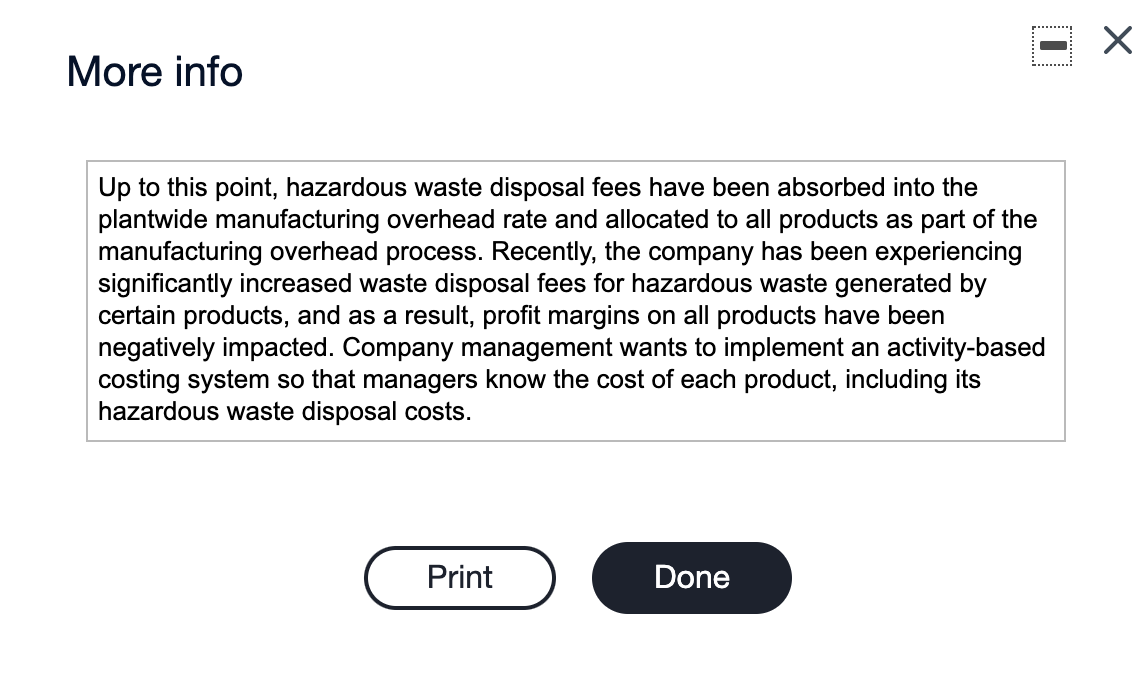

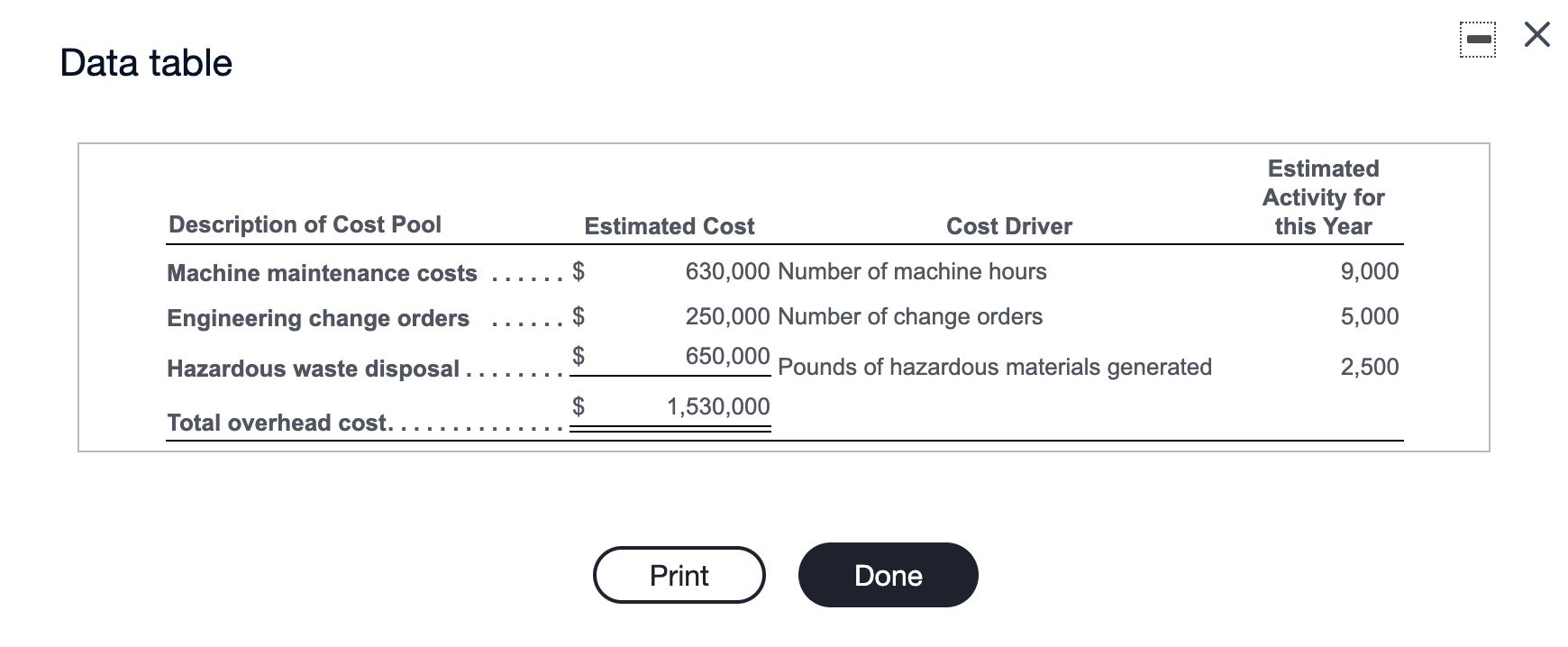

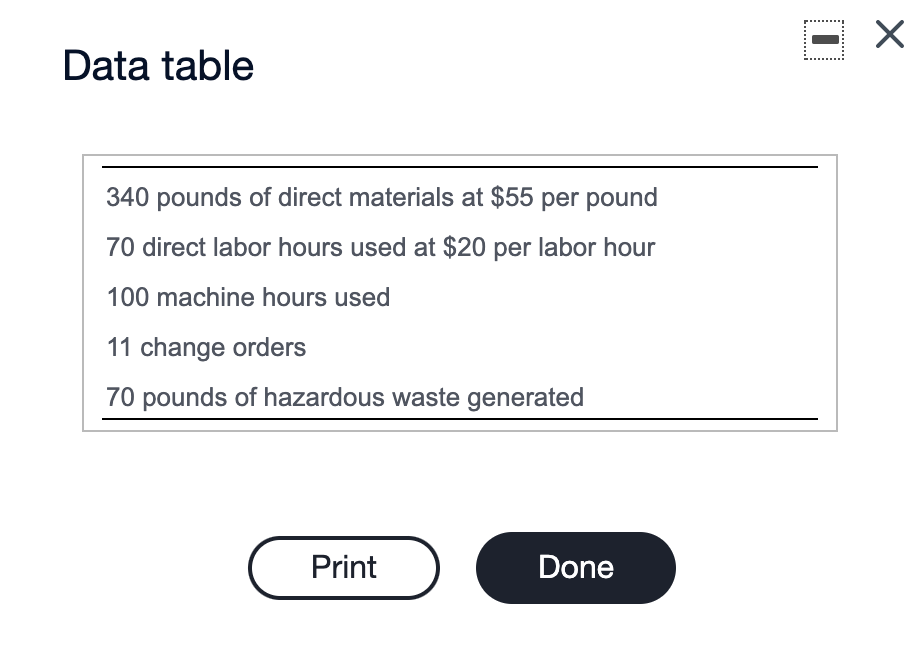

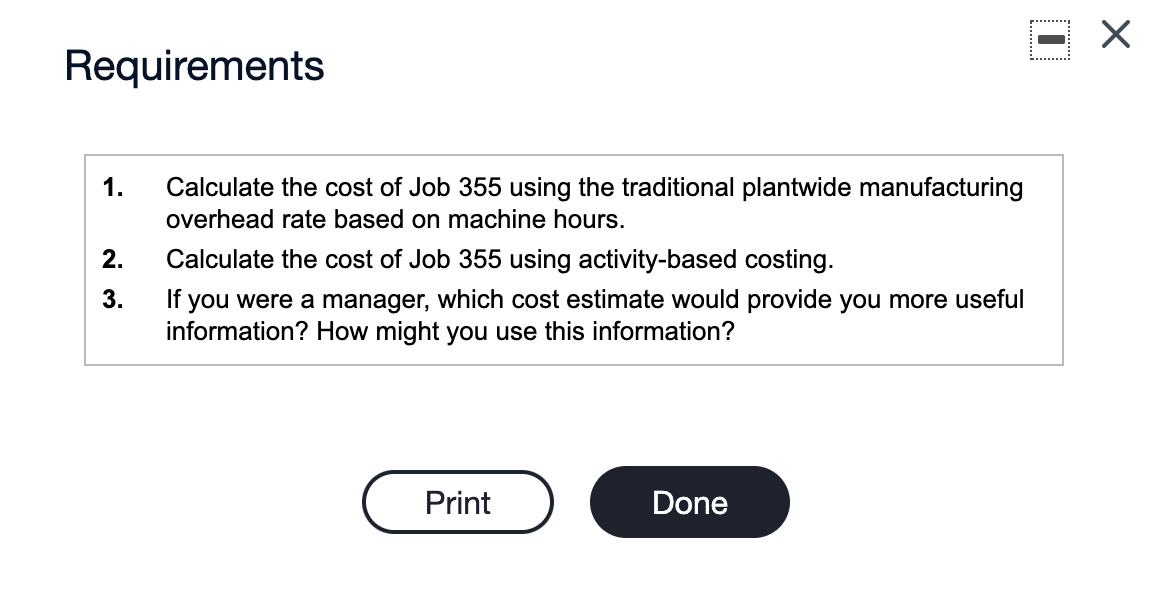

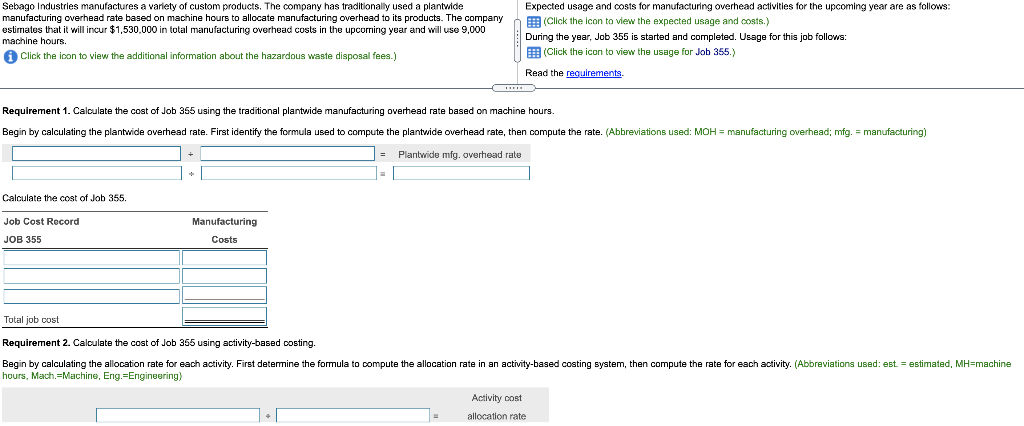

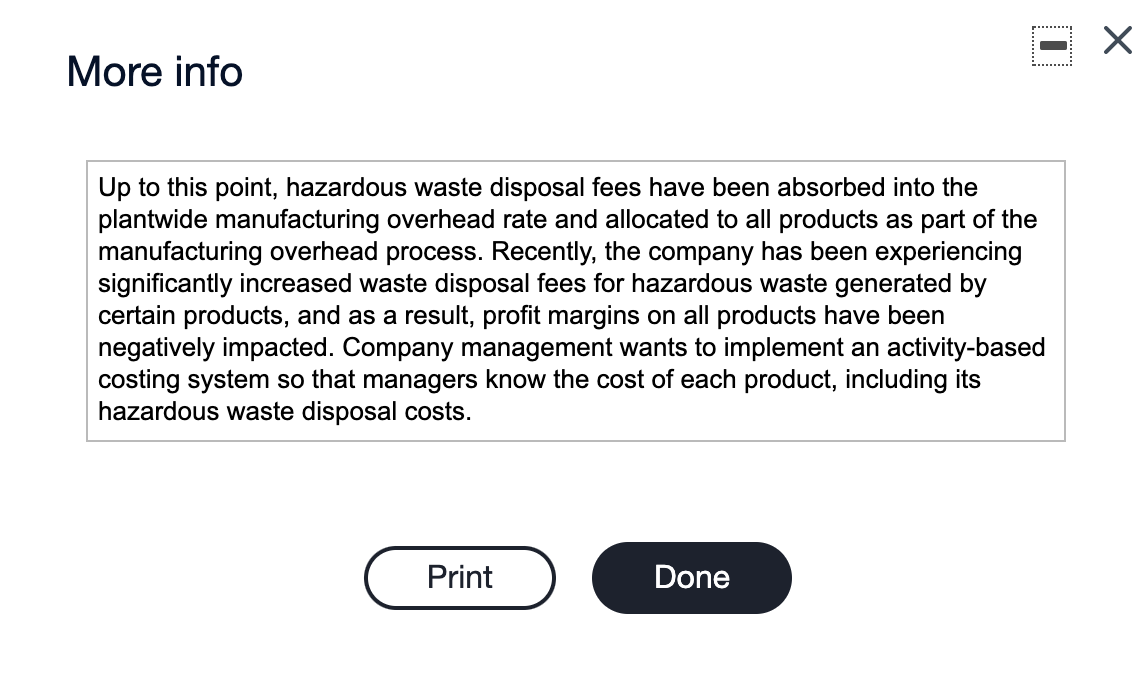

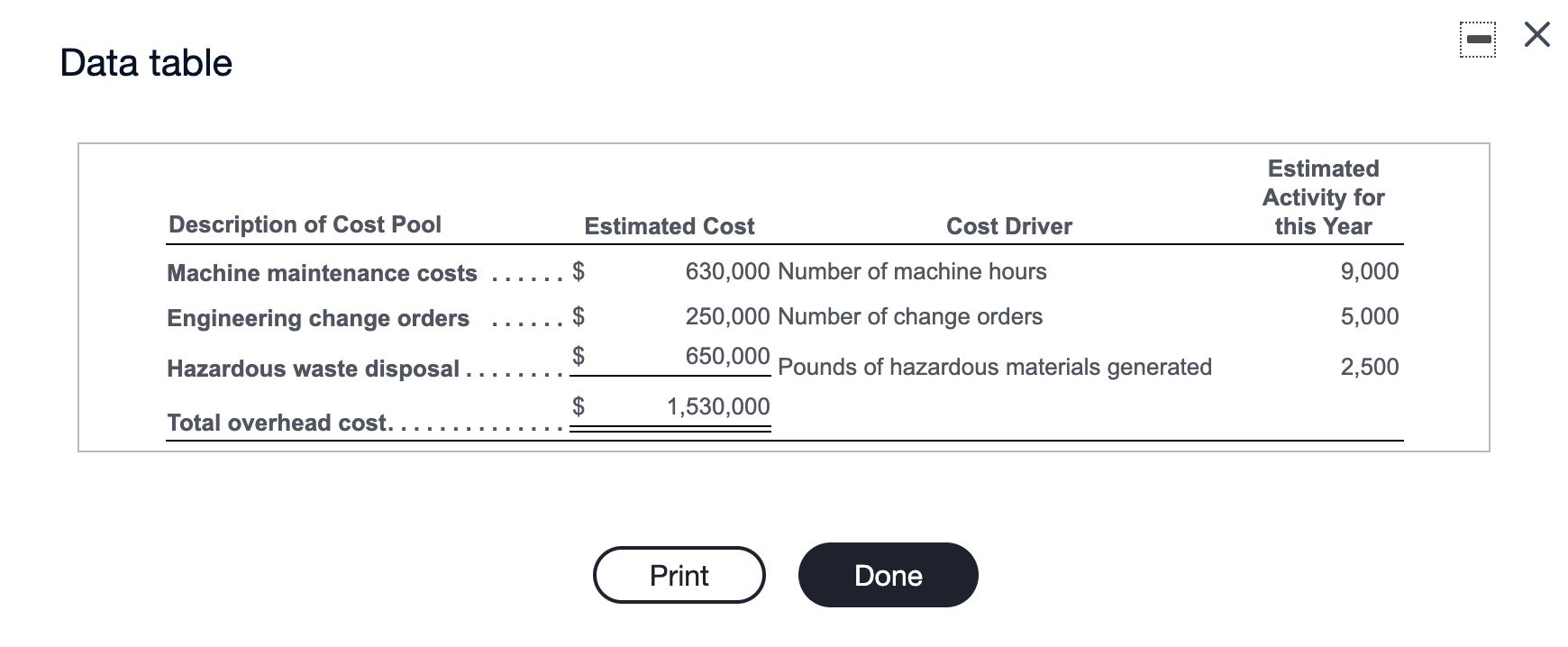

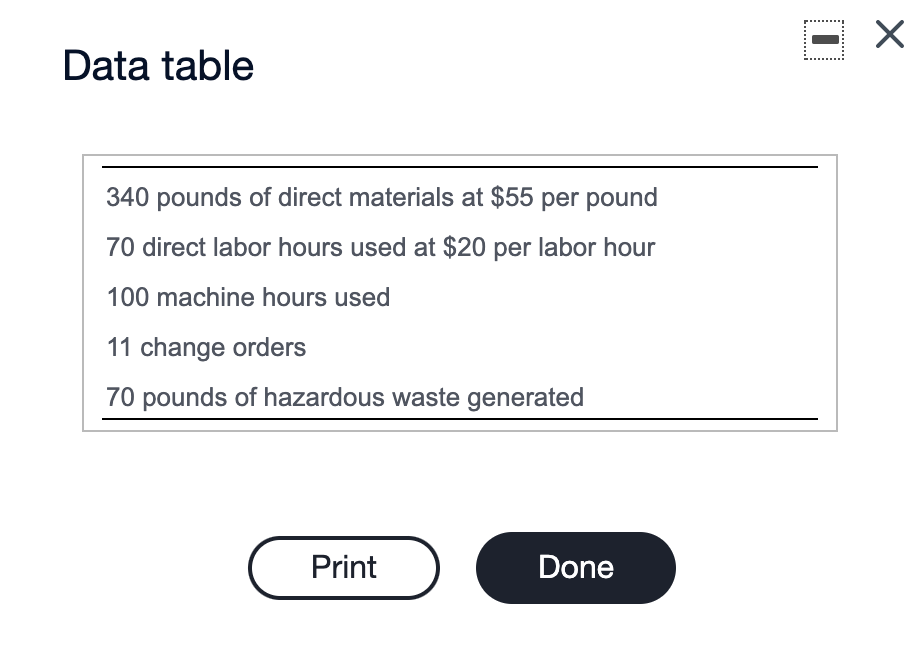

Sebago Industries manufactures a variety of custom products. The company has traditionally used a plantwide manufacturing overhead rate based on machine hours to allocate manufacturing overhead to its products. The company estimates that it will incur $1,530,000 in total manufacturing overhead costs in the upcoming year and will use 9,000 machine hours. Click the icon to view the additional information about the hazardous waste disposal