The auditors of STA, Inc., a calendar-year corporation, obtained the selected information for years 1 and 2 located in the exhibit below. Selected information Year

The auditors of STA, Inc., a calendar-year corporation, obtained the selected information for years 1 and 2 located in the exhibit below.

| Selected information | Year 2 | Year 1 | |||

| Gross revenue | $ | 63,000,000 | $ | 60,000,000 | |

| Net income before taxes | 11,650,000 | 11,000,000 | |||

| Salary expense | 12,500,000 | 8,000,000 | |||

| Rent expense | 1,920,000 | 1,200,000 | |||

| Utilities expense | 155,000 | 120,000 | |||

| Depreciation expense | 705,000 | 675,000 | |||

| Repairs and maintenance | 375,000 | 300,000 | |||

| Interest expense | 523,000 | 338,100 | |||

| Miscellaneous | 151,000 | 135,000 | |||

| Tax expense | 4,325,150 | 3,850,000 | |||

Additionally, the auditors noted the following information:

- STA rents space in an office building:

- Space in Building 1: 25,000 sq. ft.

- On January 1, year 2, the company added a second space:

- Space in Building 2: 11,000 sq. ft.

- The balance of interest-bearing debt outstanding:

- January 1, year 2: $4,830,000

- December 31, year 2: $10,262,000

- The company issued additional debt on July 1, year 2

The auditors are performing analytical procedures relative to the expectations of expenses for year 2 and have established a materiality threshold of 5% of the auditor's expected year 2 amount.

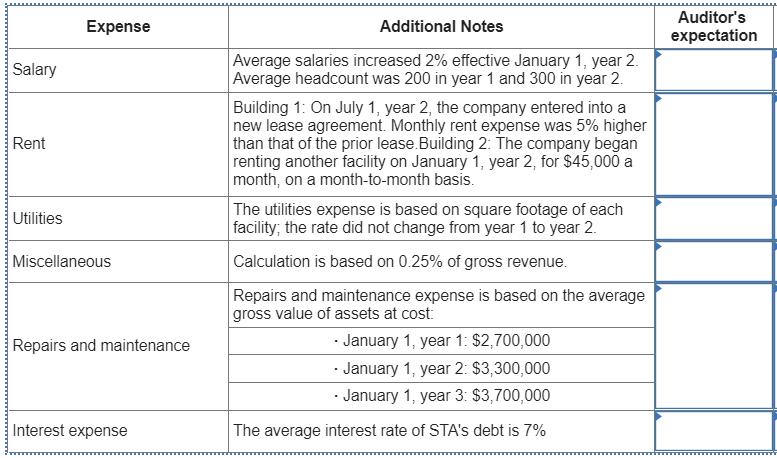

For each of the expenses in column A below, consider the additional notes in column B, and complete the following:

- In "Auditor's expectation" column, enter the auditor's expectation of year 2 expense. (Round all amounts to the nearest dollar.)

- In "Auditor's decision" column, select the auditor's decision as to whether further testing is needed. (Consider each account independently - an option may be used once, more than once, or not at all.)

Auditor's Expense Additional Notes expectation Average salaries increased 2% effective January 1, year 2. Average headcount was 200 in year 1 and 300 in year 2. Salary Building 1: On July 1, year 2, the company entered into a new lease agreement. Monthly rent expense was 5% higher than that of the prior lease.Building 2: The company began renting another facility on January 1, year 2, for $45,000 a month, on a month-to-month basis. Rent The utilities expense is based on square footage of each facility; the rate did not change from year 1 to year 2. Utilities Miscellaneous Calculation is based on 0.25% of gross revenue. Repairs and maintenance expense is based on the average gross value of assets at cost: January 1, year 1: $2,700,000 January 1, year 2: $3,300,000 January 1, year 3: $3,700,000 Repairs and maintenance Interest expense The average interest rate of STA's debt is 7%

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started