Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Second (80%): On Dec.31, 2016, Gulf Corporation signed a four-year lease for an equipment. The lease called for annual payments of $41,000 per year

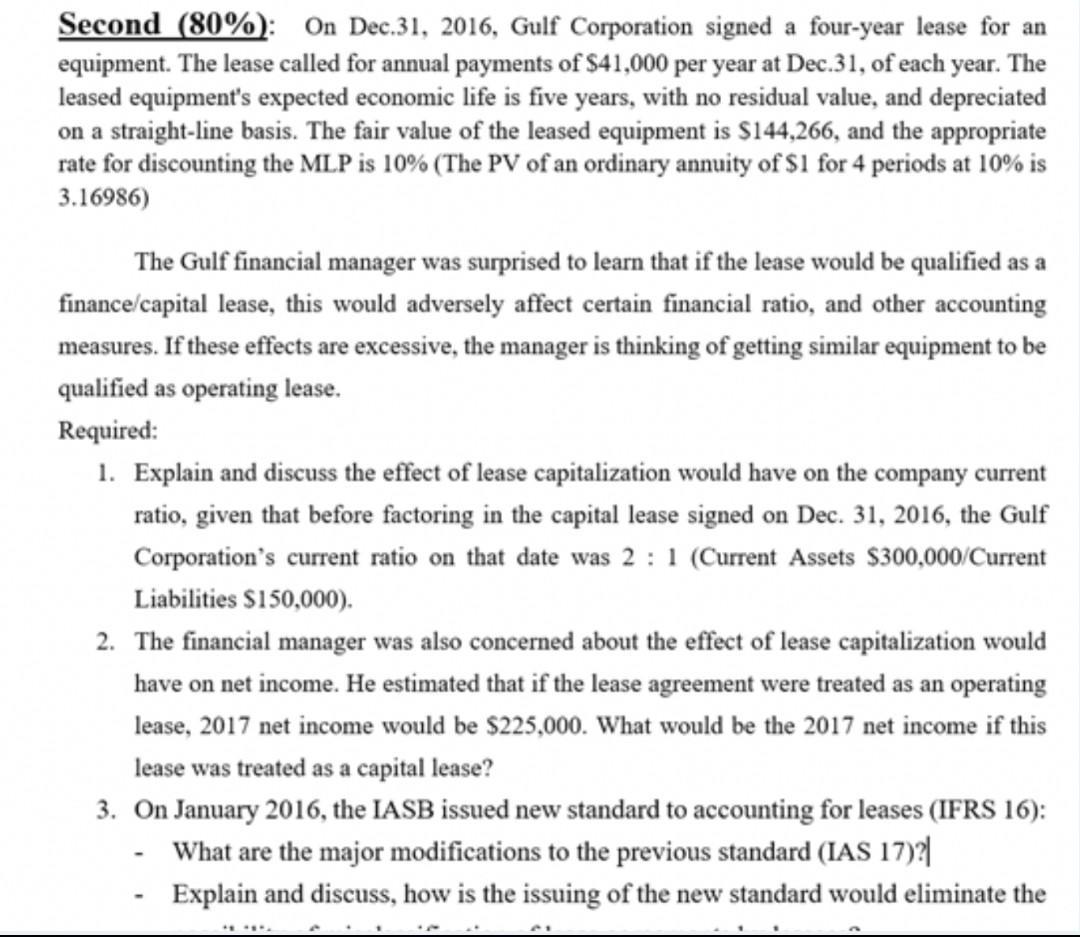

Second (80%): On Dec.31, 2016, Gulf Corporation signed a four-year lease for an equipment. The lease called for annual payments of $41,000 per year at Dec.31, of each year. The leased equipment's expected economic life is five years, with no residual value, and depreciated on a straight-line basis. The fair value of the leased equipment is $144,266, and the appropriate rate for discounting the MLP is 10% (The PV of an ordinary annuity of $1 for 4 periods at 10% is 3.16986) The Gulf financial manager was surprised to learn that if the lease would be qualified as a finance/capital lease, this would adversely affect certain financial ratio, and other accounting measures. If these effects are excessive, the manager is thinking of getting similar equipment to be qualified as operating lease. Required: 1. Explain and discuss the effect of lease capitalization would have on the company current ratio, given that before factoring in the capital lease signed on Dec. 31, 2016, the Gulf Corporation's current ratio on that date was 2 : 1 (Current Assets $300,000/Current Liabilities $150,000). 2. The financial manager was also concerned about the effect of lease capitalization would have on net income. He estimated that if the lease agreement were treated as an operating lease, 2017 net income would be $225,000. What would be the 2017 net income if this lease was treated as a capital lease? 3. On January 2016, the IASB issued new standard to accounting for leases (IFRS 16): What are the major modifications to the previous standard (IAS 17)?| Explain and discuss, how is the issuing of the new standard would eliminate the

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 If the lease agreement is treated as a capital lease then the leas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started