fees.) Expected usage and costs for manufacturing overhead activities for the upcoming year are as follows: B (Click the icon to view the expected usage and costs.) During the year, Job 355 is started and completed. Usage for this job follows: (Click the icon to view the usage for Job 355. Read the requirements. Requirement 1. Calculate the cost of Job 355 using the traditional plantwide manufacturing overhead rate based on machine hours. Begin by calculating the plantwide overhead rate. First identify the formula used to compute the plantwide overhead rate, then compute the rate. (Abbreviations used: MOH = manufacturing overhead; mfg. = manufacturing) = Plantwide mfg. overhead rate Calculate the cost of Job 355. Job Cost Record Manufacturing Costs JOB 355 Total job cost Requirement 2. Calculate the cost of Job 355 using activity-based posting. Begin by calculating the allocation rate for each activity. First determine the formula to compute the allocation rate in an activity-based costing system, then compute the rate for each activity. (Abbreviations used: est = estimated, MH=machine hours, Mach.=Machine, Eng.=Engineering) Activity cost allocation rate Mach, maintenance : per MH Eng. change orders + per order Waste disposal per pound Calculate the cost of Job 355 using activity-based costing. Job Cost Record Manufacturing JOB 355 Costs Total job cost Requirement 3. If you were a manager, which cost estimate would provide you more useful information? How might you use this information? The cost estimate based on the would provide more useful