Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Seaworthy Inc. (Seaworthy) is a manufacturing business. In January 2019, Seaworthy sold a piece of undeveloped land for $1,250,000. This land had been purchased

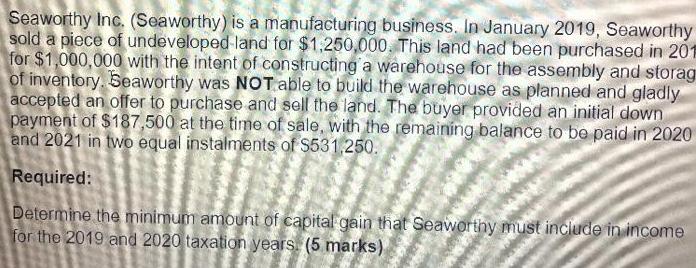

Seaworthy Inc. (Seaworthy) is a manufacturing business. In January 2019, Seaworthy sold a piece of undeveloped land for $1,250,000. This land had been purchased in 201 for $1,000,000 with the intent of constructing a warehouse for the assembly and storag of inventory. Seaworthy was NOT able to build the warehouse as planned and gladly accepted an offer to purchase and sell the land. The buyer provided an initial down payment of $187,500 at the time of sale, with the remaining balance to be paid in 2020 and 2021 in two equal instalments of $531,250. Required: Determine the minimum amount of capital gain that Seaworthy must include in income for the 2019 and 2020 taxation years. (5 marks)

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine the minimum amount of capital gain that Seaworthy must include in income for the 2019 and 2020 taxation years we need to calculate the ad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started