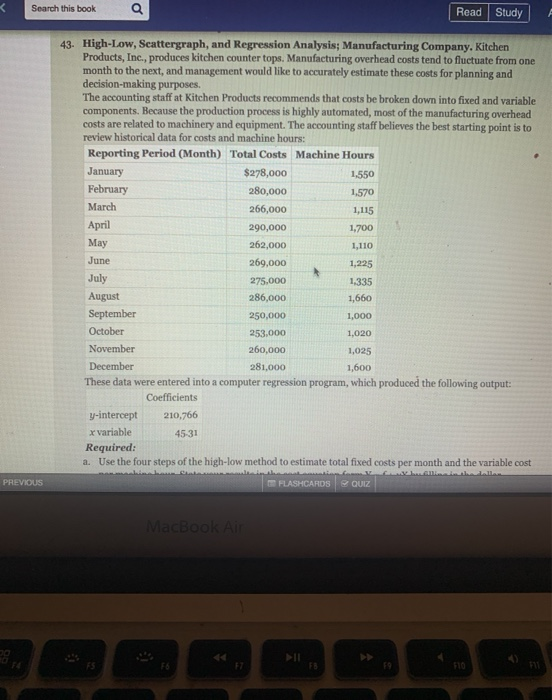

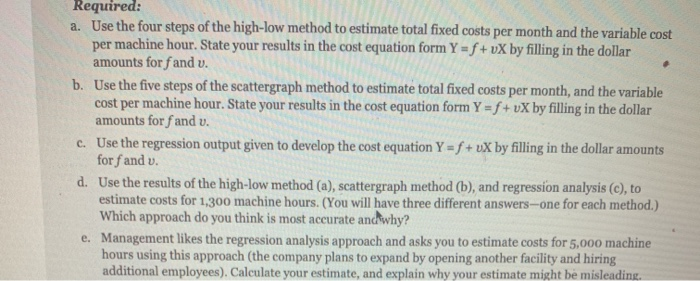

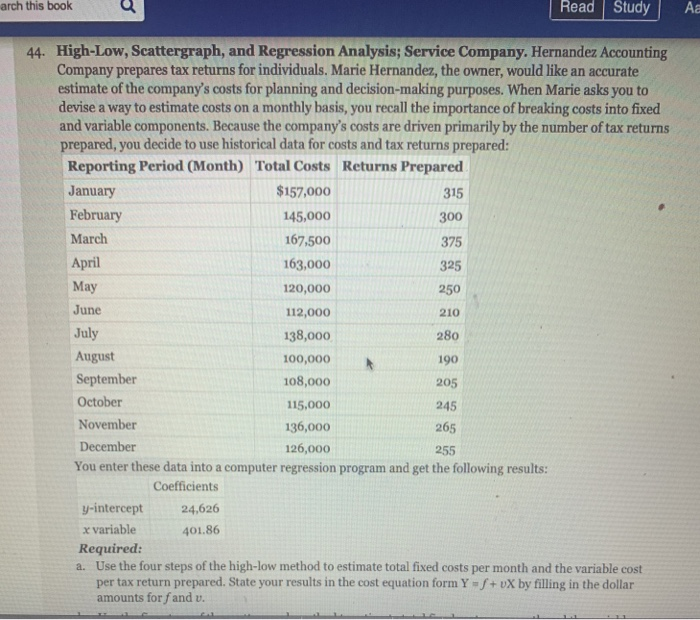

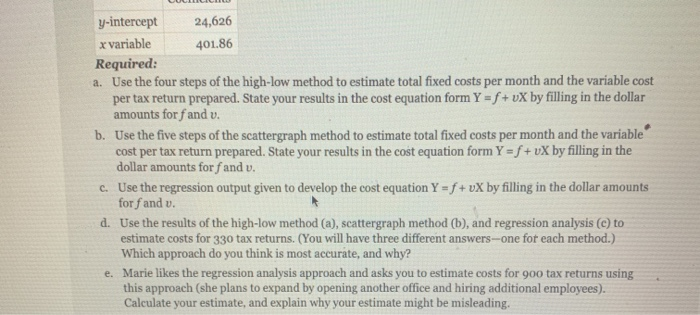

Search this book a Read Study 43. High-Low, Scattergraph, and Regression Analysis; Manufacturing Company. Kitchen Products, Inc., produces kitchen counter tops. Manufacturing overhead costs tend to fluctuate from one month to the next, and management would like to accurately estimate these costs for planning and decision-making purposes. The accounting staff at Kitchen Products recommends that costs be broken down into fixed and variable components. Because the production process is highly automated, most of the manufacturing overhead costs are related to machinery and equipment. The accounting staff believes the best starting point is to review historical data for costs and machine hours: Reporting Period (Month) Total Costs Machine Hours January $278,000 1,550 February 280,000 1,570 March 266,000 1,115 April 290,000 1,700 May 262,000 1,110 June 269,000 1,225 July 275,000 1,335 August 286,000 1,660 September 250,000 1,000 October 253,000 November 260,000 1,025 December 281,000 1,600 These data were entered into a computer regression program, which produced the following output: Coefficients y-intercept 210,766 x variable Required: a. Use the four steps of the high-low method to estimate total fixed costs per month and the variable cost 1,020 45 31 PREVIOUS C FLASHCARDS QUIZ MacBook Air ES FB 510 Required: a. Use the four steps of the high-low method to estimate total fixed costs per month and the variable cost per machine hour. State your results in the cost equation form Y=f+vX by filling in the dollar amounts for fand u. b. Use the five steps of the scattergraph method to estimate total fixed costs per month, and the variable cost per machine hour. State your results in the cost equation form Y = f + vX by filling in the dollar amounts for fand v. c. Use the regression output given to develop the cost equation Y = f + UX by filling in the dollar amounts for fand v. d. Use the results of the high-low method (a), scattergraph method (b), and regression analysis (c), to estimate costs for 1,300 machine hours. (You will have three different answers-one for each method.) Which approach do you think is most accurate and why? e. Management likes the regression analysis approach and asks you to estimate costs for 5,000 machine hours using this approach (the company plans to expand by opening another facility and hiring