Answered step by step

Verified Expert Solution

Question

1 Approved Answer

second photo answers 1. Following is the balance sheet for Cake at 1/1/2016. On 1/1/2016, Choco acquired all of the outstanding common stock of Cake

second photo answers

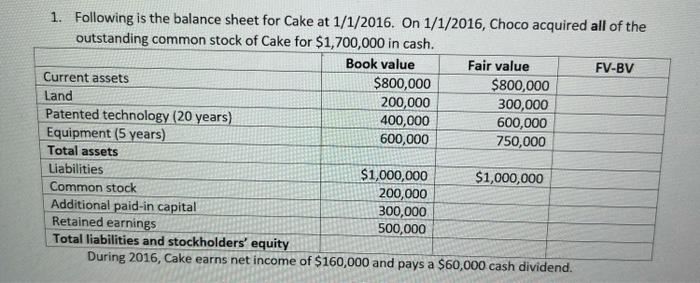

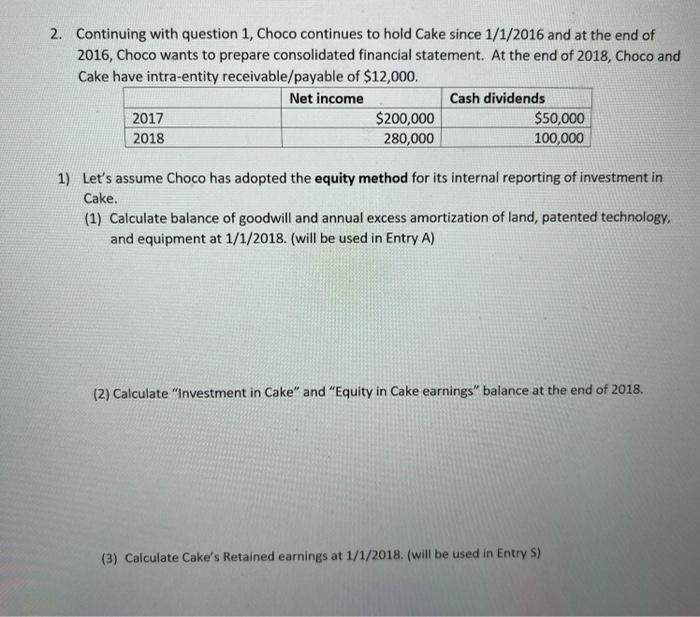

1. Following is the balance sheet for Cake at 1/1/2016. On 1/1/2016, Choco acquired all of the outstanding common stock of Cake for $1,700,000 in cash. Book value Fair value FV-BV Current assets $800,000 $800,000 Land 200,000 300,000 Patented technology (20 years) 400,000 600,000 Equipment (5 years) 600,000 750,000 Total assets Liabilities $1,000,000 $1,000,000 Common stock 200,000 Additional paid-in capital 300,000 Retained earnings 500,000 Total liabilities and stockholders' equity During 2016, Cake earns net income of $160,000 and pays a $60,000 cash dividend. 2. Continuing with question 1, Choco continues to hold Cake since 1/1/2016 and at the end of 2016, Choco wants to prepare consolidated financial statement. At the end of 2018, Choco and Cake have intra-entity receivable/payable of $12,000. Net income Cash dividends 2017 $200,000 $50,000 2018 280,000 100,000 1) Let's assume Choco has adopted the equity method for its internal reporting of investment in Cake. (1) Calculate balance of goodwill and annual excess amortization of land, patented technology, and equipment at 1/1/2018. (will be used in Entry A) (2) Calculate "Investment in Cake" and "Equity in Cake earnings" balance at the end of 2018. (3) Calculate Cake's Retained earnings at 1/1/2018. (will be used in Entry S) 1. Following is the balance sheet for Cake at 1/1/2016. On 1/1/2016, Choco acquired all of the outstanding common stock of Cake for $1,700,000 in cash. Book value Fair value FV-BV Current assets $800,000 $800,000 Land 200,000 300,000 Patented technology (20 years) 400,000 600,000 Equipment (5 years) 600,000 750,000 Total assets Liabilities $1,000,000 $1,000,000 Common stock 200,000 Additional paid-in capital 300,000 Retained earnings 500,000 Total liabilities and stockholders' equity During 2016, Cake earns net income of $160,000 and pays a $60,000 cash dividend. 2. Continuing with question 1, Choco continues to hold Cake since 1/1/2016 and at the end of 2016, Choco wants to prepare consolidated financial statement. At the end of 2018, Choco and Cake have intra-entity receivable/payable of $12,000. Net income Cash dividends 2017 $200,000 $50,000 2018 280,000 100,000 1) Let's assume Choco has adopted the equity method for its internal reporting of investment in Cake. (1) Calculate balance of goodwill and annual excess amortization of land, patented technology, and equipment at 1/1/2018. (will be used in Entry A) (2) Calculate "Investment in Cake" and "Equity in Cake earnings" balance at the end of 2018. (3) Calculate Cake's Retained earnings at 1/1/2018. (will be used in Entry S) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started