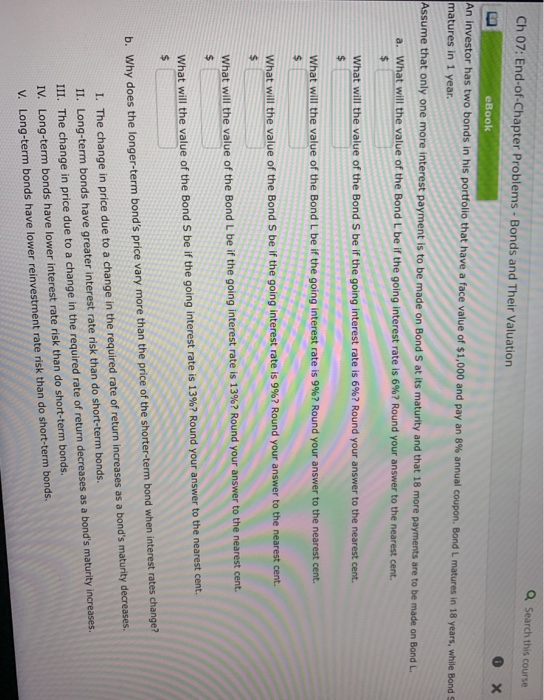

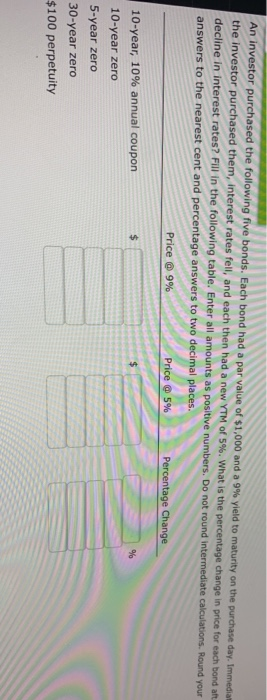

Search this course Ch 07: End-of-Chapter Problems - Bonds and Their Valuation 0 x eBook An investor has two bonds in his portfolio that have a face value of $1,000 and pay an 8% annual coupon. Bond L matures in 18 years, while Bond matures in 1 year. Assume that only one more interest payment is to be made on Bonds at its maturity and that 18 more payments are to be made an Bond L. a. What will the value of the Bond L be if the going interest rate is 6%? Round your answer to the nearest cent. $ What will the value of the Bond S be if the going interest rate is 6%? Round your answer to the nearest cent. $ What will the value of the Bond L be if the going interest rate is 9%? Round your answer to the nearest cent. $ What will the value of the Bond S be if the going interest rate is 9%? Round your answer to the nearest cent. $ the going interest rate is 13%? Round your answer to the nearest cent. What will the value of the Bond L be $ What will the value of the Bond S be if the going interest rate is 13%? Round your answer to the nearest cent. $ b. Why does the longer-term bond's price vary more than the price of the shorter-term bond when interest rates change? 1. The change in price due to a change in the required rate of return increases as a bond's maturity decreases. II. Long-term bonds have greater interest rate risk than do short-term bonds. III. The change in price due to a change in the required rate of return decreases as a bond's maturity increases. IV. Long-term bonds have lower interest rate risk than do short-term bonds. V. Long-term bonds have lower reinvestment rate risk than do short-term bonds. An investor purchased the following five bonds. Each bond had a par value of $1,000 and a 9% yield to maturity on the purchase day. Immediam the investor purchased them, interest rates fell, and each then had a new YTM of 5%. What is the percentage change in price for each bond att decline in interest rates? Fill in the following table. Enter all amounts as positive numbers. Do not round intermediate calculations. Round your answers to the nearest cent and percentage answers to two decimal places. Price @ 9% Price @ 5% Percentage Change $ $ 06 10-year, 10% annual coupon 10-year zero 5-year zero 30-year zero $100 perpetuity