Answered step by step

Verified Expert Solution

Question

1 Approved Answer

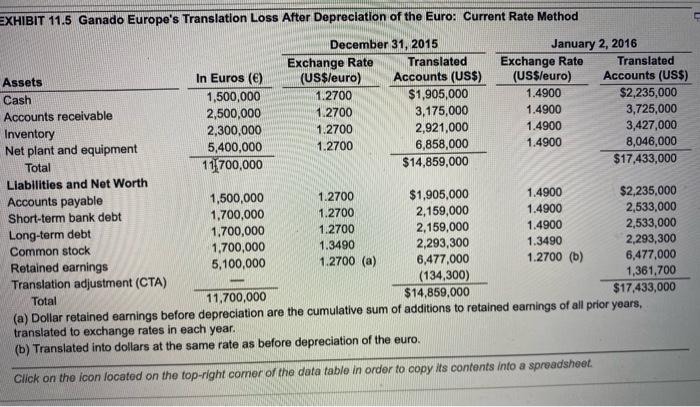

Ganado Europe (C) . Using facts in the chapter for Ganado Europe, assume the exchange rate on January 2, 2016, in Exhibit 11.5 appreciated from

Ganado Europe (C). Using facts in the chapter for Ganado Europe, assume the exchange rate on January 2, 2016, in Exhibit 11.5 appreciated from $1.2700/ to $1.4900/. Calculate Ganado Europe's translated balance sheet for January 2, 2016, with the new exchange rate using the current rate method as shown in the chart below

a. What is the amount of translation gain or loss?

b. Where should it appear in the financial statements?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started