information because this cost estimate takes into account . This information can be used to More info Up to this point, hazardous waste disposal fees have been absorbed into the plantwide manufacturing overhead rate and allocated to all products as part of the manufacturing overhead process. Recently, the company has been experiencing significantly increased waste disposal fees for hazardous waste generated by certain products, and as a result, profit margins on all products have been negatively impacted. Company management wants to implement an activity-based costing system so that managers know the cost of each product, including its hazardous waste disposal costs. Print Done Data table Estimated Activity for this Year Estimated Cost Cost Driver Description of Cost Pool Machine maintenance costs Engineering change orders $ 630,000 Number of machine hours 9,000 5,000 $ $ Hazardous waste disposal. 250,000 Number of change orders 650,000 Pounds of hazardous materials generated 1,530,000 2,500 $ Total overhead cost. ... Print Done !" Data table 340 pounds of direct materials at $55 per pound 70 direct labor hours used at $20 per labor hour 100 machine hours used 11 change orders 70 pounds of hazardous waste generated Print Done Requirements 1. 2. Calculate the cost of Job 355 using the traditional plantwide manufacturing overhead rate based on machine hours. Calculate the cost of Job 355 using activity-based costing. If you were a manager, which cost estimate would provide you more useful information? How might you use this information? 3. Print Done