Question

Assume that you are the credit manager of a medium-size supplier of building materials and related products. Home Depot wants to make credit purchases from

Assume that you are the credit manager of a medium-size supplier of building materials and related products. Home Depot wants to make credit purchases from your company, with payment due in 60 days.

Instructions:

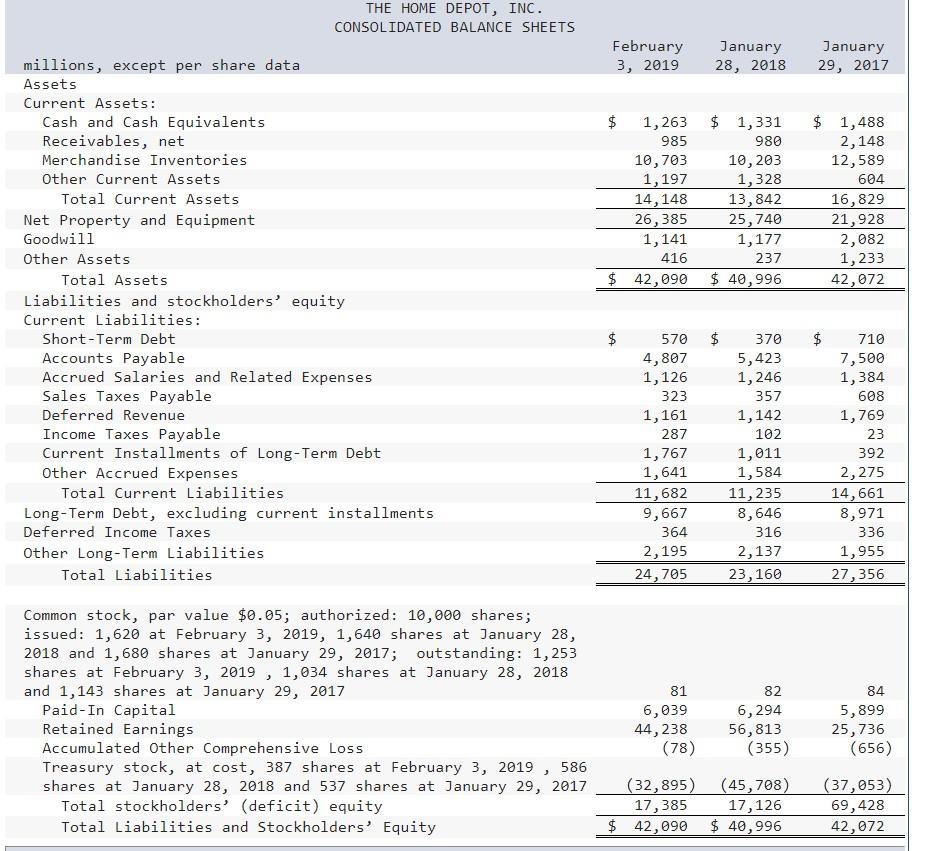

a-1. Compute the current ratio for the fiscal years ending February 3, 2019, and January 28, 2018.

a-2. Compute the quick ratio for the fiscal years ending February 3, 2019, and January 28, 2018.

a-3. Compute the amount of working capital for the fiscal years ending February 3, 2019, and January 28, 2018.

a-4. Compute the change in working capital from the prior year for the fiscal years ending February 3, 2019, and January 28, 2018.

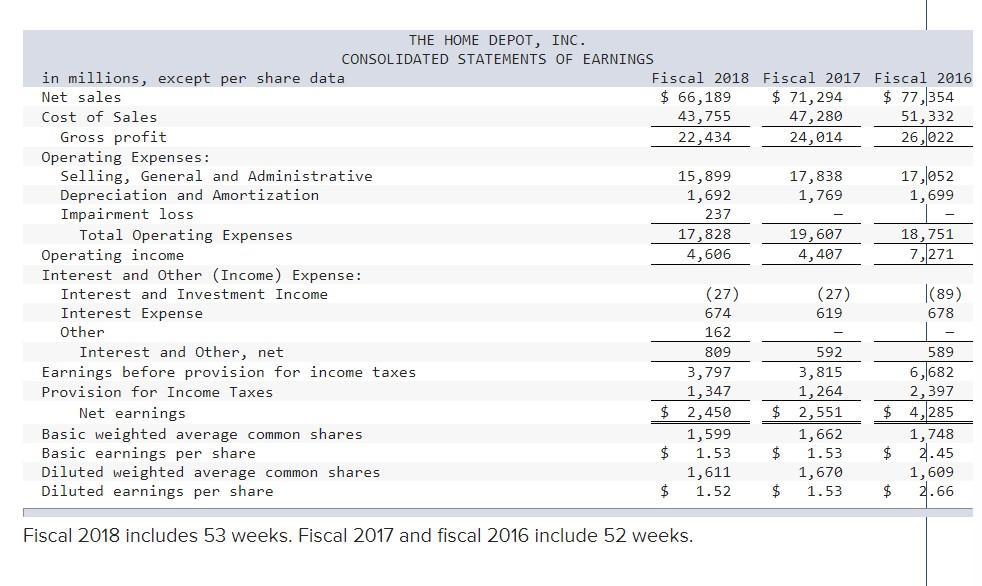

THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF EARNINGS in millions, except per share data Net sales Cost of Sales Gross profit Operating Expenses: Selling, General and Administrative Depreciation and Amortization Impairment loss. Total Operating Expenses Operating income Interest and Other (Income) Expense: Interest and Investment Income Interest Expense Other Interest and Other, net Earnings before provision for income taxes Provision for Income Taxes. Net earnings Basic weighted average common shares Basic earnings per share Fiscal 2018 $ 66,189 43,755 22,434 $ 15,899 1,692 237 17,828 4,606 3,797 1,347 $ 2,450 $ (27) 674 162 809 Diluted weighted average common shares Diluted earnings per share Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks. 1,599 1.53 1,611 1.52 Fiscal 2017 Fiscal 2016 $71,294 $ 77,354 47,280 51,332 24,014 26,022 17,838 1,769 19,607 4,407 (27) 619 592 3,815 1,264 $ 2,551 1,662 $ 1.53 1,670 $ 1.53 $ $ 17,052 1,699 - 18,751 7,271 |(89) 678 589 6,682 2,397 4,285 1,748 2.45 1,609 2.66

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Compute the current ratio for the fiscal years ending February 3 2019 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d5e588e6ed_174945.pdf

180 KBs PDF File

635d5e588e6ed_174945.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started