Answered step by step

Verified Expert Solution

Question

1 Approved Answer

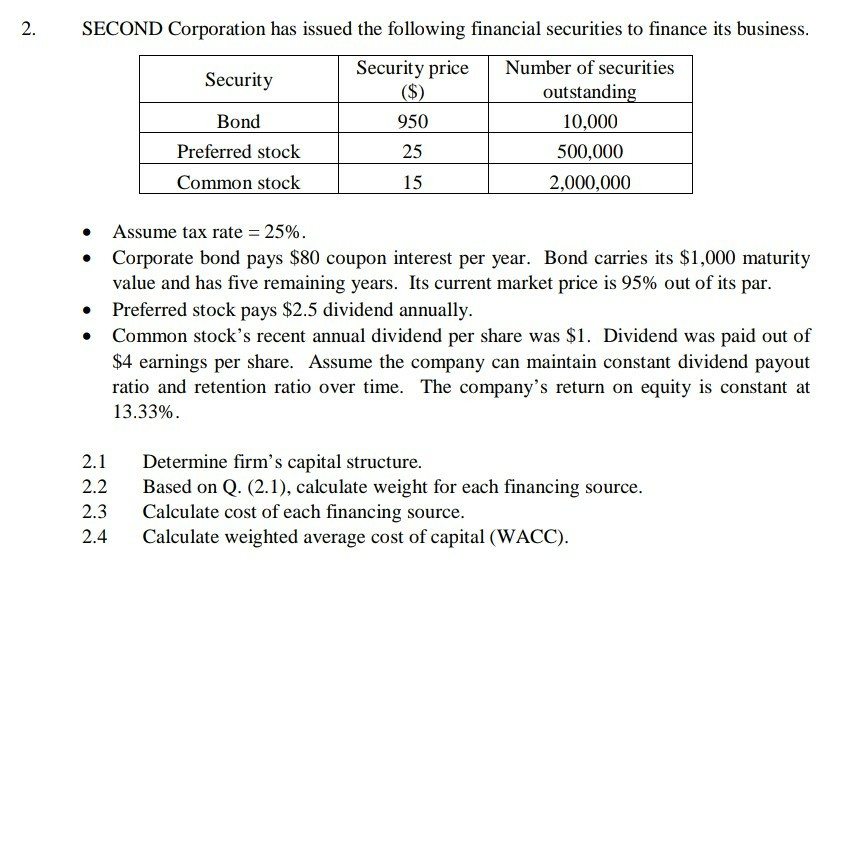

SECOND Corporation has issued the following financial securities to finance its business Security price Number of securities Security Bond Preferred stock Common stock outstandin 10,000

SECOND Corporation has issued the following financial securities to finance its business Security price Number of securities Security Bond Preferred stock Common stock outstandin 10,000 500,000 2,000,000 950 25 15 Assume tax rate-25% . . Corporate bond pays $80 coupon interest per year. Bond carries its $1,000 maturity value and has five remaining years. Its current market price is 95% out of its par Preferred stock pays $2.5 dividend annually. Common stock's recent annual dividend per share was $1. Dividend was paid out of $4 earnings per share. Assume the company can maintain constant dividend payout ratio and retention ratio over time. The company's return on equity is constant at 13.33% . 2.1 Determine firm's capital structure. 2.2 Based on Q. (2.1), calculate weight for each financing source 2.3Calculate cost of each financing source. 2.4 Calculate weighted average cost of capital (WACC)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started