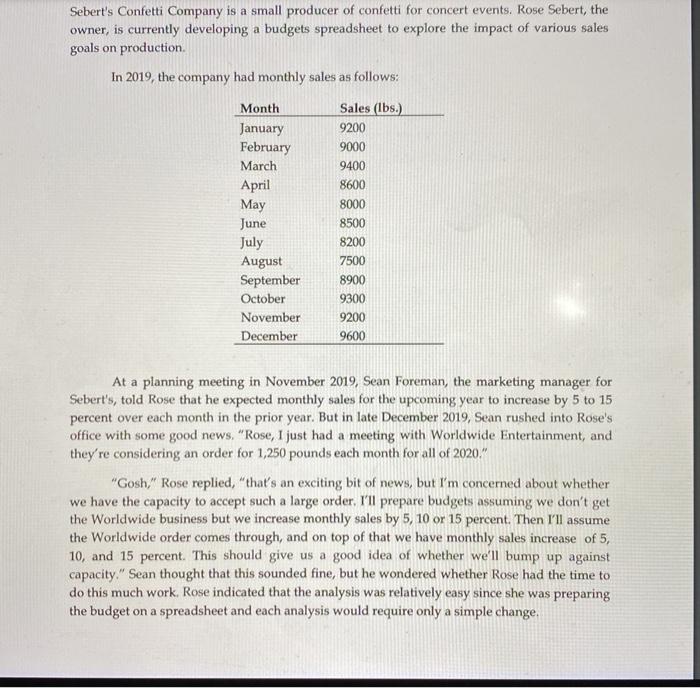

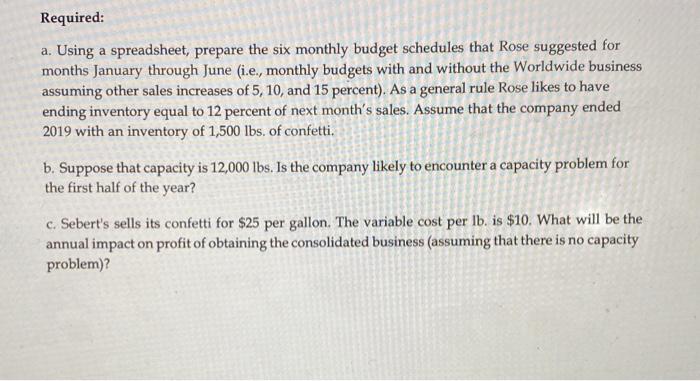

Sebert's Confetti Company is a small producer of confetti for concert events. Rose Sebert, the owner, is currently developing a budgets spreadsheet to explore the impact of various sales goals on production In 2019, the company had monthly sales as follows: Month January February March April May June July August September October November December Sales (lbs.) 9200 9000 9400 8600 8000 8500 8200 7500 8900 9300 9200 9600 At a planning meeting in November 2019, Sean Foreman, the marketing manager for Sebert's, told Rose that he expected monthly sales for the upcoming year to increase by 5 to 15 percent over each month in the prior year. But in late December 2019, Sean rushed into Rose's office with some good news. "Rose, I just had a meeting with Worldwide Entertainment, and they're considering an order for 1,250 pounds each month for all of 2020." "Gosh," Rose replied, "that's an exciting bit of news, but I'm concerned about whether we have the capacity to accept such a large order. I'll prepare budgets assuming we don't get the Worldwide business but we increase monthly sales by 5, 10 or 15 percent. Then I'll assume the Worldwide order comes through, and on top of that we have monthly sales increase of 5, 10, and 15 percent. This should give us a good idea of whether we'll bump up against capacity." Sean thought that this sounded fine, but he wondered whether Rose had the time to do this much work. Rose indicated that the analysis was relatively easy since she was preparing the budget on a spreadsheet and each analysis would require only a simple change. Required: a. Using a spreadsheet, prepare the six monthly budget schedules that Rose suggested for months January through June (i.e., monthly budgets with and without the Worldwide business assuming other sales increases of 5, 10, and 15 percent). As a general rule Rose likes to have ending inventory equal to 12 percent of next month's sales. Assume that the company ended 2019 with an inventory of 1,500 lbs. of confetti. b. Suppose that capacity is 12,000 lbs. Is the company likely to encounter a capacity problem for the first half of the year? c. Sebert's sells its confetti for $25 per gallon. The variable cost per Ib. is $10. What will be the annual impact on profit of obtaining the consolidated business (assuming that there is no capacity problem)