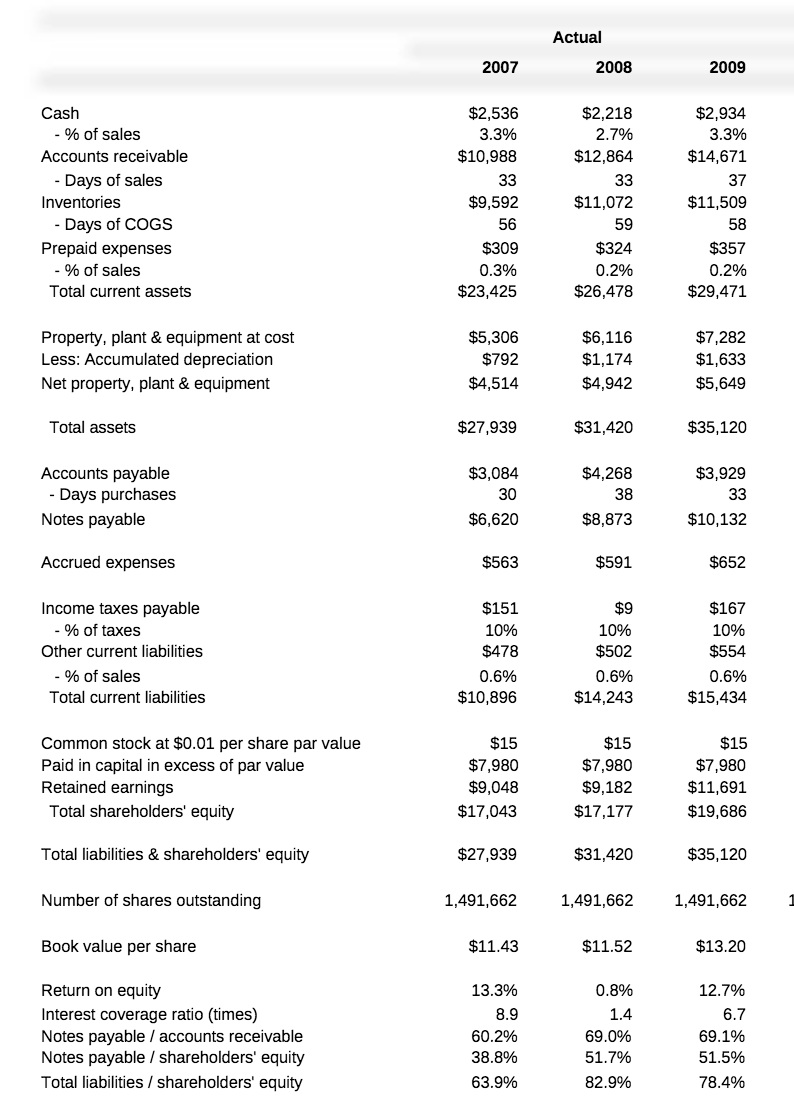

SEARCH Flash Memory, Inc. Case 1. Assuming the company does not invest in the new product line, prepare forecasted income statements and balance sheets at

SEARCH Flash Memory, Inc. Case

1. Assuming the company does not invest in the new product line, prepare forecasted income statements and balance sheets at year-end 2010, 2011, and 2012. Based on these forecasts, estimate Flashs required external financing: in this case all required external financing takes the form of additional notes payable form its commercial bank, for the same period.

2. What course of action do you recommend regarding the proposed investment in the new product line? Should the company accept or reject this investment opportunity?

3. How does your recommendation from question 2 above impact your estimate of the companys forecasted income statements and balance sheets, and required external financing in 2010, 2011, and 2012? How do these forecasted income statements and balance sheets differ if the company relies solely on additional notes payable from its commercial bank, compared to a sale of new equity?

4. As CFO Hathaway Browne, what financing alternative would you recommend to the board of the directors to meet the financing needs you estimated in questions 1 through 3 above? What are the costs and benefits of each alternative?

| xhibit 3 Key Forecasting Assumptions and Relationships for 2010 Through 2012 | |

| Line Item | Assumption or Ratio |

| Cost of goods sold | 81.10% of sales |

| Research and development | 5.0% of sales |

| Selling, general and administrative | 8.36% of sales |

| Interest expense | Beginning of year debt balance interest rate |

| Other income (expenses) | $50,000 of expense each year |

| Cash | 3.3% of sales |

| Accounts receivable | 60 days sales outstanding |

| Inventories | 52 days of cost of good sold |

| Prepaid expenses | 0.4% of sales |

| Property, plant & equipment at cost | Beginning PP&E at cost + capital expenditures |

| Accumulated depreciation | Beginning A/D + 7.5% of beginning PP&E at cost |

| Accounts payable | 30 days of purchases |

| Purchases | 60% of cost of goods sold |

| Accrued expenses | 0.73% of sales |

| Income taxes payable | 10% of income taxes expense |

| Other current liabilities | 0.62% of sales |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started