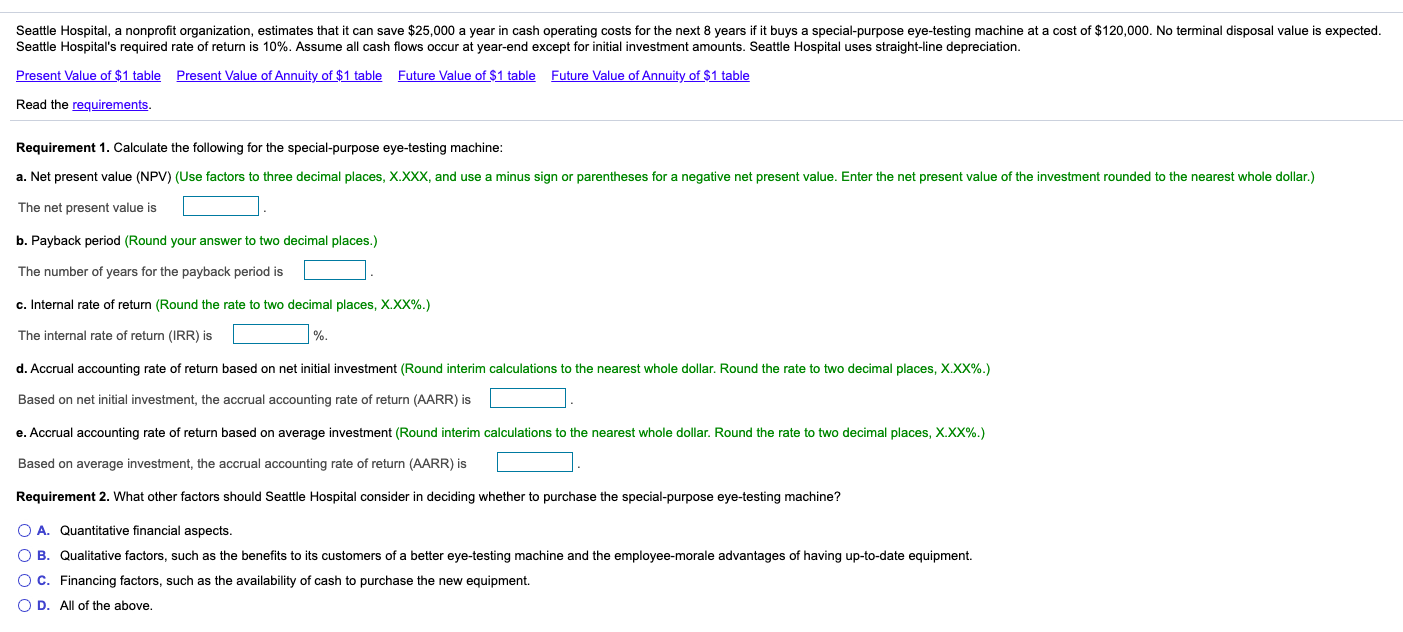

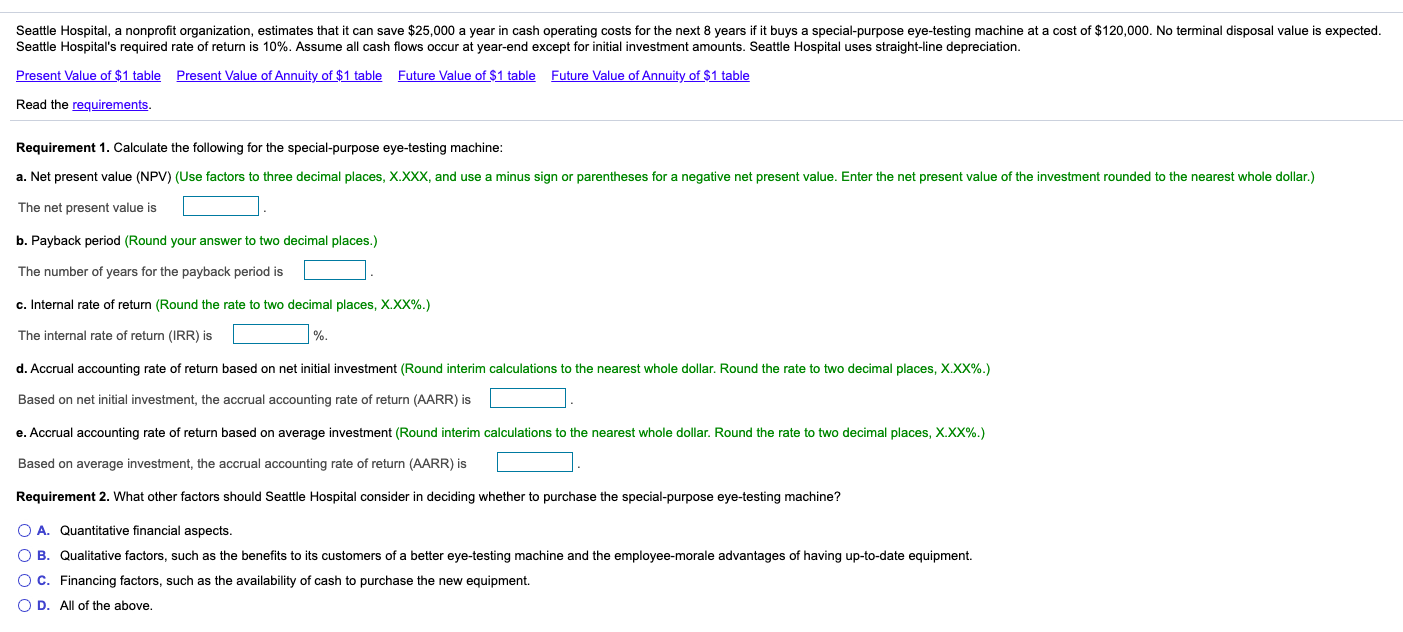

Seattle Hospital, a nonprofit organization, estimates that it can save $25,000 a year in cash operating costs for the next 8 years if it buys a special-purpose eye-testing machine at a cost of $120,000. No terminal disposal value is expected. Seattle Hospital's required rate of return is 10%. Assume all cash flows occur at year-end except for initial investment amounts. Seattle Hospital uses straight-line depreciation. Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Read the requirements. Requirement 1. Calculate the following for the special-purpose eye-testing machine: a. Net present value (NPV) (Use factors to three decimal places, X.XXX, and use a minus sign or parentheses for a negative net present value. Enter the net present value of the investment rounded to the nearest whole dollar.) The net present value is b. Payback period (Round your answer to two decimal places.) The number of years for the payback period is c. Internal rate of return (Round the rate to two decimal places, X.XX%.) The internal rate of return (IRR) is d. Accrual accounting rate of return based on net initial investment (Round interim calculations to the nearest whole dollar. Round the rate to two decimal places, X.XX%.) Based on net initial investment, the accrual accounting rate of return (AARR) is e. Accrual accounting rate of return based on average investment (Round interim calculations to the nearest whole dollar. Round the rate to two decimal places, X.XX%.) Based on average investment, the accrual accounting rate of return (AARR) is Requirement 2. What other factors should Seattle Hospital consider in deciding whether to purchase the special-purpose eye-testing machine? O A. Quantitative financial aspects. O B. Qualitative factors, such as the benefits to its customers of a better eye-testing machine and the employee-morale advantages of having up-to-date equipment. O C. Financing factors, such as the availability of cash to purchase the new equipment. OD. All of the above