Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Second part only 10. Uneven cash flows Aa Aa A series of cash flows may not always necessarily be an annuity. Cash flows can also

Second part only

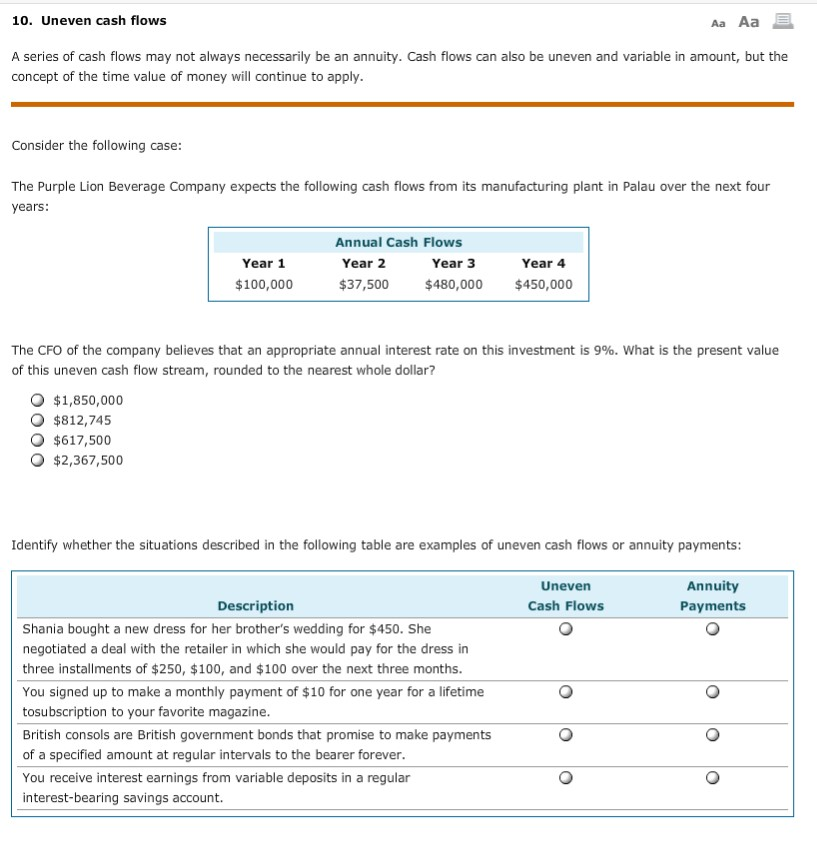

10. Uneven cash flows Aa Aa A series of cash flows may not always necessarily be an annuity. Cash flows can also be uneven and variable in amount, but the concept of the time value of money will continue to apply. Consider the following case: The Purple Lion Beverage Company expects the following cash flows from its manufacturing plant in Palau over the next four years: Year 1 $100,000 Annual Cash Flows Year 2 Year 3 $37,500 $480,000 Year 4 $450,000 The CFO of the company believes that an appropriate annual interest rate on this investment is 9%. What is the present value of this uneven cash flow stream, rounded to the nearest whole dollar? $1,850,000 $812,745 $617,500 $2,367,500 Identify whether the situations described in the following table are examples of uneven cash flows or annuity payments: Uneven Cash Flows Annuity Payments Description Shania bought a new dress for her brother's wedding for $450. She negotiated a deal with the retailer in which she would pay for the dress in three installments of $250, $100, and $100 over the next three months. You signed up to make a monthly payment of $10 for one year for a lifetime tosubscription to your favorite magazine. British consols are British government bonds that promise to make payments of a specified amount at regular intervals to the bearer forever. You receive interest earnings from variable deposits in a regular interest-bearing savings accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started