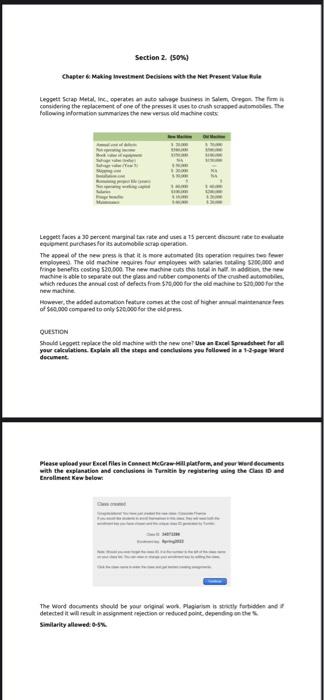

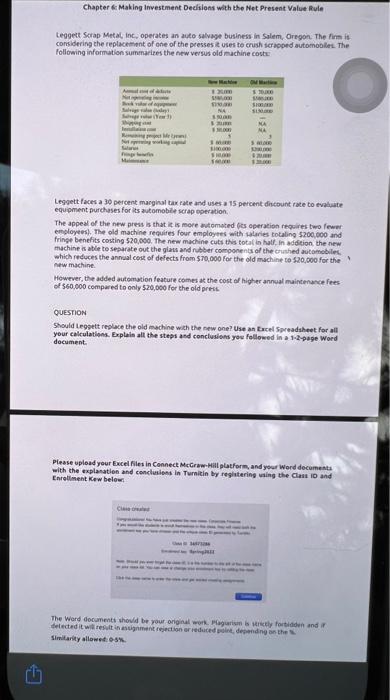

Section 2 (50%) Chapter & Making lovestment Decisions with the Net Present Value Bule Legpett Scrap Metal Tecpatent age butiness Solem, Oregon. The form considering the replacement of one of the pressure to crush padomes The Following information summarizes the new versold machine costs Leggettes 30 percent marginal tax rate and use percent discourage to w equipment purchasesforstomobile scrap operation The appeal of the new press that it is more automated superation est fewer employees. The old machine restourenployees wie stres totsing $206.000 d Fringe benes conting 520.000. The new machine cuts to the new machine is able to separate the grand rubber components of the crushed tomobiles which reduces the annual cost of defects from $70,000 for the old machine to $20.000 for the w machine However, the added tomation feature cones at the cost of higher intactes of $60.000 compared to only $20.000 for the cidress QUESTION Should Leggett replace the id machine with the new one? Uw Excel Spreadsheet for at your calculation plain all the steps and conclusions you followed in 19e Ward document Please upload your Excel files in Center McGraw Hill platform, and your ward decuments with the explanation and conclusions in Turnitin by registering in the Class and Enrollment uw below The Word documents should be your original word. Plagiarism is turtide and detected it will in assignment rejection or reduced point depending on the Similarity allowed 0-5% Chapter 6: Making Investment Decisions with the Net Present Value Rule Leggett Scrap Metal, Inc, operates an auto salvage business in Salem, Oregon. The firm is considering the replacement of one of the presses it uses to crush scrapped automobiles. The following information summarizes the new versus old machine costs: 3 SO S. She! NA NA NA . SI 30 2. Leggett faces a 30 percent marginal tax rate and uses a 15 percent discount rate to evaluate equipment purchases for its automobile scrap operation The appeal of the new press is that it is more automated lits operation requires two fewer employees). The old machine requires four employees with salaries totaling $200,000 and fringe benefits costing $20,000. The new machine cuts this total in half. In addition, the new machine is able to separate out the glass and rubber components of the crushed automobiles which reduces the annual cost of defects from $70,000 for the old machine to $20,000 for the new machine However, the added automation feature comes at the cost of higher annual maintenance fees of $60,000 compared to only $20,000 for the old press QUESTION Should Leggett replace the old machine with the new one? Use an Excel Spreadsheet for all your calculations. Explain all the steps and conclusions you followed in a 1-2-page Word document. Please upload your Excel files in Connect McGraw-Hill platform, and your Word documents with the explanation and conclusions in Turnitin by registering using the Class ID and Enrollment Kew below: The Word documents should be your original work. Plagiarism is strictly forbidden and if detected it will result in assignment rejection or reduced point, depending on the Similarity allowed: 0-5%. Chapter & Making Investment Decisions with the Net Present Value Rule Leggett Scrap Metal, Inc., operates an auto salvage business in Salem, Oregon. The firm it considering the replacement of one of the presses it uses to crush red automobile. The Following information summarizes the new versus old machine costs 100 Saw NA NA NA W! . Leggett races a 30 percent marginal tax rate and uses a 15 percent discount rate to evaluate equipment purchases for its automobile scrap operation The appeal of the new press is that it is more automated its operation requires two fewer employees). The old machine requires four employees with salaries totaling $200,000 and fringe benefits costing $20,000. The new machine cuts this totain hall, in addition the new machine is able to separate out the glass and rubber components of the crushed automobiles which reduces the annual cost of defects from $70,000 for the old machine to $20,000 for the new machine However, the added automation feature comes at the cost of Nigher annual maintenance fees of 560.000 compared to only $20,000 for the old press QUESTION Should Legett replace the old machine with the new one? Use an Excel Spreadsheet for all your calculations. Explain all the steps and conclusions you followed in a 1-2-page Word document Please upload your Excel files in Connect McGraw-Hill platform, and your Word documents with the explanation and conclusions In Turnitin by registering using the Class 10 and Enrollment Kew below The Word documents should be your original work aguru Srictly forbidden and detected it will result iniment rejection or reduced point depending on the Similarly allowed ch