additional employees). Calculate your estimate, and explain why your estimate might be misleading. arch this book Read Study Aa 375 210 44. High-Low, Scattergraph, and Regression Analysis; Service Company. Hernandez Accounting Company prepares tax returns for individuals. Marie Hernandez, the owner, would like an accurate estimate of the company's costs for planning and decision-making purposes. When Marie asks you to devise a way to estimate costs on a monthly basis, you recall the importance of breaking costs into fixed and variable components. Because the company's costs are driven primarily by the number of tax returns prepared, you decide to use historical data for costs and tax returns prepared: Reporting Period (Month) Total Costs Returns Prepared January $157,000 315 February 145,000 300 March 167,500 April 163,000 325 May 120,000 250 June 112,000 July 138,000 280 August 100,000 190 September 108,000 205 October 115,000 245 November 136,000 265 December 126,000 255 You enter these data into a computer regression program and get the following results: Coefficients y-intercept 24,626 x variable 401.86 Required: a. Use the four steps of the high-low method to estimate total fixed costs per month and the variable cost per tax return prepared. State your results in the cost equation form Y - + vX by filling in the dollar amounts for fand u. y-intercept 24,626 x variable 401.86 Required: a. Use the four steps of the high-low method to estimate total fixed costs per month and the variable cost per tax return prepared. State your results in the cost equation form Y = f + vX by filling in the dollar amounts for fand v. b. Use the five steps of the scattergraph method to estimate total fixed costs per month and the variable cost per tax return prepared. State your results in the cost equation form Y = f +vX by filling in the dollar amounts for fand v. c. Use the regression output given to develop the cost equation Y = f + UX by filling in the dollar amounts for f and v. d. Use the results of the high-low method (a), scattergraph method (b), and regression analysis (C) to estimate costs for 330 tax returns. (You will have three different answers--one for each method.) Which approach do you think is most accurate, and why? e. Marie likes the regression analysis approach and asks you to estimate costs for 900 tax returns using this approach (she plans to expand by opening another office and hiring additional employees). Calculate your estimate, and explain why your estimate might be misleading